UPS 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

94

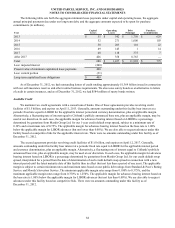

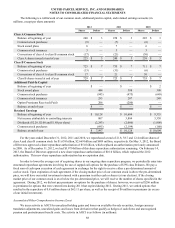

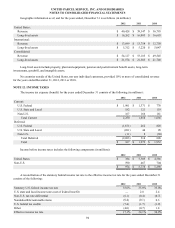

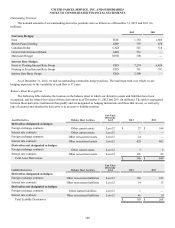

Geographic information as of, and for the years ended, December 31 is as follows (in millions):

2012 2011 2010

United States:

Revenue $ 40,428 $ 39,347 $ 36,795

Long-lived assets $ 16,262 $ 16,085 $ 16,693

International:

Revenue $ 13,699 $ 13,758 $ 12,750

Long-lived assets $ 5,312 $ 5,220 $ 5,047

Consolidated:

Revenue $ 54,127 $ 53,105 $ 49,545

Long-lived assets $ 21,574 $ 21,305 $ 21,740

Long-lived assets include property, plant and equipment, pension and postretirement benefit assets, long-term

investments, goodwill, and intangible assets.

No countries outside of the United States, nor any individual customers, provided 10% or more of consolidated revenue

for the years ended December 31, 2012, 2011 or 2010.

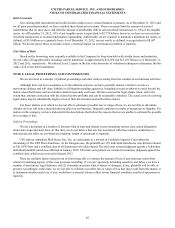

NOTE 12. INCOME TAXES

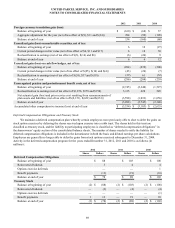

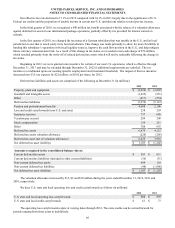

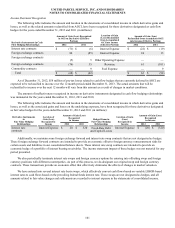

The income tax expense (benefit) for the years ended December 31 consists of the following (in millions):

2012 2011 2010

Current:

U.S. Federal $ 1,901 $ 1,371 $ 776

U.S. State and Local 182 121 119

Non-U.S. 167 166 161

Total Current 2,250 1,658 1,056

Deferred:

U.S. Federal (1,871) 262 828

U.S. State and Local (201) 44 98

Non-U.S. (11) 8 (30)

Total Deferred (2,083) 314 896

Total $ 167 $ 1,972 $ 1,952

Income before income taxes includes the following components (in millions):

2012 2011 2010

United States $ 384 $ 5,309 $ 4,586

Non-U.S. 590 467 704

$ 974 $ 5,776 $ 5,290

A reconciliation of the statutory federal income tax rate to the effective income tax rate for the years ended December 31

consists of the following:

2012 2011 2010

Statutory U.S. federal income tax rate 35.0% 35.0% 35.0%

U.S. state and local income taxes (net of federal benefit) — 2.0 2.4

Non-U.S. tax rate differential (6.1)(0.4)(0.7)

Nondeductible/nontaxable items (0.4)(0.1) 0.3

U.S. federal tax credits (7.4)(1.7)(1.9)

Other (4.0)(0.7) 1.8

Effective income tax rate 17.1% 34.1% 36.9%