UPS 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

41

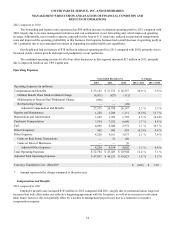

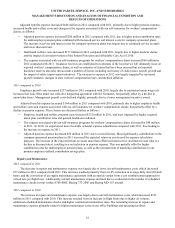

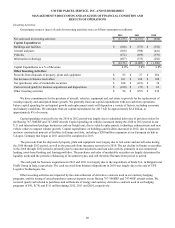

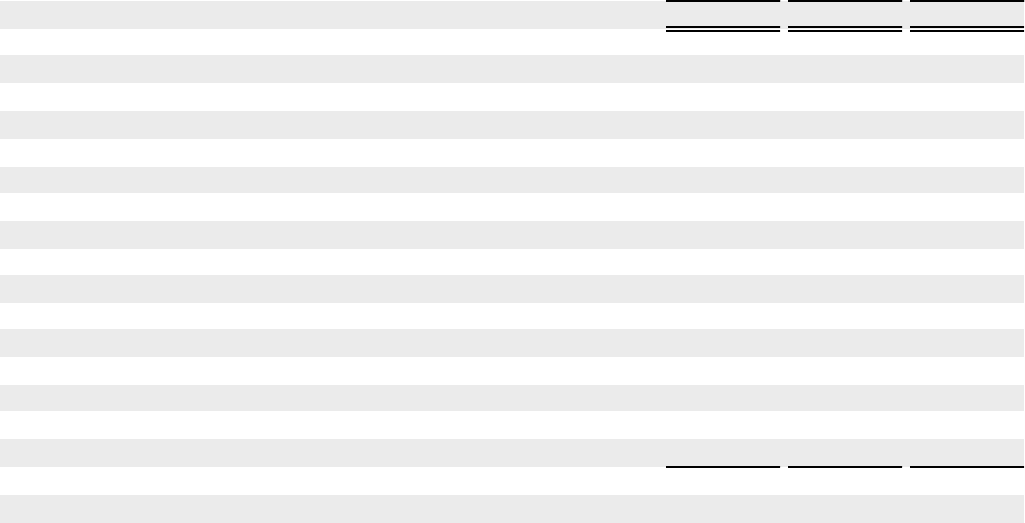

Financing Activities

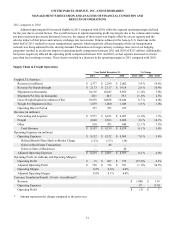

Our primary sources (uses) of cash for financing activities are as follows (amounts in millions, except per share data):

2012 2011 2010

Net cash used in financing activities $ (1,817) $ (4,862) $ (1,346)

Share Repurchases:

Cash expended for shares repurchased $ (1,621) $ (2,665) $ (817)

Number of shares repurchased (21.8) (38.7) (12.4)

Shares outstanding at year-end 953 963 991

Percent reduction in shares outstanding (1.0)% (2.8)% (0.3)%

Dividends:

Dividends declared per share $ 2.28 $ 2.08 $ 1.88

Cash expended for dividend payments $ (2,130) $ (1,997) $ (1,818)

Borrowings:

Net borrowings (repayments) of debt principal $ 1,729 $ (95) $ 1,246

Other Financing Activities:

Cash received for common stock issuances $ 301 $ 290 $ 218

Other financing activities $ (96) $ (395) $ (175)

Capitalization:

Total debt outstanding at year-end $ 12,870 $ 11,128 $ 10,846

Total shareowners’ equity at year-end 4,733 7,108 8,047

Total capitalization $ 17,603 $ 18,236 $ 18,893

Debt to Total Capitalization % 73.1 % 61.0 % 57.4 %

On May 3, 2012, the Board of Directors approved a share repurchase authorization of $5.0 billion, which replaced an

authorization previously announced in 2008. As of December 31, 2012, we had $3.970 billion of this share repurchase

authorization remaining. On February 14, 2013, the Board of Directors approved a new share repurchase authorization of

$10.0 billion, which replaced the 2012 authorization. This new share repurchase authorization has no expiration date. We

anticipate repurchasing approximately $4.0 billion of shares in 2013.

The declaration of dividends is subject to the discretion of the Board of Directors and will depend on various factors,

including our net income, financial condition, cash requirements, future prospects, and other relevant factors. We expect to

continue the practice of paying regular cash dividends. In February 2013, we increased our quarterly dividend payment from

$0.57 to $0.62 per share, an 8.8% increase.

Issuances of debt in 2012 consisted primarily of senior fixed rate note offerings totaling $1.75 billion, the proceeds of

which were used to repay the principal balance of our $1.75 billion notes that matured on January 15, 2013. In 2011, issuances

of debt consisted primarily of commercial paper and five new aircraft leases. In 2010, issuances of debt consisted of senior

fixed rate note offerings totaling $2.0 billion, the proceeds of which were used to make discretionary contributions to UPS-

sponsored pension plans and other general corporate purposes.

Repayments of debt in 2012, 2011 and 2010 consisted primarily of paydowns of commercial paper, early redemptions of

our UPS Notes program and certain facilities bonds, and scheduled principal payments on our capitalized lease obligations. We

consider the overall fixed and floating interest rate mix of our portfolio and the related overall cost of borrowing when planning

for future issuances and non-scheduled repayments of debt.

We had no commercial paper outstanding at December 31, 2012 and 2011. The amount of commercial paper outstanding

fluctuates throughout each year based on daily liquidity needs. The average commercial paper balance was $962 million and

the average interest rate paid was 0.07% in 2012 ($849 million and 0.08% in 2011, respectively).