Redbox 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

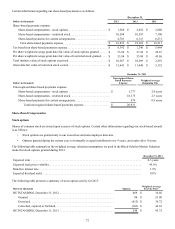

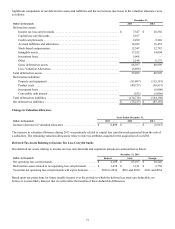

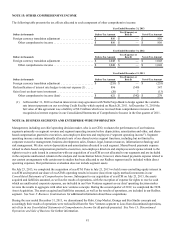

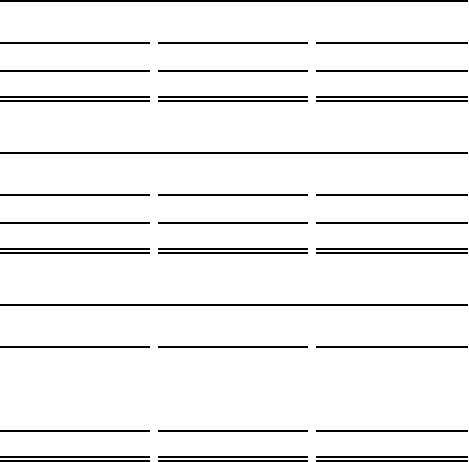

NOTE 15: OTHER COMPREHENSIVE INCOME

The following table presents the tax effects allocated to each component of other comprehensive income:

Year Ended December 31, 2013

Dollars in thousands Before-Tax Amount

Tax (Expense) or

Benefit Net-of-Tax Amount

Foreign currency translation adjustment . . . . . . . . . . . . . . . . . . . . . . $ 856 $ — $ 856

Other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 856 $ — $ 856

Year Ended December 31, 2012

Dollars in thousands Before-Tax Amount

Tax (Expense) or

Benefit Net-of-Tax Amount

Foreign currency translation adjustment . . . . . . . . . . . . . . . . . . . . . . $ 1,048 $ — $ 1,048

Other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,048 $ — $ 1,048

Year Ended December 31, 2011

Dollars in thousands Before-Tax Amount

Tax (Expense) or

Benefit Net-of-Tax Amount

Foreign currency translation adjustment . . . . . . . . . . . . . . . . . . . . . . $ (255)$ — $ (255)

Reclassification of interest rate hedges to interest expense (1) . . . . . 896 (349) 547

Gain (loss) on short-term investment . . . . . . . . . . . . . . . . . . . . . . . . . (20)7

(13)

Other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . . $ 621 $ (342) $ 279

(1) At December 31, 2010 we had an interest rate swap agreement with Wells Fargo Bank to hedge against the variable-

rate interest payments on our revolving Credit Facility which expired on March 20, 2011. At December 31, 2010 the

fair value of this agreement was a liability of $0.9 million which was reversed from comprehensive income and

recognized as interest expense in our Consolidated Statements of Comprehensive Income in the first quarter of 2011.

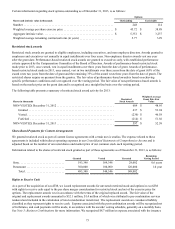

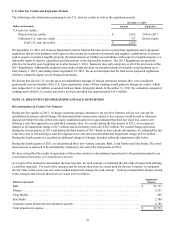

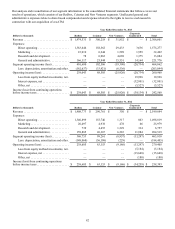

NOTE 16: BUSINESS SEGMENTS AND ENTERPRISE-WIDE INFORMATION

Management, including our chief operating decision maker, who is our CEO, evaluates the performances of our business

segments primarily on segment revenue and segment operating income before depreciation, amortization and other, and share-

based compensation granted to executives, non-employee directors and employees (“segment operating income”). Segment

operating income contains internally allocated costs of our shared service support functions, including but not limited to,

corporate executive management, business development, sales, finance, legal, human resources, information technology and

risk management. We also review depreciation and amortization allocated to each segment. Shared-based payments expense

related to share-based compensation granted to executives, non-employee directors and employees and expense related to the

rights to receive cash issued in connection with our acquisition of ecoATM are not allocated to our segments and are included

in the corporate unallocated column in the analysis and reconciliation below; however, share-based payments expense related to

our content arrangements with certain movie studios has been allocated to our Redbox segment and is included within direct

operating expenses. Our performance evaluation does not include segment assets.

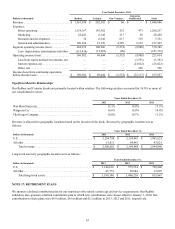

On July 23, 2013, we completed the acquisition of ecoATM. Prior to July 23, 2013 we held a non-controlling equity interest in

ecoATM and reported our share of ecoATM's operating results in income (loss) from equity method investments in our

Consolidated Statements of Comprehensive Income. Subsequent to our acquisition of ecoATM on July 23, 2013, the assets

acquired and liabilities assumed, as well as the results of operations, with the exception of expense for rights to receive cash

which are unallocated corporate expenses, are included in our New Ventures segment as our chief operating decision maker

reviews the results in aggregate with other new ventures concepts. During the second quarter of 2012, we completed the NCR

Asset Acquisition. The assets acquired and liabilities assumed, as well as the results of operations, are included in our Redbox

segment. See Note 3: Business Combinations for additional information about these acquisitions.

During the year ended December 31, 2013, we discontinued the Rubi, Crisp Market, Orango and Star Studio concepts and

accordingly their results of operations were reclassified from the New Ventures segment to Loss from discontinued operations,

net of tax in our Consolidated Statements of Comprehensive Income for all periods presented. See Note 13: Discontinued

Operations and Sale of Business for further information.