Redbox 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

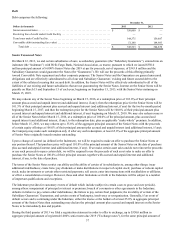

2013 Events

• Starting in January in conjunction with our rental revenue sharing agreement entered into on October 19, 2012 (the

“Warner Agreement”) with Warner Home Video, a division of Warner Bros. Home Entertainment Inc., we began

offering Warner content on a 28-day delay from “street date”. Under the Warner Agreement, Redbox agrees to license

minimum quantities of theatrical and direct-to-video Blu-ray and DVD titles for rental. The Warner Agreement covers

titles that have a street date through December 31, 2014.

• In January, we signed a five-year renewal with Walgreen Company (“Walgreens”). The renewal with Walgreens will

run through December 31, 2017.

• On January 22, we expanded our Redbox Tickets pilot offering to the Los Angeles market providing customers better

access to event tickets at affordable prices. In the second quarter, we concluded our Tickets pilot in Los Angeles and

Philadelphia. We were pleased with the consumer response, and our operational capabilities, but did not see the

momentum in aggregating ticket inventory that we needed to scale with the existing go-to-market approach.

• On March 25, we amended the terms of our existing content licensing agreement with Universal Studios Home

Entertainment LLC (“Universal”) to extend the end date from August 2014 to December 2014. Universal received, at

its sole discretion, the option to extend the agreement for an additional year through December 2015.

• During the second quarter of 2013, we updated our methodology for amortizing our Redbox content library which

resulted in a $21.7 million reduction in Redbox direct operating expenses. For the year ended December 31, 2013, the

cumulative benefit was a $31.8 million reduction in Redbox direct operating expenses. See Note 2: Summary of

Significant Accounting Policies in our Notes to Consolidated Financial Statements.

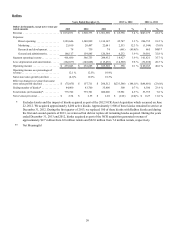

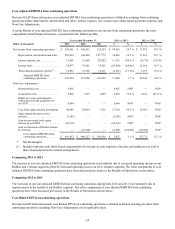

Comparing 2013 to 2012

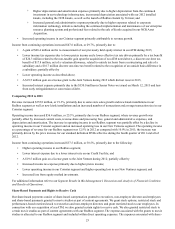

Revenue increased $65.8 million, or 3.4%, primarily due to the following:

• $139.0 million from new kiosk installations that were primarily installed in the second half of 2012 and were not

included in our same store sales until the second half of 2013, as well as the replacement of NCR kiosks; and

• $2.7 million from kiosks acquired from NCR; partially offset by a

• $75.9 million decrease from a 4.1% decline in same store sales due primarily to a considerably weaker start to first

quarter’s release schedule, which has a significant influence on Q1 rentals, with only 36.0% of the total Q1 box office

(representing titles with total North American box office receipts of at least $5.0 million) available to rent in January

versus 50.0% last year, an overall weaker box office during the second and fourth quarters, an increase in single night

and discounted rentals for most of the year, as well as cannibalization of rentals as we installed over 5,200 new kiosks

during the second half of 2012. Partially offsetting this was growth in Q3 and Q4 in same stores sales from over 4,200

of our 2012 kiosk installations that are now included in same store sales, a significantly stronger box office during the

third quarter; up 46.0% from prior year as a result of the Summer Olympics in 2012, as well as substantial growth in

Blu-ray and video game disc rentals, which were up 59.3% and 16.3%, respectively. While our same store sales

declined from the prior period as noted above, we have seen improvement in 2013 as some of the converted kiosk

installs begin contributing to same store sales and product strength compares more favorably year over year.

Additionally, we saw improvement in our single versus multiple night rental mix in December as they moved closer to

historical averages due to less reliance on discounted rentals both of which drive higher net revenue per rental.

Net revenue per rental decreased $0.01 to $2.54 primarily due to higher than expected customer response to promotions during

Q3 which drove discounted rentals and an increase in single night rentals for most of the year. This decrease was partially offset

by increases in Blu-ray and video game rentals as a percentage of our total rentals, both of which have a higher daily rental fee.

Blu-ray rentals continued prior trends and increased to 13.1% of total rentals for the year, with Q4 Blu-ray rentals hitting an all-

time high of 14.2% of total disc rentals. We consider Blu-ray a key focus for future revenue growth as it has a higher revenue

and margin dollar per rental and offers consumers a better viewing experience due to superior picture and sound quality

compared to other options such as digital streaming and video on demand. Video game rentals increased from 2.0% to 2.2% of

total rentals despite several popular releases being available only on multi-disc sets, which presented a challenge for our

customers in renting these releases.

Operating income increased $0.4 million, or 0.1%, primarily due to the following:

• $65.8 million increase in revenue as described above; offset by