UPS 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

89

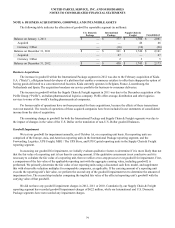

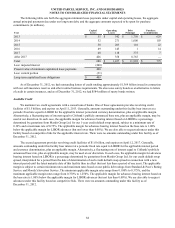

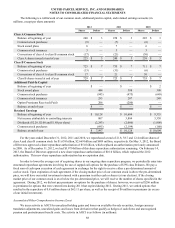

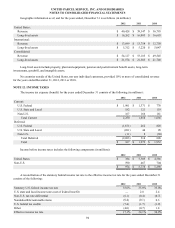

2012 2011 2010

Foreign currency translation gain (loss):

Balance at beginning of year $ (160) $ (68) $ 37

Aggregate adjustment for the year (net of tax effect of $(9), $11 and $(34)) 294 (92)(105)

Balance at end of year 134 (160)(68)

Unrealized gain (loss) on marketable securities, net of tax:

Balance at beginning of year 6 12 (27)

Current period changes in fair value (net of tax effect of $4, $11 and $17) 6 18 30

Reclassification to earnings (net of tax effect of $(3), $(14) and $6) (6)(24) 9

Balance at end of year 6 6 12

Unrealized gain (loss) on cash flow hedges, net of tax:

Balance at beginning of year (204)(239)(200)

Current period changes in fair value (net of tax effect of $(25), $(16) and $(4)) (43)(26)(7)

Reclassification to earnings (net of tax effect of $(24), $37 and $(19)) (39) 61 (32)

Balance at end of year (286)(204)(239)

Unrecognized pension and postretirement benefit costs, net of tax:

Balance at beginning of year (2,745)(2,340)(1,527)

Reclassification to earnings (net of tax effect of $1,876, $378 and $150) 3,135 628 245

Net actuarial gain (loss) and prior service cost resulting from remeasurements of

plan assets and liabilities (net of tax effect of $(2,151), $(622) and $(633)) (3,598)(1,033)(1,058)

Balance at end of year (3,208)(2,745)(2,340)

Accumulated other comprehensive income (loss) at end of year $ (3,354) $ (3,103) $ (2,635)

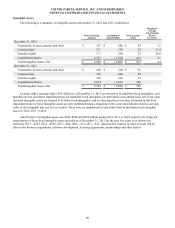

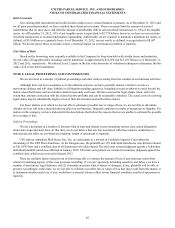

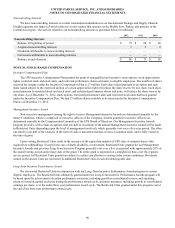

Deferred Compensation Obligations and Treasury Stock

We maintain a deferred compensation plan whereby certain employees were previously able to elect to defer the gains on

stock option exercises by deferring the shares received upon exercise into a rabbi trust. The shares held in this trust are

classified as treasury stock, and the liability to participating employees is classified as “deferred compensation obligations” in

the shareowners’ equity section of the consolidated balance sheets. The number of shares needed to settle the liability for

deferred compensation obligations is included in the denominator in both the basic and diluted earnings per share calculations.

Employees are generally no longer able to defer the gains from stock options exercised subsequent to December 31, 2004.

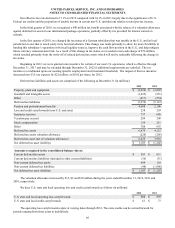

Activity in the deferred compensation program for the years ended December 31, 2012, 2011 and 2010 is as follows (in

millions):

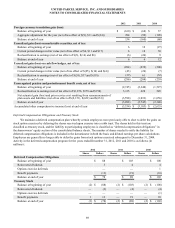

2012 2011 2010

Shares Dollars Shares Dollars Shares Dollars

Deferred Compensation Obligations

Balance at beginning of year $ 88 $ 103 $ 108

Reinvested dividends 3 4 4

Options exercise deferrals — — 1

Benefit payments (13)(19)(10)

Balance at end of year $ 78 $ 88 $ 103

Treasury Stock

Balance at beginning of year (2) $ (88)(2) $ (103)(2) $ (108)

Reinvested dividends — (3) — (4) — (4)

Options exercise deferrals — — — — — (1)

Benefit payments 1 13 — 19 — 10

Balance at end of year (1) $ (78)(2) $ (88)(2) $ (103)