Redbox 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

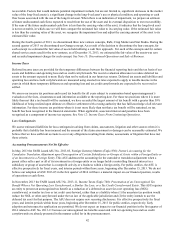

49

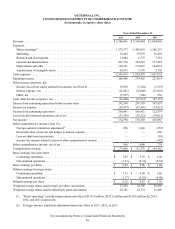

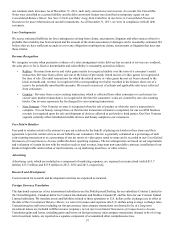

OUTERWALL INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

Accumulated

Other

Comprehensive

Loss

Common Stock Treasury Retained

Shares Amount Stock Earnings Total

BALANCE, December 31, 2010. . . . . . . . . 31,815,085 434,169 (90,076) 84,866 (2,950) 426,009

Proceeds from exercise of stock options,

net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112,364 3,261 — — — 3,261

Adjustments related to tax withholding for

share-based compensation . . . . . . . . . . . . . . (39,276) (1,794) — — — (1,794)

Share-based payments expense . . . . . . . . . . 365,641 16,211 — — — 16,211

Tax benefit on share-based compensation

expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2,548 — — — 2,548

Repurchases of common stock . . . . . . . . . . (1,374,036) — (63,349) — — (63,349)

Debt conversion feature. . . . . . . . . . . . . . . . — 26,854 — — — 26,854

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . — — — 103,883 — 103,883

Other comprehensive income, net of tax(1) .— — — — 279 279

BALANCE, December 31, 2011. . . . . . . . . 30,879,778 481,249 (153,425) 188,749 (2,671) 513,902

Proceeds from exercise of stock options,

net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 381,468 8,263 — — — 8,263

Adjustments related to tax withholding for

share-based compensation . . . . . . . . . . . . . . (61,362) (3,671) — — — (3,671)

Share-based payments expense . . . . . . . . . . 225,445 19,362 — — — 19,362

Tax benefit on share-based compensation

expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 5,418 — — — 5,418

Repurchases of common stock . . . . . . . . . . (2,799,115) — (139,724) — — (139,724)

Convertible debt—conversion option . . . . . 109 (5,740) — — — (5,740)

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . — — — 150,230 — 150,230

Foreign currency translation adjustment(1) .— — — — 1,048 1,048

BALANCE, December 31, 2012. . . . . . . . . 28,626,323 $ 504,881 $ (293,149) $ 338,979 $ (1,623) $ 549,088

Proceeds from exercise of stock options,

net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 411,902 12,655 — — — 12,655

Adjustments related to tax withholding for

share-based compensation . . . . . . . . . . . . . . (76,401) (4,195) — — — (4,195)

Share-based payments expense . . . . . . . . . . 223,173 16,831 — — — 16,831

Tax benefit on share-based compensation

expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 3,287 — — — 3,287

Repurchases of common stock . . . . . . . . . . (3,306,433) — (195,004) — — (195,004)

Repurchase and conversion of callable

convertible debt, net of tax . . . . . . . . . . . . . 272,336 (49,532) 11,357 — — (38,175)

Reclassification of debt conversion feature

to temporary equity . . . . . . . . . . . . . . . . . . . — (1,446) — — — (1,446)

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . — — — 174,792 — 174,792

Foreign currency translation adjustment(1) .— — — — 856 856

BALANCE, December 31, 2013. . . . . . . . . 26,150,900 $ 482,481 $ (476,796) $ 513,771 $ (767) $ 518,689

(1) Foreign currency translation adjustment has no tax effect for the years ended December 31, 2013, 2012, and 2011.

See accompanying Notes to Consolidated Financial Statements