Redbox 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

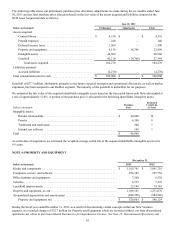

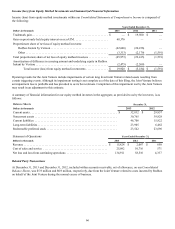

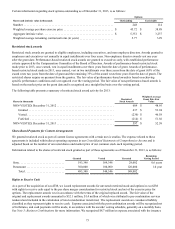

Other Intangible Assets

The gross amount of our other intangible assets and the related accumulated amortization were as follows:

Amortization

Period

December 31,

Dollars in thousands 2013 2012

Retailer relationships. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 - 10 years $ 53,295 $ 53,344

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,768)(11,518)

35,527 41,826

Developed technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 years 34,000 —

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,833)—

31,167 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 - 40 years 16,800 9,404

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,111)(2,261)

12,689 7,143

Intangible assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 79,383 $ 48,969

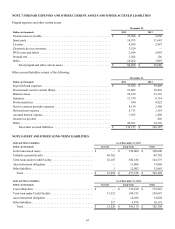

Amortization expense was as follows:

Year Ended December 31,

Dollars in thousands 2013 2012 2011

Retailer relationships. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,250 $ 4,456 $ 2,457

Developed technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,833 — 283

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,850 922 —

Total amortization of intangible assets . . . . . . . . . . . . . . . . . . . . $ 10,933 $ 5,378 $ 2,740

During the third quarter of 2013 we acquired ecoATM resulting in a $41.4 million increase in Other Intangible Assets. See

Note 3: Business Combinations for more information.

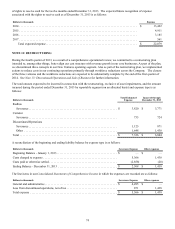

Assuming no future impairment, the expected future amortization as of December 31, 2013 is as follows:

Dollars in thousands

Retailer

Relationships

Developed

Technology Other Total

2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,432 $ 6,800 $ 2,449 $ 14,681

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 6,800 2,419 13,231

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 6,800 2,307 13,119

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 6,800 2,285 13,097

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,012 3,967 1,664 9,643

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,047 — 1,565 15,612

Total expected amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 35,527 $ 31,167 $ 12,689 $ 79,383

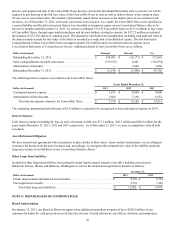

NOTE 6: EQUITY METHOD INVESTMENTS AND RELATED PARTY TRANSACTIONS

Redbox Instant™ by Verizon

In February 2012, Redbox and Verizon Ventures IV LLC (“Verizon”), a wholly owned subsidiary of Verizon Communications

Inc., entered into a Limited Liability Company Agreement (the “LLC Agreement”) and related arrangements. The LLC

Agreement governs the relationship of the parties with respect to a joint venture, Redbox Instant by Verizon (the “Joint

Venture”) formed for the primary purpose of developing, launching, marketing and operating a nationwide “over-the-top” video

distribution service to provide consumers with access to video programming content, including linear content, delivered via

broadband networks to video enabled viewing devices and offering rental of physical DVDs and Blu-ray™ discs from Redbox

kiosks. Redbox initially acquired a 35.0% ownership interest in the Joint Venture and made an initial capital contribution of

$14.0 million in cash in February 2012 subsequent to the formation of the Joint Venture. The Joint Venture board of managers

may request each member to make additional capital contributions, on a pro rata basis relative to its respective ownership

interest. If a member does not make any or all of its requested capital contributions, as the case may be, the other contributing