Redbox 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

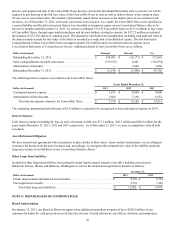

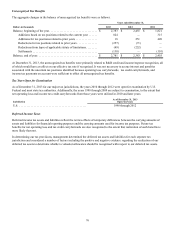

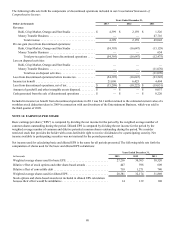

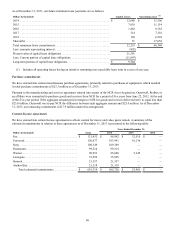

The following table sets forth the components of discontinued operations included in our Consolidated Statements of

Comprehensive Income:

Dollars in thousands

Years Ended December 31,

2013 2012 2011

Revenue:

Rubi, Crisp Market, Orango and Star Studio . . . . . . . . . . . . . . . . $ 4,399 $ 2,159 $ 1,326

Money Transfer Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 47,716

Total revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,399 2,159 49,042

Pre-tax gain (loss) from discontinued operations:

Rubi, Crisp Market, Orango and Star Studio . . . . . . . . . . . . . . . . (54,395)(16,647)(13,129)

Money Transfer Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 654

Total pre-tax gain (loss) from discontinued operations . . . . . (54,395)(16,647)(12,475)

Loss on disposal activities:

Rubi, Crisp Market, Orango and Star Studio . . . . . . . . . . . . . . . . — — —

Money Transfer Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (11,070)

Total loss on disposal activities . . . . . . . . . . . . . . . . . . . . . . . — — (11,070)

Loss from discontinued operations before income tax . . . . . . . . . . . . . (54,395)(16,647)(23,545)

Income tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,096 6,425 4,494

Loss from discontinued operations, net of tax . . . . . . . . . . . . . . . . . . . $ (33,299)$ (10,222)$ (19,051)

Amount of goodwill and other intangible assets disposed . . . . . . . . . . $ — $ — $ 8,037

Cash generated from the sale of discontinued operations . . . . . . . . . . $ — $ — $ 8,220

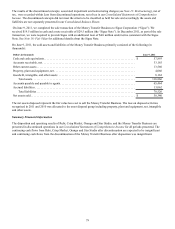

Included in income tax benefit from discontinued operations in 2011 was $4.1 million related to the estimated current value of a

worthless stock deduction taken in 2009 in connection with our divestiture of the Entertainment Business, which was sold in

the third quarter of 2009.

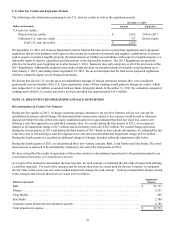

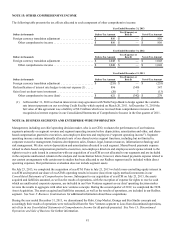

NOTE 14: EARNINGS PER SHARE

Basic earnings per share (“EPS”) is computed by dividing the net income for the period by the weighted average number of

common shares outstanding during the period. Diluted EPS is computed by dividing the net income for the period by the

weighted average number of common and dilutive potential common shares outstanding during the period. We consider

restricted stock that provides the holder with a non-forfeitable right to receive dividends to be a participating security. Net

income available to participating securities was not material for the periods presented.

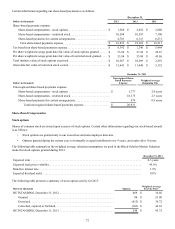

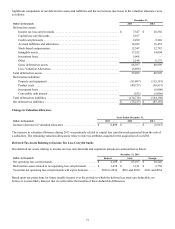

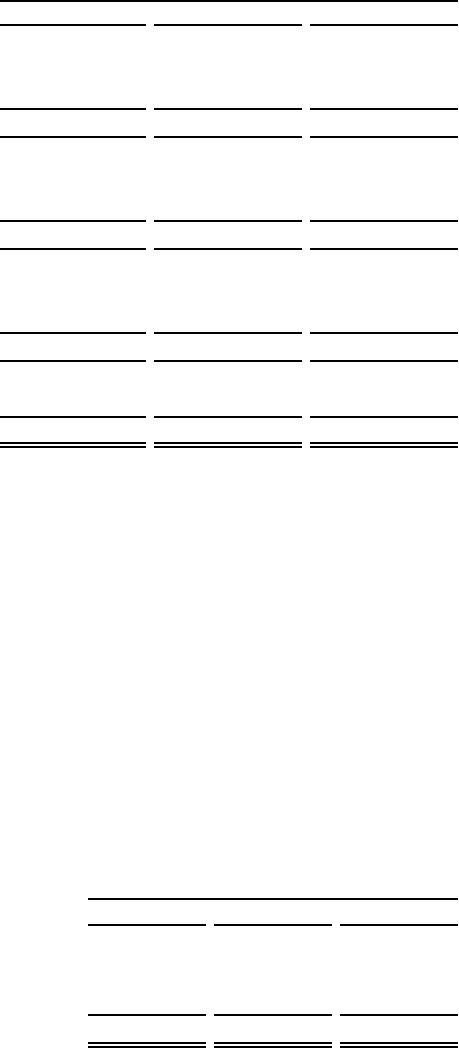

Net income used for calculating basic and diluted EPS is the same for all periods presented. The following table sets forth the

computation of shares used for the basic and diluted EPS calculations:

Years Ended December 31,

In thousands 2013 2012 2011

Weighted average shares used for basic EPS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,216 30,305 30,520

Dilutive effect of stock options and other share-based awards . . . . . . . . . . . . . . . 447 598 609

Dilutive effect of convertible debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 718 1,271 740

Weighted average shares used for diluted EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,381 32,174 31,869

Stock options and share-based awards not included in diluted EPS calculation

because their effect would be antidilutive . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 139 108