Redbox 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

member generally may make such capital contributions. So long as Redbox contributes its pro rata share of the first $450.0

million of capital contributions to the Joint Venture, Redbox’s interest cannot be diluted below 10.0%. At the request of the

Joint Venture board of managers, in addition to the initial capital contribution, Redbox made cash payments of $10.5 million

during the third quarter of 2012 and $14.0 million during each of the first and third quarters of 2013 representing its pro-rata

share of the requested capital contribution.

In addition to the initial cash capital contribution, Redbox granted the Joint Venture a limited, non-exclusive, non-transferable,

royalty-free right and license to use certain Redbox trademarks, of which the estimated fair value was approximately $30.0

million based on an evaluation of information available as of the date of the grant. As a result, during the first quarter of 2012,

we recognized a gain of $19.5 million related to the pro-rata amount of fair value given up in exchange for our 35.0% interest

in the Joint Venture. See Note 18: Fair Value for additional information about how we estimated the fair value of the Redbox

trademarks. The initial excess of our cost of the investment in the Joint Venture over our share of the Joint Venture’s equity will

be used to adjust future amortization expense.

We account for Redbox’s ownership interest in the Joint Venture using the equity method of accounting. During the first quarter

of 2012, the transaction related costs of $4.4 million were recorded as a part of the equity investment in the Joint Venture. We

recognized a loss of approximately $45.1 million and $22.5 million from our equity method investment, representing our share

of the Joint Venture’s operating results as well as the amortization of differences in carrying amount and underlying equity for

the years ended December 31, 2013, and 2012, respectively. Separate from equity method accounting for our ownership interest

in the Joint Venture, we record revenue attributable with the rental of DVDs and Blu-ray discs from our Redbox kiosks arising

from Joint Venture subscribers within our Redbox segment.

Redbox has certain rights to cause Verizon to acquire Redbox’s interest in the Joint Venture at fair value (generally following

the fifth anniversary of the LLC Agreement or in limited circumstances, at an earlier period of time) and Verizon has certain

rights to acquire Redbox’s interest in the Joint Venture at fair value (generally following the seventh anniversary of the LLC

Agreement, or, in limited circumstances, the fifth anniversary of the LLC Agreement).

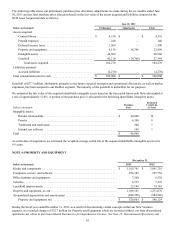

Other Equity Method Investments

We make strategic equity investments in external companies that provide automated self-service kiosk solutions. Our equity

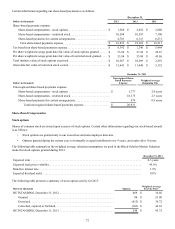

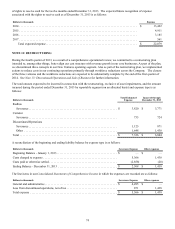

method investments and ownership percentages as of December 31, 2013, were as follows:

Dollars in thousands

Equity

Investment

Ownership

Percentage

Redbox Instant by Verizon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,709 35%

SoloHealth, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,998 10%

Equity method investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,707

Our equity method investments are included within other long-term assets on our Consolidated Balance Sheets.

During the third quarter of 2013, we acquired ecoATM, previously one of our equity method investments. See Note 3:

Business Combinations for more information.