UPS 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

32

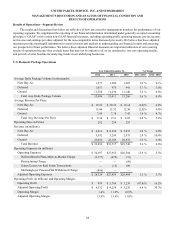

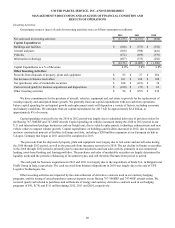

Revenue

2012 compared to 2011

Forwarding and logistics revenue decreased $126 million in 2012 compared with 2011. Forwarding revenue decreased in

2012, primarily due to lower rates in our air forwarding business and the adverse impact of foreign currency exchange rates;

however, this was partially offset by improved tonnage in both our air and ocean forwarding businesses. The reduction in rates

in the air forwarding business was largely due to industry overcapacity in key trade lanes, particularly the Asia-outbound

market. In our logistics products, revenue increased in 2012 as we experienced robust growth in our mail services and health

care solutions. The improved revenue in our health care solutions business was driven by organic growth as well as the

December 2011 acquisition of Pieffe Group.

Freight revenue increased $77 million for the year, driven by an increase in LTL revenue per hundredweight and in gross

weight hauled; however, these factors were somewhat offset by a decline in average daily LTL shipments. The increase in LTL

revenue per hundredweight was largely due to our focus on yield management and profitable revenue growth, as well as a

general rate increase averaging 5.9% that took effect on July 16, 2012, covering non-contractual shipments in the United States,

Canada and Mexico. The decline in average daily LTL shipments in 2012 was impacted by increased competitiveness in the

LTL market and the slowdown in the U.S. economy. Fuel surcharge revenue increased by $16 million for 2012 compared with

the prior year, due to changes in diesel fuel prices and overall LTL shipment volume.

The other businesses within Supply Chain & Freight increased revenue by $57 million in 2012 compared with 2011,

primarily due to growth at The UPS Store, UPS Customer Solutions and our contract to provide domestic air transportation

services for the U.S. Postal Service.

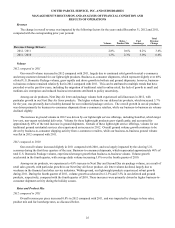

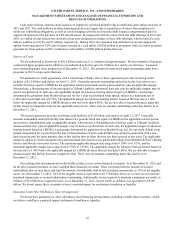

2011 compared to 2010

Forwarding and logistics revenue increased $81 million in 2011 compared with 2010, primarily due to growth in our

logistics services, where we experienced solid growth in our mail services, retail and health care solutions. Forwarding revenue

decreased primarily due to volume and tonnage declines in our air and ocean forwarding businesses, as well as lower third-

party transportation carrier rates. The tonnage decrease was mainly the result of revenue management initiatives that improve

the matching of customer pricing with market conditions, as well as the impact of the global economic slowdown.

Freight revenue increased $355 million in 2011 compared with 2010, primarily due to growth in LTL shipments, an

increase in base rates, and increased fuel surcharge rates. LTL shipments per day increased in 2011, largely due to improving

LTL market conditions in the first half of the year and an increase in market share. However, volume declined in the latter half

of the year, and was impacted by our focus on yield management and also due to the overall LTL market being adversely

impacted by the slowing economy. LTL revenue per hundredweight increased, primarily as a result of a base rate increase that

took effect during the year, negotiated increases on existing contract rates and higher fuel surcharge rates, as total fuel

surcharge revenue increased $159 million for the year driven by higher diesel fuel prices. An increase in base prices took effect

on August 1, 2011, as our freight unit increased minimum charge, LTL and TL rates an average of 6.9%, covering non-

contractual shipments in the United States, Canada and Mexico.

The other businesses within Supply Chain & Freight experienced a $33 million increase in revenue, primarily due to

growth at UPS Capital, the UPS Store, UPS Customer Solutions and our contract to provide domestic air transportation

services for the U.S. Postal Service.

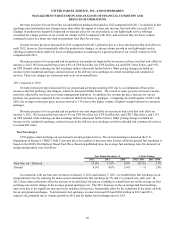

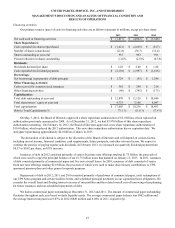

Operating Expenses

2012 compared to 2011

Forwarding and logistics adjusted operating expenses decreased $97 million in 2012 compared with 2011, due to several

factors. Purchased transportation expense fell by $65 million in 2012, primarily due to lower rates charged to us by third-party

transportation carriers (though this briefly reversed in the fourth quarter). Compensation and benefits expense declined by $28

million in 2012, largely due to reduced payroll and lower management incentive compensation costs. These factors were

partially offset by a $10 million increase in depreciation and amortization, due to the amortization of intangible assets

associated with our acquisition of Pieffe Group and the continued investment in technology and facilities in our health care

logistics business.