UPS 2012 Annual Report Download - page 35

Download and view the complete annual report

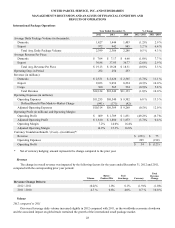

Please find page 35 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

23

These items have been excluded from comparisons of "adjusted" operating expenses, operating profit and operating

margin in the discussion that follows.

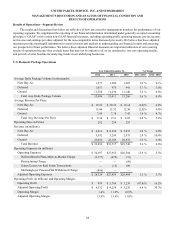

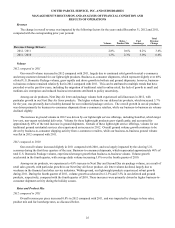

Defined Benefit Plans Mark-to-Market Charge

In 2012, 2011 and 2010, we incurred pre-tax mark-to-market losses of $4.831 billion, $827 million and $112 million,

respectively, on a consolidated basis ($3.023 billion, $527 million and $75 million after-tax, respectively) on our pension and

postretirement defined benefit plans related to the remeasurement of plan assets and liabilities recognized outside of a 10%

corridor. These mark-to-market losses for 2012, 2011 and 2010 primarily resulted from decreases in the discount rates used to

value our projected benefit obligations in each year, which more than offset the impact of the actual rate of return on plan assets

exceeding the expected rate of return. These losses, which were recorded in compensation and benefits expense in our

statements of consolidated income, impacted each of our three reporting segments for 2012, 2011 and 2010.

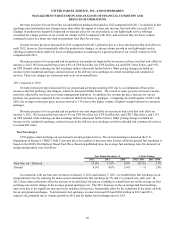

Multiemployer Pension Plan Withdrawal Charge

In 2012, we recognized an $896 million pre-tax charge ($559 million after-tax) for the establishment of a withdrawal

liability related to our withdrawal from the New England Teamsters and Trucking Industry Pension Fund ("New England

Pension Fund"), a multiemployer pension plan. This charge was recorded in compensation and benefits expense in our

statements of consolidated income, and impacted our U.S. Domestic Package segment.

Restructuring Charge

In 2010, we streamlined the management structure in our U.S. Domestic Package segment, and incurred a restructuring

charge associated with this reorganization. This pre-tax charge totaled $98 million ($64 million after-tax), and was recorded in

compensation and benefits expense in our statements of consolidated income. The charge reflects the value of voluntary

retirement benefits and severance benefits, as well as the accelerated recognition of unvested stock compensation.

Gain on Sales of Businesses

In 2010, we sold our UPS Logistics Technologies business unit within our Supply Chain & Freight segment, and

recognized a pre-tax gain of $71 million ($44 million after-tax). Also in 2010, we sold a specialized transportation business in

Germany within our Supply Chain & Freight segment, and incurred a pre-tax loss on the sale of $51 million ($47 million after-

tax), which includes a fair value adjustment loss due to a financial guarantee associated with this business sale. The gains and

losses associated with these transactions are recorded in other operating expenses in our statements of consolidated income.

Gains on Real Estate Transactions

In 2011, we recognized a net $33 million pre-tax gain ($20 million after-tax) on a consolidated basis on certain real estate

transactions (consisting of a $48 million pre-tax gain in our Supply Chain & Freight segment, and a $15 million pre-tax loss in

our U.S. Domestic Package segment). In 2010, we recognized a pre-tax gain of $109 million ($61 million after-tax) on the sale

of real estate within our U.S. Domestic Package segment. The gains and losses associated with these transactions are recorded

in other operating expenses in our statements of consolidated income.

Charge for Change in Tax Filing Status for German Subsidiary

In 2010, we changed the tax status of a German subsidiary that was taxable in the U.S. and its local jurisdiction to one

that is solely taxed in its local jurisdiction. As a result of this change in tax status, we recorded a non-cash charge of $76 million

to income tax expense, which resulted primarily from the write-off of related deferred tax assets which will not be realizable

following the change in tax status.