UPS 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

85

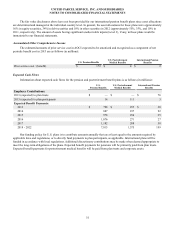

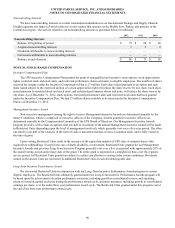

Debt Covenants

Our existing debt instruments and credit facilities subject us to certain financial covenants. As of December 31, 2012 and

for all prior periods presented, we have satisfied these financial covenants. These covenants limit the amount of secured

indebtedness that we may incur, and limit the amount of attributable debt in sale-leaseback transactions, to 10% of net tangible

assets. As of December 31, 2012, 10% of net tangible assets is equivalent to $2.770 billion; however, we have no covered sale-

leaseback transactions or secured indebtedness outstanding. Additionally, we are required to maintain a minimum net worth, as

defined, of $5.0 billion on a quarterly basis. As of December 31, 2012, our net worth, as defined, was equivalent to $8.007

billion. We do not expect these covenants to have a material impact on our financial condition or liquidity.

Fair Value of Debt

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and maturities,

the fair value of long-term debt, including current maturities, is approximately $14.658 and $12.035 billion as of December 31,

2012 and 2011, respectively. We utilized Level 2 inputs in the fair value hierarchy of valuation techniques to determine the fair

value of all of our debt instruments.

NOTE 8. LEGAL PROCEEDINGS AND CONTINGENCIES

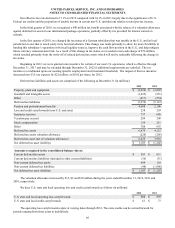

We are involved in a number of judicial proceedings and other matters arising from the conduct of our business activities.

Although there can be no assurance as to the ultimate outcome, we have generally denied, or believe we have a

meritorious defense and will deny, liability in all litigation pending against us, including (except as otherwise noted herein) the

matters described below, and we intend to defend vigorously each case. We have accrued for legal claims when, and to the

extent that, amounts associated with the claims become probable and can be reasonably estimated. The actual costs of resolving

legal claims may be substantially higher or lower than the amounts accrued for those claims.

For those matters as to which we are not able to estimate a possible loss or range of loss, we are not able to determine

whether the loss will have a material adverse effect on our business, financial condition or results of operations or liquidity. For

matters in this category, we have indicated in the descriptions that follow the reasons that we are unable to estimate the possible

loss or range of loss.

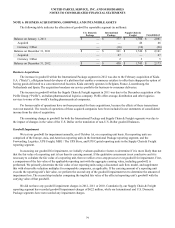

Judicial Proceedings

We are a defendant in a number of lawsuits filed in state and federal courts containing various class action allegations

under state wage-and-hour laws. At this time, we do not believe that any loss associated with these matters, would have a

material adverse effect on our financial condition, results of operations or liquidity.

UPS and our subsidiary Mail Boxes Etc., Inc. are defendants in a lawsuit in California Superior Court about the

rebranding of The UPS Store franchises. In the Morgate case, the plaintiffs are 125 individual franchisees who did not rebrand

to The UPS Store and a certified class of all franchisees who did rebrand. The trial court entered judgment against a bellwether

individual plaintiff, which was affirmed in January 2012. The trial court granted our motion for summary judgment against the

certified class, which was reversed in January 2012.

There are multiple factors that prevent us from being able to estimate the amount of loss, if any, that may result from

whatever remaining aspects of this case proceeds, including: (1) we are vigorously defending ourselves and believe we have a

number of meritorious legal defenses; and (2) it remains uncertain what evidence of damages, if any, plaintiffs will be able to

present. Accordingly, at this time, we are not able to estimate a possible loss or range of loss that may result from this matter or

to determine whether such loss, if any, would have a material adverse effect on our financial condition, results of operations or

liquidity.