UPS 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

47

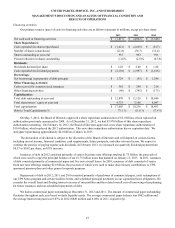

Upon ratification of the agreement by the Teamsters in September 2012, we withdrew from the original pool of the New

England Pension Fund and incurred an undiscounted withdrawal liability of $2.162 billion to be paid in equal monthly

installments over 50 years. The undiscounted withdrawal liability was calculated by independent actuaries employed by the

New England Pension Fund, in accordance with the governing plan documents and the applicable requirements of the

Employee Retirement Income Security Act of 1974. In the third quarter of 2012, we recorded a charge to expense to establish

an $896 million withdrawal liability on our balance sheet, which represents the present value of the $2.162 billion future

payment obligation discounted at a 4.25% interest rate. This discount rate represents the estimated credit-adjusted market rate

of interest at which we could obtain financing of a similar maturity and seniority.

As part of this agreement, we believe that UPS, the New England Pension Fund and our affected employees have

obtained several benefits, including:

• The old pool of the New England Pension Fund has historically had, and would likely continue to have, funding

challenges; this represented a risk to UPS of having to face higher future contribution requirements, as well as a

risk to the security of the pension benefits of those UPS employees who participate in the New England Pension

Fund. The 50 year fixed payment obligation should improve the funded status of the New England Pension Fund

over time, while reducing the risk to UPS of significantly higher future contribution requirements.

• The newly-established pool provides better protections for new participating employers. This pool uses a direct-

attribution methodology for calculating any potential future withdrawal liabilities, which reduces our exposure to

the liabilities of other participating employers. Additionally, this pool contains provisions designed to maintain a

fully-funded status, including automatic benefit reductions and/or increased employee contributions in the event

of an underfunded situation occurring.

• As part of the agreement, we were able to freeze our hourly pension contribution rate to the newly-established

pool of the New England Pension Fund for a period of 10 years, which provides cash flow visibility for both UPS

and the New England Pension Fund.

The $896 million charge to expense recorded in the third quarter of 2012 is included in "compensation and benefits

expense" in the consolidated statement of income, while the corresponding withdrawal liability is included in "other non-

current liabilities" on the consolidated balance sheet. We will impute interest on the withdrawal liability using the 4.25%

discount rate, while the monthly payments made to the New England Pension Fund will reduce the remaining balance of the

withdrawal liability.

Our status in the newly-established pool of the New England Pension Fund is accounted for as the participation in a new

multiemployer pension plan, and therefore we will recognize expense based on the contractually-required contribution for each

period, and we will recognize a liability for any contributions due and unpaid at the end of a reporting period.

Rate Adjustments

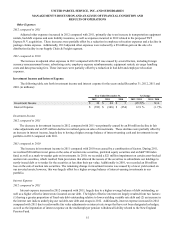

In June 2012, our UPS Freight unit announced a general rate increase averaging 5.9%, covering non-contractual

shipments in the United States, Canada and Mexico. The rate adjustment took effect on July 16, 2012, and applies to minimum

charge, LTL rates and accessorial charges.

In November 2012, we announced an increase in base rates and changes in our fuel surcharge for package shipments that

took effect December 31, 2012, including the following:

• UPS Ground service rates increased an average net 4.9% through a combination of a 5.9% increase in rates and a

1% reduction in the index used to determine the ground fuel surcharge.

• UPS Next Day Air, UPS 2nd Day Air, UPS 3 Day Select, and international air shipments originating in the United

States (including Worldwide Express, Worldwide Express Plus, UPS Worldwide Expedited and UPS International

Standard Service) increased an average net 4.5%, through a combination of a 6.5% increase in base rates and a 2%

reduction in the index used to determine the air fuel surcharge.