UPS 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

96

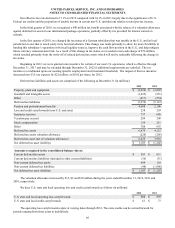

We also have non-U.S. loss carryforwards of approximately $842 million as of December 31, 2012, the majority of which

may be carried forward indefinitely. As indicated in the table above, we have established a valuation allowance for certain non-

U.S. and state carryforwards, due to the uncertainty resulting from a lack of previous taxable income within the applicable tax

jurisdictions.

Undistributed earnings of foreign subsidiaries amounted to approximately $3.575 billion at December 31, 2012. Those

earnings are considered to be indefinitely reinvested and, accordingly, no deferred income taxes have been provided thereon.

Upon distribution of those earnings in the form of dividends or otherwise, we would be subject to income taxes and

withholding taxes payable in various jurisdictions, which could potentially be offset by foreign tax credits. Determination of the

amount of unrecognized deferred income tax liability is not practicable because of the complexities associated with its

hypothetical calculation.

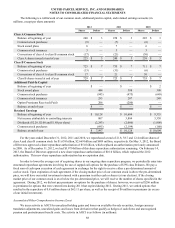

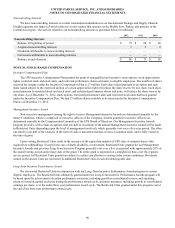

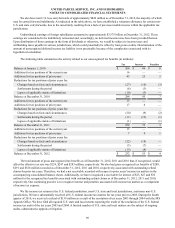

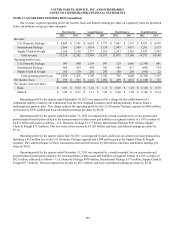

The following table summarizes the activity related to our unrecognized tax benefits (in millions):

Tax Interest Penalties

Balance at January 1, 2010 $ 266 $ 86 $ 8

Additions for tax positions of the current year 16 — —

Additions for tax positions of prior years 45 25 2

Reductions for tax positions of prior years for:

Changes based on facts and circumstances (27)(10)(3)

Settlements during the period (6)(3) —

Lapses of applicable statute of limitations (10)(3) —

Balance at December 31, 2010 284 95 7

Additions for tax positions of the current year 13 — —

Additions for tax positions of prior years 17 6 —

Reductions for tax positions of prior years for:

Changes based on facts and circumstances (50)(9)(2)

Settlements during the period (11)(19)(1)

Lapses of applicable statute of limitations (1) — (1)

Balance at December 31, 2011 252 73 3

Additions for tax positions of the current year 13 — —

Additions for tax positions of prior years 7 9 1

Reductions for tax positions of prior years for:

Changes based on facts and circumstances (22)(18) —

Settlements during the period (3)(7) —

Lapses of applicable statute of limitations (15)(4) —

Balance at December 31, 2012 $ 232 $ 53 $ 4

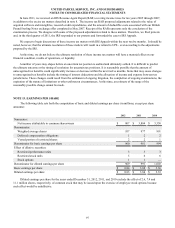

The total amount of gross unrecognized tax benefits as of December 31, 2012, 2011 and 2010 that, if recognized, would

affect the effective tax rate was $224, $247 and $283 million, respectively. We also had gross recognized tax benefits of $280,

$291 and $326 million recorded as of December 31, 2012, 2011 and 2010, respectively, associated with outstanding refund

claims for prior tax years. Therefore, we had a net receivable recorded with respect to prior years’ income tax matters in the

accompanying consolidated balance sheets. Additionally, we have recognized a receivable for interest of $23, $27 and $32

million for the recognized tax benefits associated with outstanding refund claims as of December 31, 2012, 2011 and 2010,

respectively. Our continuing practice is to recognize interest and penalties associated with income tax matters as a component

of income tax expense.

We file income tax returns in the U.S. federal jurisdiction, most U.S. state and local jurisdictions, and many non-U.S.

jurisdictions. We have substantially resolved all U.S. federal income tax matters for tax years prior to 2005. During the fourth

quarter of 2010, we received a refund of $139 million as a result of the resolution of tax years 2003 through 2004 with the IRS

Appeals Office. We have filed all required U.S. state and local returns reporting the result of the resolution of the U.S. federal

income tax audit of the tax years 2003 and 2004. A limited number of U.S. state and local matters are the subject of ongoing

audits, administrative appeals or litigation.