Redbox 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

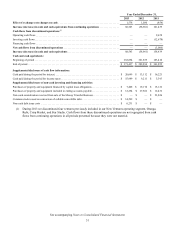

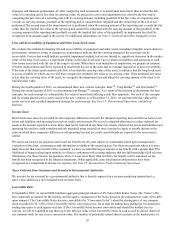

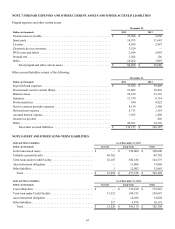

The following table shows the revenue and operating loss included in our Consolidated Statements of Comprehensive Income

resulting from the acquisition of ecoATM since the closing date, including the amortization for acquired intangibles which are

allocated to our New Ventures segment and expense for rights to receive cash which are unallocated corporate expenses:

Year Ended

Dollars in thousands December 31, 2013

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 31,824

Operating loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,538

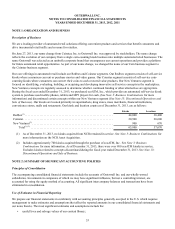

Pro forma information

The following unaudited pro forma information represents the results of operations for Outerwall Inc. and includes the ecoATM

business acquired as if the acquisition was consummated as of January 1, 2012.

Years Ended

December 31,

(Unaudited)

Dollars in thousands 2013 2012

Pro-forma revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,330,195 $ 2,212,107

Pro-forma income from continuing operations (1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 136,245 $ 208,209

(1) Pro-forma income from continuing operations includes the acquisition costs of $1.7 million and $4.0 million recorded

in the second and third quarters of 2013, respectively.

The unaudited pro forma results have been adjusted with respect to certain aspects of our acquisition of ecoATM to reflect:

• changes in assets and liabilities to record their acquisition date fair values and the resulting changes in certain expenses

such as amortization;

• recognition of the gain on our previously held equity interest as if the acquisition occurred on January 1, 2012;

• recognition of expense associated with the post-combination rights to receive cash as if they were granted on January 1,

2012;

• reversals of losses from our equity investment; and

• the inclusion of the results of operations and the impact on taxes as if ecoATM had been a wholly owned subsidiary since

January 1, 2012.

The unaudited pro forma results do not reflect future events that may occur after the acquisition, including, but not limited to,

the anticipated realization of ongoing savings from operating synergies in subsequent periods.

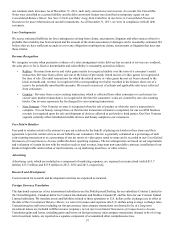

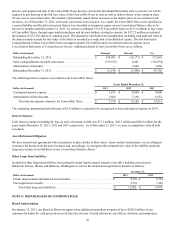

Acquisition of NCR Corporation

On June 22, 2012, Redbox acquired certain assets of NCR Corporation (“NCR”) related to NCR’s self-service entertainment

DVD kiosk business (the “NCR Asset Acquisition”). The purchased assets include, among others, self-service DVD kiosks,

content library, intellectual property, and certain related contracts, including with certain retailers. In consideration, Redbox

paid NCR $100.0 million in cash and assumed certain liabilities of NCR related to the purchased assets. The operating results

of NCR’s self-service entertainment DVD kiosk business are included in our Redbox segment results.

We accounted for the NCR Asset Acquisition as a business combination. In accordance with US GAAP, the measurement

period for our purchase price allocation ends as soon as information regarding our assessment of the quality and quantity of the

kiosks acquired as well as certain facts and circumstances becomes available; such measurement period will not exceed twelve

months from the acquisition date. During the second quarter of 2013, we obtained sufficient evidence regarding the quality and

market value of the kiosks acquired (See Note 4: Property and Equipment for more information on the sale of certain NCR

kiosks during the second quarter of 2013) to finalize our purchase price allocation. As a result, we retroactively adjusted our

purchase price allocation to increase the value assigned to the kiosks acquired by $14.8 million with a corresponding decrease

to goodwill to the period in which the NCR Asset Acquisition occurred. This adjustment to our purchase price allocation

resulted in an immaterial difference in depreciation which we recorded as a cumulative adjustment in the second quarter of

2013.