UPS 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

26

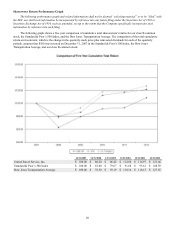

Revenue per piece for our Next Day Air and deferred products decreased in 2012 compared with 2011, as declines in fuel

surcharge rates and product mix changes more than offset the impact of a base rate increase that took effect in early 2012.

Changes in product mix negatively impacted revenue per piece for our air products, as our lightweight service offerings

accounted for a larger portion of our overall air volume in 2012 compared with 2011, and our Next Day Air Saver volume

continued to grow at a faster rate than our premium Next Day Air services.

Ground revenue per piece increased in 2012 compared with 2011, primarily due to a base rate increase that took effect in

early 2012; however, this was partially offset by product mix changes, as strong volume growth in our lightweight service

offerings resulted in these relatively lower-yielding products accounting for a greater portion of our overall volume in 2012,

compared with 2011.

Revenue per piece for our ground and air products was positively impacted by an increase in base rates that took effect on

January 2, 2012. We increased the base rates 6.9% on UPS Next Day Air, UPS 2nd Day Air and UPS 3 Day Select, and 5.9%

on UPS Ground, while reducing our fuel surcharge indices (discussed further below). Other pricing changes included an

increase in the residential surcharge, and an increase in the delivery area surcharge on certain residential and commercial

services. These rate changes are customary and occur on an annual basis.

2011 compared to 2010

Overall revenue per piece increased for our ground and air products during 2011 due to a combination of base price

increases and fuel surcharge rate changes, which are discussed further below. The overall revenue per piece increase was also

positively affected by our focus on revenue management initiatives. In addition, the revenue per piece increase for our air

products was positively impacted by the overall mix shift from letters to packages. Comparing the fourth quarter of 2011 with

2010, the average revenue per piece increase slowed to 3.4% due to the higher volume of lighter-weight business-to-consumer

packages.

Revenue per piece for our ground and air products was also impacted by an increase in base rates that took effect on

January 3, 2011. We increased the base rates 6.9% on UPS Next Day Air, UPS 2nd Day Air, and UPS 3 Day Select, and 5.9%

on UPS Ground, while reducing our fuel surcharge indices (discussed further below). Other pricing changes included an

increase in the residential surcharge, and an increase in the delivery area surcharge on both residential and commercial services

to certain ZIP codes.

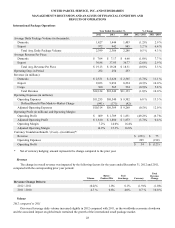

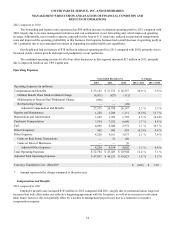

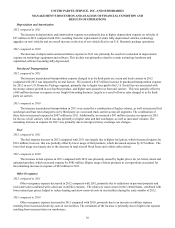

Fuel Surcharges

UPS applies a fuel surcharge on our domestic air and ground services. The air fuel surcharge is based on the U.S.

Department of Energy’s (“DOE”) Gulf Coast spot price for a gallon of kerosene-type jet fuel, while the ground fuel surcharge is

based on the DOE’s On-Highway Diesel Fuel Price. Based on published rates, the average fuel surcharge rates for domestic air

and ground products were as follows:

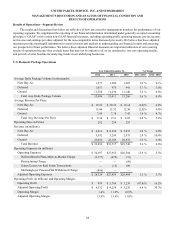

Year Ended December 31, % Point Change

2012 2011 2010 2012 / 2011 2011 / 2010

Next Day Air / Deferred 13.0% 13.3% 8.0% (0.3)% 5.3%

Ground 8.0% 8.0% 5.6% — % 2.4%

In connection with our base rate increases on January 2, 2012 and January 3, 2011, we modified the fuel surcharge on air

and ground services by reducing the index used to determine the fuel surcharge by 2% and 1%, respectively, each year. In

2012, these index reductions offset the increase in jet and diesel fuel prices, resulting in a small decrease in the average air fuel

surcharge rate and no change in the average ground surcharge rate. The 2011 increases in the air and ground fuel surcharge

rates were due to the significant increases in jet and diesel fuel prices, but partially offset by the reductions in the index on both

the air and ground surcharges. Total domestic fuel surcharge revenue increased $54 and $884 million in 2012 and 2011,

respectively, primarily due to volume growth in 2012 and the higher fuel surcharge rates in 2011.