UPS 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

38

2011 compared to 2010

Interest expense declined slightly in 2011 due to a lower average interest rate incurred on variable rate debt and interest

rate swaps, which reduced expense by $60 million for 2011 compared with 2010. However, this was largely offset as a result of

a higher average balance of outstanding debt in 2011 compared with 2010.

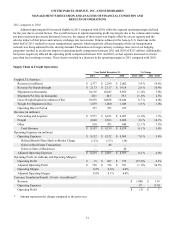

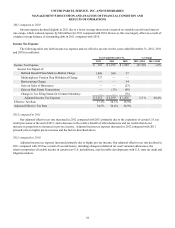

Income Tax Expense

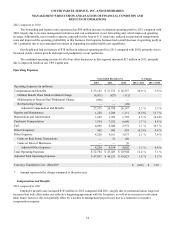

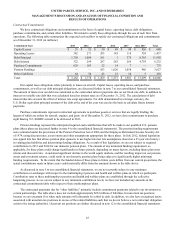

The following table sets forth income tax expense and our effective tax rate for the years ended December 31, 2012, 2011

and 2010 (in millions):

Year Ended December 31, % Change

2012 2011 2010 2012 / 2011 2011 / 2010

Income Tax Expense $ 167 $ 1,972 $ 1,952 (91.5)% 1.0%

Income Tax Impact of:

Defined Benefit Plans Mark-to-Market Charge 1,808 300 37

Multiemployer Pension Plan Withdrawal Charge 337 — —

Restructuring Charge — — 34

Gain on Sales of Businesses — — (23)

Gain on Real Estate Transactions — (13)(48)

Change in Tax Filing Status for German Subsidiary — — (76)

Adjusted Income Tax Expense $ 2,312 $ 2,259 $ 1,876 2.3 % 20.4%

Effective Tax Rate 17.1% 34.1% 36.9%

Adjusted Effective Tax Rate 34.5% 34.4% 34.9%

2012 compared to 2011

Our adjusted effective tax rate increased in 2012 compared with 2011 primarily due to the expiration of certain U.S. tax

credit provisions at the end of 2011, and a decrease in the relative benefit of other deductions and tax credits that do not

increase in proportion to increases in pre-tax income. Adjusted income tax expense increased in 2012 compared with 2011

primarily due to higher pre-tax income and the factors described above.

2011 compared to 2010

Adjusted income tax expense increased primarily due to higher pre-tax income. Our adjusted effective tax rate declined in

2011 compared with 2010 as a result of several factors, including changes in deferred tax asset valuation allowances, the

relative proportion of taxable income in certain non-U.S. jurisdictions, and favorable developments with U.S. state tax audit and

litigation matters.