Redbox 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

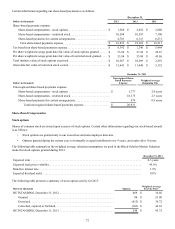

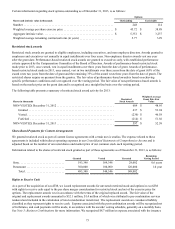

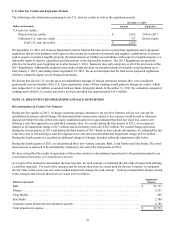

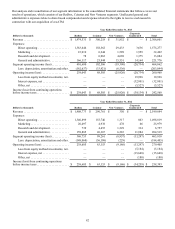

Certain information regarding stock options outstanding as of December 31, 2013, is as follows:

Options

Shares and intrinsic value in thousands Outstanding Exercisable

Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 248 114

Weighted average per share exercise price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 45.72 $ 38.88

Aggregate intrinsic value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,351 $ 3,237

Weighted average remaining contractual term (in years) . . . . . . . . . . . . . . . . . . . . . . . 5.77 3.29

Restricted stock awards

Restricted stock awards are granted to eligible employees, including executives, and non-employee directors. Awards granted to

employees and executives vest annually in equal installments over four years. Non-employee director awards vest one year

after the grant date. Performance-based restricted stock awards are granted to executives only, with established performance

criteria approved by the Compensation Committee of the Board of Directors. Awards of performance-based restricted stock

made prior to 2013, once earned, vest in equal installments over three years from the date of grant. Awards of performance-

based restricted stock made in 2013, once earned, vest in two installments over three years from the date of grant (65% of the

award vests two years from the date of grant and the remaining 35% of the award vests three years from the date of grant). The

restricted shares require no payment from the grantee. The fair value of performance-based awards is based on achieving

specific performance conditions and is recognized over the vesting period. The fair value of non-performance-based awards is

based on the market price on the grant date and is recognized on a straight-line basis over the vesting period.

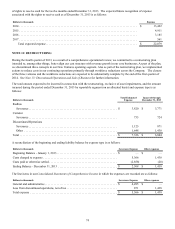

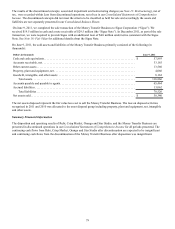

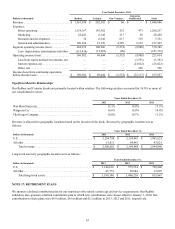

The following table presents a summary of restricted stock award activity for 2013:

Shares in thousands

Restricted

Stock Awards

Weighted Average

Grant Date Fair

Value

NON-VESTED, December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 604 $ 48.95

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 437 $ 53.94

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (230) $ 46.58

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (214) $ 51.56

NON-VESTED, December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 597 $ 52.58

Share-Based Payments for Content Arrangements

We granted restricted stock as part of content license agreements with certain movie studios. The expense related to these

agreements is included within direct operating expenses in our Consolidated Statements of Comprehensive Income and is

adjusted based on the number of unvested shares and market price of our common stock each reporting period.

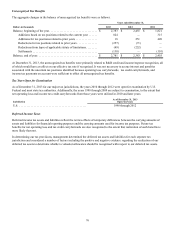

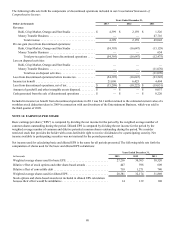

Information related to the shares of restricted stock granted as part of these agreements as of December 31, 2013, is as follows:

Granted Vested Unvested

Remaining

Vesting Period

Sony. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 193,348 164,346 29,002 0.6 years

Paramount . . . . . . . . . . . . . . . . . . . . . . . . . . 300,000 180,000 120,000 1.0 year

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . 493,348 344,346 149,002

Rights to Receive Cash

As a part of the acquisition of ecoATM, we issued replacement awards for unvested restricted stock and options in ecoATM

with rights to receive cash equal to the per share merger consideration for restricted stock and net of the exercise price for

options. The replacement awards vest in accordance with the terms of the original replaced award. The fair value of the

original and replacement awards amounted to $32.1 million, $1.4 million of which was attributed to pre-combination services

rendered and included in the calculation of total consideration transferred. The replacement awards are considered liability

classified as they represent rights to receive cash. Expense associated with the post-combination awards will be recognized net

of forfeitures, and cash payments will be made, in accordance with the awards' vesting schedule, generally on a monthly basis.

See Note 3: Business Combinations for more information. We recognized $8.7 million in expense associated with the issuance