UPS 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

103

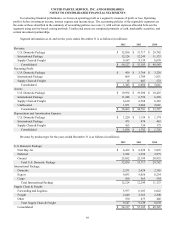

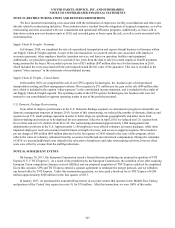

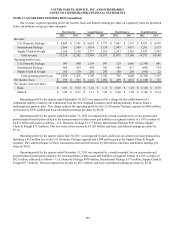

NOTE 15. RESTRUCTURING COSTS AND BUSINESS DISPOSITIONS

We have incurred restructuring costs associated with the termination of employees, facility consolidations and other costs

directly related to restructuring initiatives. These initiatives have resulted from the integration of acquired companies, as well as

restructuring activities associated with cost containment and operational efficiency programs. Additionally, we have sold or

shut-down certain non-core business units in 2010, and recorded gains or losses upon the sale, as well as costs associated with

each transaction.

Supply Chain & Freight—Germany

In February 2010, we completed the sale of a specialized transportation and express freight business in Germany within

our Supply Chain & Freight segment. As part of the sale transaction, we incurred certain costs associated with employee

severance payments, other employee benefits, transition services, and leases on operating facilities and equipment.

Additionally, we provided a guarantee for a period of two years from the date of sale for certain employee benefit payments

being assumed by the buyer. We recorded a pre-tax loss of $51 million ($47 million after-tax) for this transaction in 2010,

which included the costs associated with the sale transaction and the fair value of the guarantee. This loss is recorded in the

caption “other expenses” in the statements of consolidated income.

Supply Chain & Freight—United States

In December 2010, we completed the sale of our UPS Logistics Technologies, Inc. business unit, which produced

transportation routing and fleet management systems. We recognized a $71 million pre-tax gain on the sale ($44 million after

tax), which is included in the caption “other expenses” in the consolidated income statement, and is included in the results of

our Supply Chain & Freight segment. The operating results of the UPS Logistics Technologies, Inc business unit were not

material to our consolidated or segment operating results in any of the periods presented.

U.S. Domestic Package Restructuring

In an effort to improve performance in the U.S. Domestic Package segment, we announced a program to streamline our

domestic management structure in January 2010. As part of this restructuring, we reduced the number of domestic districts and

regions in our U.S. small package operation in order to better align our operations geographically and allow more local

decision-making and resources to be deployed for our customers. Effective in April 2010, we reduced our U.S. regions from

five to three and our U.S. districts from 46 to 20. The restructuring eliminated approximately 1,800 management and

administrative positions in the U.S. Approximately 1,100 employees were offered voluntary severance packages, while other

impacted employees received severance benefits based on length of service, and access to support programs. We recorded a

pre-tax charge of $98 million ($64 million after-tax) in the first quarter of 2010 related to the costs of this program, which

reflects the value of voluntary retirement benefits, severance benefits and unvested stock compensation. During the remainder

of 2010, we incurred additional costs related to the relocation of employees and other restructuring activities, however those

costs were offset by savings from the staffing reductions.

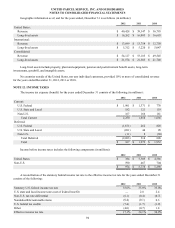

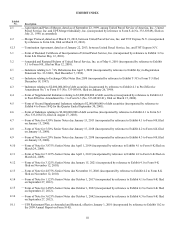

NOTE 16. SUBSEQUENT EVENTS

On January 30, 2013, the European Commission issued a formal decision prohibiting our proposed acquisition of TNT

Express N.V. ("TNT Express"). As a result of the prohibition by the European Commission, the condition of our offer requiring

European Union competition clearance was not fulfilled, and our proposed acquisition of TNT Express could not be completed.

Given this outcome, UPS and TNT Express entered a separate agreement to terminate the merger protocol, and we withdrew

our formal offer for TNT Express. Under this termination agreement, we have paid a break-up fee to TNT Express of €200

million (approximately $268 million) in the first quarter of 2013.

In January 2013, we purchased the noncontrolling interest in our joint venture that operates in the Middle East, Turkey,

and portions of the Central Asia region (see note 9), for $70 million. After this transaction, we own 100% of this entity.