UPS 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

97

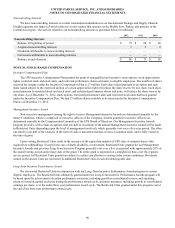

In June 2011, we received an IRS Revenue Agent Report (RAR) covering income taxes for tax years 2005 through 2007,

in addition to the excise tax matters described in note 8. The income tax RAR proposed adjustments related to the value of

acquired software and intangibles, research credit expenditures, and the amount of deductible costs associated with our British

Pound Sterling Notes exchange offer completed in May 2007. Receipt of the RAR represents only the conclusion of the

examination process. We disagree with some of the proposed adjustments related to these matters. Therefore, we filed protests

and, in the third quarter of 2011, the IRS responded to our protests and forwarded the case to IRS Appeals.

We expect to begin discussions of these income tax matters with IRS Appeals within the next twelve months. It should be

noted, however, that the ultimate resolution of these matters will result in a refund to UPS - even according to the adjustments

proposed by the IRS.

At this time, we do not believe the ultimate resolution of these income tax matters will have a material effect on our

financial condition, results of operations, or liquidity.

A number of years may elapse before an uncertain tax position is audited and ultimately settled. It is difficult to predict

the ultimate outcome or the timing of resolution for uncertain tax positions. It is reasonably possible that the amount of

unrecognized tax benefits could significantly increase or decrease within the next twelve months. Items that may cause changes

to unrecognized tax benefits include the timing of interest deductions and the allocation of income and expense between tax

jurisdictions. These changes could result from the settlement of ongoing litigation, the completion of ongoing examinations, the

expiration of the statute of limitations or other unforeseen circumstances. At this time, an estimate of the range of the

reasonably possible change cannot be made.

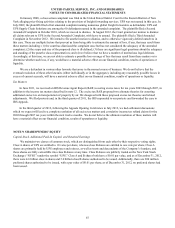

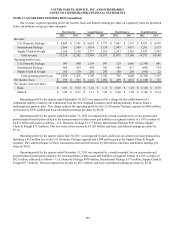

NOTE 13. EARNINGS PER SHARE

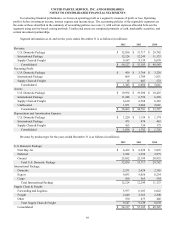

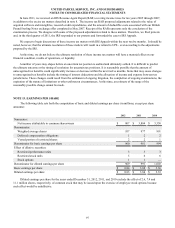

The following table sets forth the computation of basic and diluted earnings per share (in millions, except per share

amounts):

2012 2011 2010

Numerator:

Net income attributable to common shareowners $ 807 $ 3,804 $ 3,338

Denominator:

Weighted average shares 957 977 991

Deferred compensation obligations 1 2 2

Vested portion of restricted shares 2 2 1

Denominator for basic earnings per share 960 981 994

Effect of dilutive securities:

Restricted performance units 3 3 3

Restricted stock units 5 6 6

Stock options 1 1 —

Denominator for diluted earnings per share 969 991 1,003

Basic earnings per share $ 0.84 $ 3.88 $ 3.36

Diluted earnings per share $ 0.83 $ 3.84 $ 3.33

Diluted earnings per share for the years ended December 31, 2012, 2011, and 2010 exclude the effect of 2.6, 7.4 and

11.1 million shares, respectively, of common stock that may be issued upon the exercise of employee stock options because

such effect would be antidilutive.