UPS 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

69

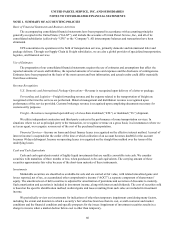

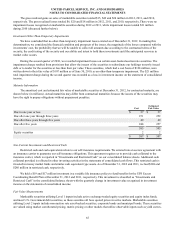

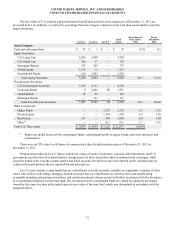

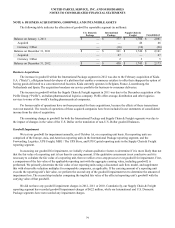

Net Periodic Benefit Cost

Information about net periodic benefit cost for the company-sponsored pension and postretirement benefit plans is as

follows (in millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension Benefits

2012 2011 2010 2012 2011 2010 2012 2011 2010

Net Periodic Cost:

Service cost $ 998 $ 870 $ 723 $ 89 $ 89 $ 86 $ 41 $ 34 $ 24

Interest cost 1,410 1,309 1,199 208 207 214 41 39 34

Expected return on assets (1,970) (1,835) (1,381)(18)(16)(22)(47)(43)(36)

Amortization of:

Transition obligation — — — — — — — — —

Prior service cost 173 171 172 5 7 4 2 1 1

Actuarial (gain) loss 4,388 736 70 374 — — 69 91 42

Other — — — — — — (10) — 6

Net periodic benefit cost $4,999 $1,251 $ 783 $ 658 $ 287 $ 282 $ 96 $ 122 $ 71

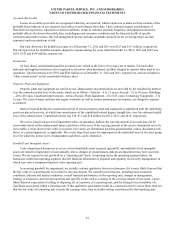

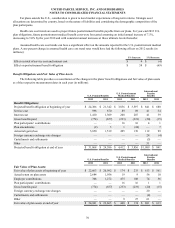

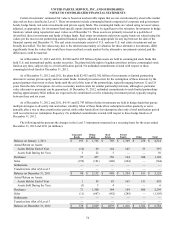

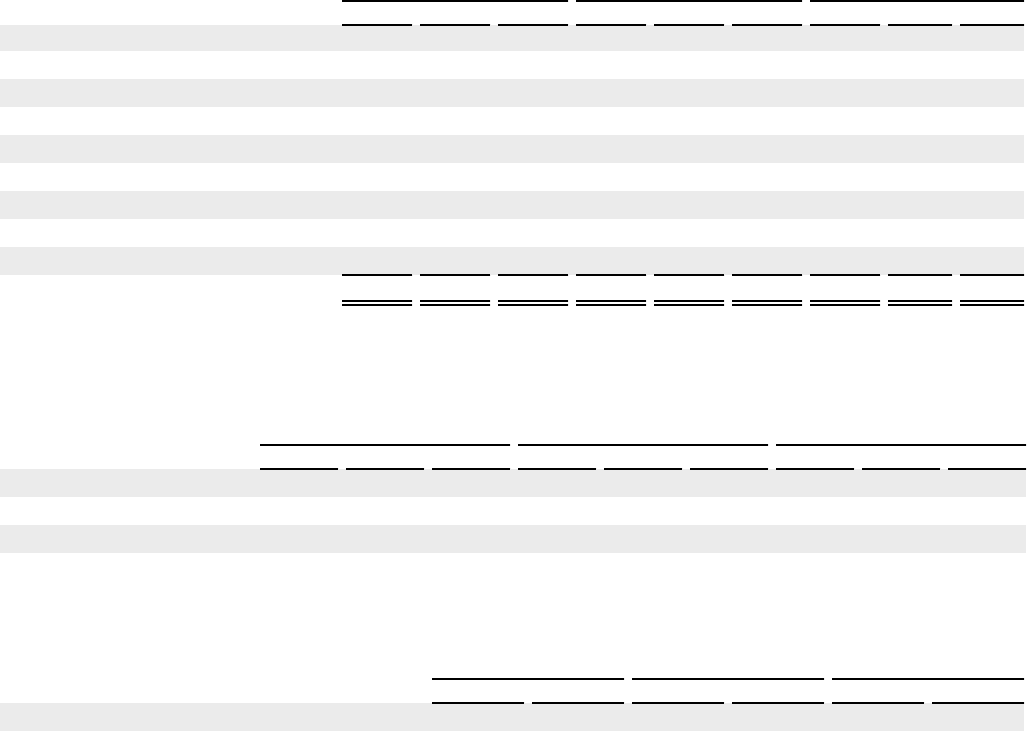

Actuarial Assumptions

The table below provides the weighted-average actuarial assumptions used to determine the net periodic benefit cost.

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension Benefits

2012 2011 2010 2012 2011 2010 2012 2011 2010

Discount rate 5.64% 5.98% 6.58% 5.47% 5.77% 6.43% 4.63% 5.36% 5.84%

Rate of compensation increase 4.50% 4.50% 4.50% N/A N/A N/A 3.58% 3.57% 3.62%

Expected return on assets 8.75% 8.75% 8.75% 8.75% 8.75% 8.75% 7.20% 7.31% 7.25%

The table below provides the weighted-average actuarial assumptions used to determine the benefit obligations of our

plans.

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension Benefits

2012 2011 2012 2011 2012 2011

Discount rate 4.42% 5.64% 4.21% 5.47% 4.00% 4.63%

Rate of compensation increase 4.16% 4.50% N/A N/A 3.03% 3.58%

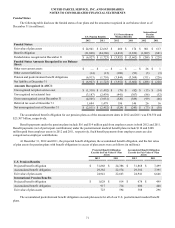

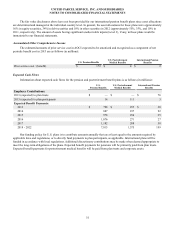

A discount rate is used to determine the present value of our future benefit obligations. To determine our discount rate for

our U.S. pension and other postretirement benefit plans, we use a bond matching approach to select specific bonds that would

satisfy our projected benefit payments. We believe the bond matching approach reflects the process we would employ to settle

our pension and postretirement benefit obligations. For our international plans, the discount rate is determined by matching the

expected cash flows of a sample plan of similar duration to a yield curve based on long-term, high quality fixed income debt

instruments available as of the measurement date. For 2012, each basis point increase in the discount rate decreases the

projected benefit obligation by approximately $57 million and $5 million for pension and postretirement medical benefits,

respectively. These assumptions are updated each measurement date, which is typically annually.

An assumption for expected return on plan assets is used to determine a component of net periodic benefit cost for the

fiscal year. This assumption for our U.S. plans was developed using a long-term projection of returns for each asset class, and

taking into consideration our target asset allocation. The expected return for each asset class is a function of passive, long-term

capital market assumptions and excess returns generated from active management. The capital market assumptions used are

provided by independent investment advisors, while excess return assumptions are supported by historical performance, fund

mandates and investment expectations. In addition, we compare the expected return on asset assumption with the average

historical rate of return these plans have been able to generate.