Xerox 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report

Table of contents

-

Page 1

2008 Annual Report -

Page 2

"Bottom line: yes, we are feeling the impact of the recession; yes, we are moving aggressively to reduce costs, generate cash and weather the storm; but no, we are neither giving up on 2009 nor mortgaging our future by compromising on investments that will give us ... -

Page 3

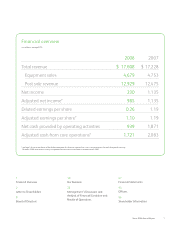

Financial overview (in millions, except EPS) 2008 Total revenue Equipment sales Post sale revenue Net income Adjusted net income* Diluted earnings per share Adjusted earnings per share* Net cash provided by operating activities Adjusted cash from core operations* $ 17,608 4,679 12,929 230 985 0.26 ... -

Page 4

... of our recurring revenue stream that is driven by installs of Xerox technology and multi-year contracts for Xerox services. More than 70 percent of our revenue and 80 percent of our cash ï¬,ow is generated from our annuity-based business model, making for a solid and reliable asset, especially... -

Page 5

... everywhere. The highly respected Gartner organization lists us as a "Magic Quadrant" market leader in managed print services, as well as for printers and multifunction systems that print, copy, fax and scan all in one device. Our new offerings last year garnered some 230 awards from industry groups... -

Page 6

... list of actions aimed at getting our expenses aligned with the realities of faltering economies in just about every corner of the globe. Our investments over the years in Lean Six Sigma have given us a set of tools and processes that simplify and reduce the cost of managing our global operations... -

Page 7

...-wide IT systems. And, we are the preferred global imaging partner for IBM Managed Business Process Services, a unit of IBM Global Technology Services. Under our worldwide agreement, we're scanning and imaging millions of documents for IBM and their customers. We provide affordable color printing... -

Page 8

...® , iGen3® and iGen4™ presses accounted for approximately one-half of the total worldwide color pages printed by high-speed digital systems. With the broadest portfolio of color printing systems on the market, we continue to create new business opportunities in production printing through color... -

Page 9

... data, shares in thousands) Operating Cash Flow - As Reported Payments for securities litigation, net Capital expenditures Internal-use software Adjusted Free Cash Flow (FCF) Adjusted Weighted Average Shares Outstanding Adjusted Free Cash Flow Per Share Full-year 2008 Net Income $ 230 240 24 491... -

Page 10

... Corporation Norwalk, CT 2. Ursula M. Burns President Xerox Corporation Norwalk, CT 3. Glenn A. BrittA, B President and Chief Executive Ofï¬cer Time Warner Cable Stamford, CT 4. Ann N. ReeseC, D Executive Director Center for Adoption Policy Rye, NY 5. Vernon E. Jordan, Jr.**B, C Senior Managing... -

Page 11

... Statements of Shareholders' Equity 51 Notes to the Consolidated Financial Statements 90 Reports of Management 91 Report of Independent Registered Public Accounting Firm 92 Quarterly Results of Operations (Unaudited) 93 Five Years in Review 96 Shareholder Information Xerox 2008 Annual Report... -

Page 12

... and services for businesses of any size. Digital systems include high-end printing and publishing systems; digital presses, advanced and basic multifunctional devices ("MFD's") which can print, copy, scan and fax; digital copiers; laser and solid ink printers and fax machines. We provide software... -

Page 13

... production imaging software to manage both high volume standardized activities as well as lower volume complex workflows. • Driving the New Business of Printing® - We continue to create new market opportunities with digital printing as a complement to traditional offset printing through a market... -

Page 14

...post sale revenue trends because color pages use more consumables per page than black-and-white. In addition, expanding our market, particularly within the New Business of Printing, is key to increasing pages and we have developed tools and resources to be the leader in this large market opportunity... -

Page 15

... communications industry and for large enterprises. � $2,543 Other Our Other segment primarily includes revenue from paper sales, wide-format systems, value-added services and Global Imaging Systems network integration solutions and electronic presentation systems. Xerox 2008 Annual Report 13 -

Page 16

... Sales & Marketing, Workflow and Application Development efforts, and are delivered at the customers' location or via the web. These offerings include creating marketing and sales management plans, sales force training, designing for digital, color management, implementing direct mail/marketing... -

Page 17

... capabilities to these Digital Color Presses. • Xerox 490/980 Color Continuous Feed Printing System: We launched the world's fastest toner based full color roll fed printer that produces up to 986 full color duplex images per minute in May for Europe and part of developing markets and in November... -

Page 18

... Xerox develops and manufactures a range of color and black-and-white multifunction, printer, copier and fax products. Our Office segment serves global, national and small to mid-size commercial customers as well as government, education and other public sector customers. Office systems and services... -

Page 19

...sided printing. This product offers color scanning to USB, email or the network. It is equipped with Xerox Scan to PC Desktop® which allows users to send a document from the MFP to their desktop for viewing, editing or storing. An increasingly important part of our offering is value-added services... -

Page 20

... agreement, whether rental or operating lease, and report it in "post sale revenue." Our accounting policies for revenue recognition for leases and bundled arrangements are included in Note 1 - Summary of Significant Accounting Policies in the Consolidated Financial Statements in our 2008 Annual... -

Page 21

... of Printing, extending our color capabilities, expanding our services offerings and delivering lower-cost platforms and customer productivity enablers. The Xerox iGen family, advanced next-generation digital printing presses that produce photographic-quality prints Xerox 2008 Annual Report 19 -

Page 22

...our competitors continue to develop and market new and innovative products at competitive prices, and, at any given time, we may set new market standards for quality, speed and function. a network of independent agents, dealers, value-added resellers, systems integrators and the Web. In the U.S. GIS... -

Page 23

... and Canada. � Developing Markets Developing Markets supports more than 130 countries. � Fuji Xerox Fuji Xerox, an unconsolidated entity of which we own 25%, develops, manufactures and distributes document management systems, supplies and services. � Xerox Europe Xerox Europe covers 17... -

Page 24

...Globally, we have 57,100 direct employees. We have over 7,500 Sales Professionals, over 13,000 Managed Service Employees at customer sites and over 13,000 Technical Service Employees. In addition, we have over 6,500 Agents and Concessionaires and over 10,000 resellers. 22 Xerox 2008 Annual Report -

Page 25

... the plant to produce the new breakthrough Ultra Low-Melt EA Toner. Our remaining primary manufacturing operations are located in: Dundalk, Ireland for our high-end production products and consumables; and Wilsonville, Oregon for solid ink products, consumable supplies, and components for our Office... -

Page 26

...or the value of unfilled orders, is not a meaningful indicator of future business prospects because of the significant proportion of our revenue that follows equipment installation, the large volume of products we deliver from shelf inventories and the shortening of product life cycles. Seasonality... -

Page 27

... such as managed print services which help customers reduce their costs, also drives post sale revenue. In 2008, we completed several acquisitions to further strengthen our distribution capacity and expand our reach in the small to mid-size business ("SMB") market. Global Imaging Systems, Inc. ("GIS... -

Page 28

...returning value to shareholders through acquisitions, share repurchase and dividends. We continue to maintain debt levels primarily to support our customer financing operations. Cash flow from operations was $939 million in 2008 and included $615 million of net securities-related litigation payments... -

Page 29

... in office multifunction color and production color install activity was offset by overall price declines of between 5%-10%, declines in production black-and-white products and color printers, as well as an increased proportion of equipment installed under operating lease contracts where revenue is... -

Page 30

... of the equipment placed at customer locations, the volume of prints and copies that our customers make on that equipment, the mix of color pages and associated services. The percentage point impacts from GIS reflect the revenue growth year-over-year after including GIS's results for 2007 and 2006... -

Page 31

... of cash selling prices must be reasonably consistent with the lease selling prices, taking into account residual values, in order for us to determine that such lease prices are indicative of fair value. Our pricing interest rates, which are used in determining customer payments, are developed based... -

Page 32

... future events are used in calculating the expense, liability and asset values related to our pension and post-retirement benefit plans. These factors include assumptions we make about the discount rate, expected return on plan assets, rate of increase in healthcare costs, the rate of future... -

Page 33

... in net periodic pension cost, were $80 million, $80 million and $70 million for the years ended December 31, 2008, 2007 and 2006, respectively. Pension cost is included in several income statement components based on the related underlying employee costs. Pension and post-retirement benefit plan... -

Page 34

... useful life over which cash flows will occur, determination of our weighted average cost of capital for purposes of establishing a discount rate and relevant market data. Our annual impairment test of goodwill is performed in the fourth quarter. The estimated fair values of the Company's reporting... -

Page 35

... Financial Statements for further discussion on our segment operating revenues and segment operating profit. Revenues by segment for the years ended 2008, 2007 and 2006 were as follows: Year Ended December 31, (in millions) Production Office Other Total 2008 Equipment sales Post sale revenue Total... -

Page 36

... within developing markets. • 2% increase in equipment sales revenue, reflecting the full year inclusion of GIS as well as growth from color digital products which more than offset declines from black-and-white devices primarily due to price declines and product mix. • 24% color multifunction... -

Page 37

...Other Income Gross Margin Gross margins by revenue classification were as follows: Year Ended December 31, 2008 2007 2006 Sales Service, outsourcing and rentals Finance income Total Gross margin 33.7% 41.9% 61.8% 38.9% 35.9% 42.7% 61.6% 40.3% 35.7% 43.0% 63.7% 40.6% Xerox 2008 Annual Report 35 -

Page 38

.... Much of the reported Fuji Xerox R&D increase was caused by changes in foreign exchange rates. • Sustaining engineering costs of $134 million were $14 million lower than 2007 due primarily to lower spending related to environmental compliance activities and maturing product platforms in the... -

Page 39

...approximately 300 from December 31, 2007, primarily reflecting the reductions from restructuring partially offset by additions as a result of 2008 acquisition activity. Worldwide employment was approximately 57,400 and 53,700 at December 31, 2007 and 2006, respectively. Xerox 2008 Annual Report 37 -

Page 40

... assets acquired as part of our recent acquisitions. 2007 amortization of intangible assets expense of $42 million reflects amortization expense of $16 million associated with intangible assets acquired as part of our acquisition of GIS, partially offset by reduced amortization from prior years due... -

Page 41

.... • $73 million decrease due to a lower net run-off of finance receivables. • $49 million decrease primarily due to higher accounts receivable reflecting increased revenue, partially offset by $110 million year-over-year benefit from increased receivables sales. Xerox 2008 Annual Report 39 -

Page 42

...well as lower related tax benefits. • $33 million decrease due to share repurchases related to employee withholding taxes on stock-based compensation vesting. Net cash used in financing activities was $619 million in year ended December 31, 2007. The $809 million increase in cash was primarily due... -

Page 43

... in the equipment subsequent to its sale; therefore, the related receivable and debt are not included in our Consolidated Financial Statements. The following represents total finance assets associated with our lease or finance operations as of December 31, 2008 and 2007: (in millions) 2008 2007 At... -

Page 44

Management's Discussion million, $1,871 million and $1,617 million for the years ended December 31, 2008, 2007 and 2006, respectively. Cash flows from operations in 2008 included $615 million in net payments for our securities litigation. • Our debt maturities are in line with historical and ... -

Page 45

... Financial Statements for additional information and interest payments related to long-term debt (amounts above include principal portion only). Refer to Note 6 - Land, Buildings and Equipment, Net in our Consolidated Financial Statements for additional information related to minimum operating lease... -

Page 46

... operations. Cash contributions are made each year to cover medical claims costs incurred in that year. The amounts reported in the above table as retiree health payments represent our estimated future benefit payments. Fuji Xerox We purchased products, including parts and supplies, from Fuji Xerox... -

Page 47

... operating results, financial position and cash flows. We manage our exposure to these market risks through our regular operating and financing activities and, when appropriate, through the use of derivative financial instruments. These derivative financial instruments are Xerox 2008 Annual Report... -

Page 48

... for the year ended December 31, 2008 using non-GAAP financial measures. To understand trends in the business, we believe that it is helpful to adjust the revenue growth rates to illustrate the impact of the acquisition of GIS by including their estimated revenue for the comparable 2007 and 2006... -

Page 49

Xerox Corporation Consolidated Statements of Income Year Ended December 31, (in millions, except per-share data) 2008 2007 2006 Revenues Sales Service, outsourcing and rentals Finance income Total Revenues Costs and Expenses Cost of sales Cost of service, outsourcing and rentals Equipment ... -

Page 50

... in thousands) 2008 2007 Assets Cash and cash equivalents Accounts receivable, net Billed portion of finance receivables, net Finance receivables, net Inventories Other current assets Total current assets Finance receivables due after one year, net Equipment on operating leases, net Land, buildings... -

Page 51

... securities litigation, net Restructuring and asset impairment charges Payments for restructurings Contributions to pension benefit plans Decrease (increase) in accounts receivable and billed portion of finance receivables (Increase) decrease in inventories Increase in equipment on operating leases... -

Page 52

... plans, net Payments to acquire treasury stock Cancellation of treasury stock Other Balance at December 31, 2007 Net income Translation adjustments Cumulative Effect of Change in Accounting Principles Changes in defined benefit plans(2) Other unrealized losses Comprehensive loss Cash dividends... -

Page 53

... and a leader in the global document market. We develop, manufacture, market, service and finance a complete range of document equipment, software, solutions and services. Basis of Consolidation The Consolidated Financial Statements include the accounts of Xerox Corporation and all of our controlled... -

Page 54

...credit risk - related as well as cross-referencing within the notes to the financial statements to enable financial statement users to locate important information about derivative instruments, financial performance and cash flows. We adopted this standard effective as of December 31, 2008. The only... -

Page 55

...of employees' rights to compensated absences under a sabbatical or other similar benefit arrangement. We recorded a $7 after-tax charge to Retained earnings in 2007 reflecting our share of the cumulative effect recorded by Fuji Xerox upon adoption of EITF 06-2. This was Xerox 2008 Annual Report 53 -

Page 56

... and installed at the customer location. Sales of customer installable products are recognized upon shipment or receipt by the customer according to the customer's shipping terms. Revenues from equipment under other leases and similar arrangements are accounted for by the operating lease method and... -

Page 57

... customer whereby we extend the term. Revenue from such lease extensions is typically recognized over the extension period. Revenue Recognition Under Bundled Arrangements: We sell the majority of our products and services under bundled lease arrangements, which typically include equipment, service... -

Page 58

...excess and/or obsolete service parts inventory is based primarily on projected servicing requirements over the life of the related equipment populations. Cost of sales in 2008 included a charge of $39 associated with an Office segment product line equipment and residual value writeoff. The write-off... -

Page 59

...the volatility in net periodic pension cost that results from using the fair market value approach. The discount rate is used to present value our future anticipated benefit obligations. In estimating our discount rate, we consider rates of return on high quality fixed-income investments included in... -

Page 60

... paper sales), value-added services, Wide Format Systems, Xerox Technology Enterprises, royalty and licensing revenues, GIS network integration solutions and electronic presentation systems, equity net income and non-allocated Corporate items. Other segment profit (loss) includes the operating... -

Page 61

... Selected financial information for our Operating segments for each of the years ended December 31, 2008, 2007 and 2006, respectively, was as follows: Production Office Other Total 2008(1) Revenues Finance income Total Segment Revenues Interest expense Segment profit (loss)(2) Equity in net income... -

Page 62

... on operating leases, net, (iii) internal use software, net and (iv) capitalized software costs, net. Income as of May 9, 2007. Refer to Note 2 - Segment Reporting for a discussion of the segment classification of GIS. The total cost of the acquisition has been allocated to the assets acquired and... -

Page 63

... Business Systems, an office equipment supplier in Florida, for approximately $69 in cash, including transaction costs. GIS acquired three other similar businesses in 2008 for a total of $17 in cash. In 2007, GIS acquired four businesses that provide office-imaging solutions and related services for... -

Page 64

...non-cash adjustment. Equipment on operating leases and similar arrangements consists of our equipment rented to customers and depreciated to estimated salvage value at the end of the lease term. We recorded $115, $66 and $69 in inventory write-down charges for the years ended December 31, 2008, 2007... -

Page 65

... our 25% ownership interest. Equity income for 2008 and 2007 includes after-tax restructuring charges of $16 and $30, respectively, primarily reflecting employee related costs as part of Fuji Xerox's continued cost-reduction actions to improve its competitive position. Xerox 2008 Annual Report 63 -

Page 66

... financial data of Fuji Xerox for the three calendar years ended December 31, 2008 was as follows: 2008 2007 2006 Yen/U.S. Dollar exchange rates used to translate above are as follows: Exchange Basis 2008 2007 2006 Summary of Operations Revenues Costs and expenses Income before income taxes Income... -

Page 67

... from 2009 through 2013. Amortization expense is primarily recorded in Other expenses, net, with the exception of amortization expense associated with licensed technology, which is recorded in Cost of sales and Cost of service, outsourcing and rentals, as appropriate. Xerox 2008 Annual Report 65 -

Page 68

... Consolidated Statements of Income totaled $429, $(6) and $385 in 2008, 2007 and 2006, respectively. Detailed information related to restructuring program activity during the three years ended December 31, 2008 is outlined below: Restructuring Activity Severance and Related Costs Lease Cancellation... -

Page 69

... North America and Europe. Focus areas for the actions include the following: • Improving efficiency and effectiveness of infrastructure including: marketing, finance, human resources & training. • Capturing efficiencies in technical services, managed services and supply chain & manufacturing... -

Page 70

...: 2008 2007 Note 11 - Debt Short-term borrowings at December 31, 2008 and 2007 were as follows: 2008 2007 Other long-term assets Prepaid pension costs Net investment in discontinued operations(1) Internal use software, net Restricted cash Debt issuance costs, net Other Total Other long-term assets... -

Page 71

... to the Consolidated Financial Statements (in millions, except per share data and unless otherwise indicated) Long-term debt at December 31, 2008 and 2007 was as follows: Weighted Average Interest Rates at December 31, 2008 2008 2007 U.S. Operations Xerox Corporation Notes due 2008 Notes due 2011... -

Page 72

Notes to the Consolidated Financial Statements (in millions, except per share data and unless otherwise indicated) Scheduled payments due on long-term debt for the next five years and thereafter are as follows: 2009 2010 2011 2012 2013 Thereafter Total The Credit Facility contains various ... -

Page 73

... in market rates. We enter into limited types of derivative contracts, including interest rate swap agreements, foreign currency spot, forward and swap contracts and net purchased foreign currency options to manage interest rate and foreign currency exposures. Our primary foreign Cash payments on... -

Page 74

... market values of all our derivative contracts change with fluctuations in interest rates and/or currency rates and are designed so that any changes in their values are offset by changes in the values of the underlying exposures. Derivative financial instruments are held solely as risk management... -

Page 75

... in the Consolidated Statements of Income for these designated cash flow hedges and all components of each derivative's gain or loss was included in the assessment of hedge effectiveness. As of December 31, 2008, the net liability fair value of these contracts was $1. Xerox 2008 Annual Report 73 -

Page 76

... Location of Derivative Gain (Loss) Reclassified from AOCI into Income (Effective Portion) Gain (Loss) Reclassified from AOCI to Income (Effective Portion) 2008 2007 Interest rate contracts Foreign exchange contracts - forwards Total Cash Flow Hedges $(2) 4 $2 $ 9 - $ 9 Interest expense Cost... -

Page 77

... fair values of our other financial assets and liabilities not measured at fair value on a recurring basis at December 31, 2008 and 2007 were as follows: 2008 Carrying Fair Amount Value 2007 Carrying Fair Amount Value Cash and cash equivalents Accounts receivable, net Short-term debt Long-term debt... -

Page 78

... recognized in Accumulated other comprehensive (income) loss consist of: Pension Benefits 2008 2007 2008 Retiree Health 2007 Net actuarial loss (gain) Prior service (credit) cost Total $ 1,818 (192) $ 1,626 $ 1,032 (212) $ 820 $ (85) (186) $ $ 169 11 180 $ (271) 76 Xerox 2008 Annual Report -

Page 79

... contribution plan (Transitional Retirement Account or TRA). 2008 Pension Benefits 2007 2006 2008 Retiree Health 2007 2006 Components of Net Periodic Benefit Cost Service cost Interest cost(1) Expected return on plan assets(2) Recognized net actuarial loss Amortization of prior service credit... -

Page 80

..., and corporate financial condition. This consideration involves the use of long-term measures that address both return and risk. The investment portfolio contains a diversified 2009 2010 2011 2012 2013 Years 2014-2018 $ 557 606 603 636 633 3,300 $105 99 99 98 97 445 78 Xerox 2008 Annual Report -

Page 81

..., 2008 were as follows: 2008 2007 2006 Weighted-average assumptions used to determine net periodic benefit cost for years ended December 31: Pension Benefits 2009 2008 2007 2006 Retiree Health 2009 2008 2007 2006 Discount rate 6.3% 5.9% 5.3% 5.2% 6.3% 6.2% 5.8% 5.6% Expected return on plan assets... -

Page 82

... well as interest received from favorable settlements within income tax expense. We had $22 and $23 accrued for the payment of interest and penalties associated with unrecognized tax benefits at December 31, 2008 and 2007, respectively. We file income tax returns in the U.S. federal jurisdiction and... -

Page 83

... our 1999-2003 Internal Revenue Service ("IRS") audit as well as an income tax benefits of $46 related to the favorable resolution of certain tax matters associated with the finalization of foreign tax audits. The recorded benefits did not result in a significant cash refund, but it did increase tax... -

Page 84

... as well as disputes associated with former employees and contract labor. The tax matters, which comprise a significant portion of the total contingencies, principally relate to claims for taxes on the internal transfer of inventory, municipal service taxes on rentals and gross revenue taxes. We are... -

Page 85

... scheme that operated as a fraud and deceit on purchasers of the Company's common stock and bonds by disseminating materially false and misleading statements and/or concealing material adverse facts relating to various of the Company's accounting and reporting practices and financial condition. The... -

Page 86

... of appeal of the Court's January 15, 2009 order and final judgement and ruling on motion for award of attorneys fees. In Re Xerox Corp. ERISA Litigation: On July 1, 2002, a class action complaint captioned Patti v. Xerox Corp. et al. was filed in the United States District Court for the District of... -

Page 87

... subsidiary's books and certain alleged improper payments in connection with sales to government customers. These transactions were not material to the Company's financial statements. We reported these transactions to the Indian authorities, the U.S. Department of Justice ("DOJ") and to the SEC. In... -

Page 88

... a period equivalent to the lease term or the expected useful life under a cash sale. The service agreements involve the payment of fees in return for our performance of repairs and maintenance. As a consequence, we do not have any significant product warranty obligations including any obligations... -

Page 89

...year actual results for EPS and Cash Flow from Operations exceed the stated targets, then the plan participants have the potential to earn additional shares of common stock. This overachievement can not exceed 50% for officers and 25% for non-officers of the original grant. Xerox 2008 Annual Report... -

Page 90

... information relating to the status of, and changes in, outstanding stock options for each of the three years ended December 31, 2008 (stock options in thousands): 2008 Stock Options Average Option Price Stock Options 2007 Average Option Price Stock Options 2006 Average Option Price Employee Stock... -

Page 91

...194.1 million shares at a cost of $2,945 (including associated fees of $4) under these stock repurchase programs. Total intrinsic value Cash received Tax benefit realized for tax deductions $4 6 2 $61 65 22 $72 82 25 Note 18 - Earnings Per Share The following table sets forth the computation of... -

Page 92

...on the above evaluation, management has concluded that our internal control over financial reporting was effective as of December 31, 2008. Anne M. Mulcahy Chief Executive Officer Lawrence A. Zimmerman Chief Financial Officer Gary R. Kabureck Chief Accounting Officer 90 Xerox 2008 Annual Report -

Page 93

... sheets and the related consolidated statements of income, cash flows and shareholders' equity present fairly, in all material respects, the financial position of Xerox Corporation and its subsidiaries at December 31, 2008 and 2007, and the results of their operations and their cash flows for each... -

Page 94

... Quarter Full Year 2008 Revenues Costs and Expenses(1) (Loss) Income before Income Taxes and Equity Income Income tax (benefits) expenses(2) Equity in net income of unconsolidated affiliates(3) Net (Loss) Income Basic (Loss) Earnings per Diluted (Loss) Earnings per Share(4) 2007 Revenues Costs and... -

Page 95

... dividends Operations Revenues Sales Service, outsourcing and rentals Finance income Research, development and engineering expenses Selling, administrative and general expenses Income from continuing operations Net income Financial Position Cash, cash equivalents and short-term investments Accounts... -

Page 96

...on common stock in 2006 or 2007. Certifications We have filed with the SEC the certification required by Section 302 of the Sarbanes-Oxley Act as an exhibit to our 2008 Annual Report on Form 10-K, and have submitted to the NYSE in 2008 the CEO certification required by the NYSE corporate governance... -

Page 97

... and Chief Accounting Officer John M. Kelly Vice President President, Xerox Global Services North America James H. Lesko Vice President Investor Relations Jule E. Limoli Vice President President, North American Agent Operations Douglas C. Lord Vice President President, North American Solutions Group... -

Page 98

... EDT Xerox Corporate Headquarters 45 Glover Avenue Norwalk, Connecticut Proxy material mailed on April 9, 2009, to shareholders of record March 23, 2009. Products and services www.xerox.com or by phone: 800 ASK-XEROX (800.275.9376) Investor contacts Jason Barnecut, Manager Investor Relations jason... -

Page 99

-

Page 100

© 2009 Xerox Corporation. All rights reserved. XEROX® , the sphere of connectivity design, DocuColor® , DocuTech® , FreeFlow® , New Business , Phaser® , WorkCentre® , iGen3® , iGen4™ , and Xerox Nuvera® are trademarks of, or licensed to Xerox Corporation in the U.S. of Printing® and/or ...