UPS 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

75

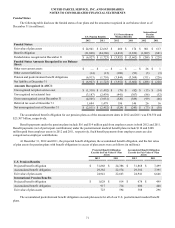

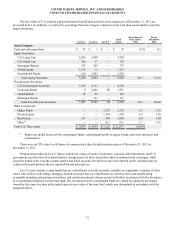

The fair value disclosures above have not been provided for our international pension benefit plans since asset allocations

are determined and managed at the individual country level. In general, the asset allocations for these plans were approximately

56% in equity securities, 34% in debt securities and 10% in other securities in 2012 (approximately 55%, 35%, and 10% in

2011, respectively). The amount of assets having significant unobservable inputs (Level 3), if any, in these plans would be

immaterial to our financial statements.

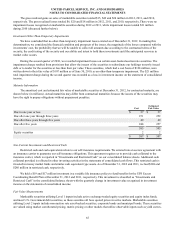

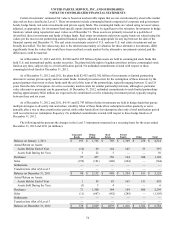

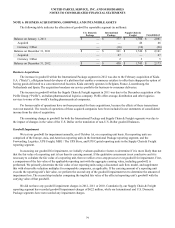

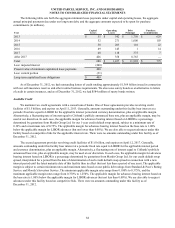

Accumulated Other Comprehensive Income

The estimated amounts of prior service cost in AOCI expected to be amortized and recognized as a component of net

periodic benefit cost in 2013 are as follows (in millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Prior service cost / (benefit) $ 172 $ 4 $ 2

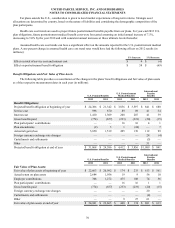

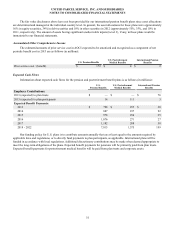

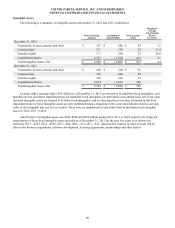

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in millions):

U.S.

Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Employer Contributions:

2013 (expected) to plan trusts $ — $ — $ 76

2013 (expected) to plan participants 14 111 3

Expected Benefit Payments:

2013 $ 798 $ 255 $ 20

2014 887 237 22

2015 978 254 25

2016 1,076 271 27

2017 1,182 288 30

2018 - 2022 7,815 1,575 199

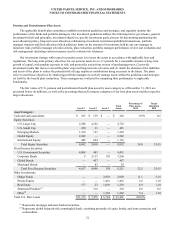

Our funding policy for U.S. plans is to contribute amounts annually that are at least equal to the amounts required by

applicable laws and regulations, or to directly fund payments to plan participants, as applicable. International plans will be

funded in accordance with local regulations. Additional discretionary contributions may be made when deemed appropriate to

meet the long-term obligations of the plans. Expected benefit payments for pensions will be primarily paid from plan trusts.

Expected benefit payments for postretirement medical benefits will be paid from plan trusts and corporate assets.