Redbox 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

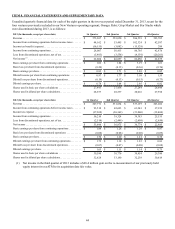

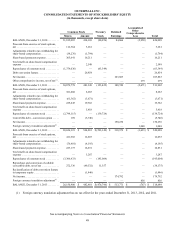

Contractual Payment Obligations

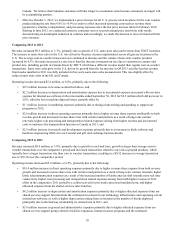

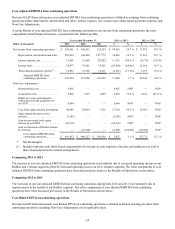

A summary of our contractual commitments and obligations as of December 31, 2013 was as follows:

Dollars in thousands Total 2014

2015 &

2016

2017 &

2018

2019 &

Beyond

Long-term debt and other. . . . . . . . . . . . . . . $ 745,526 $ 93,338 $ 302,188 $ — $ 350,000

Contractual interest on long-term debt . . . . 111,614 22,364 42,000 42,000 5,250

Capital lease obligations(1) . . . . . . . . . . . . . . 22,252 12,640 9,079 482 51

Operating lease obligations(1). . . . . . . . . . . . 66,369 15,306 19,880 13,529 17,654

Purchase obligations(1)(2) . . . . . . . . . . . . . . . 23,333 23,285 48 — —

Asset retirement obligations . . . . . . . . . . . . 13,087———13,087

Content agreement obligations(1) . . . . . . . . . 619,719 565,728 53,991 — —

Retailer revenue share obligations(1) . . . . . . 37,707 31,933 5,084 690 —

Total(3) . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,639,607 $ 764,594 $ 432,270 $ 56,701 $ 386,042

(1) See Note 19: Commitments and Contingencies in our Notes to Consolidated Financial Statements.

(2) Excludes any amounts associated with the manufacturing and services agreement entered into as part of the NCR Asset

Acquisition, pursuant to which Outerwall, Redbox or an affiliate will purchase goods and services from NCR for a

period of five years from June 22, 2012. At the end of the five-year period, if the aggregate amount paid in margin to

NCR for goods and services delivered equals less than $25.0 million, Outerwall will pay NCR the difference between

such aggregate amount and $25.0 million. As of December 31, 2013, the remaining commitment is $17.9 million under

this agreement. See Note 3: Business Combinations in our Notes to Consolidated Financial Statements.

(3) Income tax liabilities for uncertain tax positions were excluded as we are not able to make a reasonably reliable

estimate of the amount and period of related future payments. As of December 31, 2013, we had $2.8 million of gross

unrecognized tax benefits for uncertain tax positions.

Off-Balance Sheet Arrangements

Other than certain contractual arrangements listed above, we do not have any off-balance sheet arrangements that have or are

reasonably likely to have a material current or future effect on our financial condition, changes in financial condition, revenues

or expenses, results of operations, liquidity, capital expenditures or capital resources. For additional information see Note 19:

Commitments and Contingencies in our Notes to Consolidated Financial Statements.

Inflation

We believe that the impact of inflation was minimal on our business in 2013, 2012 and 2011.

CRITICAL ACCOUNTING POLICIES

Our consolidated financial statements have been prepared in accordance with US GAAP. Preparation of these statements

requires management to make judgments and estimates. We base our estimates on historical experience and on other

assumptions that we believe to be reasonable under the present circumstances.

Significant estimates underlying our consolidated financial statements include the:

• useful lives and salvage values of our content library;

• determination of goodwill impairment;

• lives of equipment and other long-lived assets;

• recognition and measurement of current and long-term deferred income taxes (including the measurement of uncertain

tax positions);

• recognition and measurement of purchase price allocation for business combinations; and

• loss contingencies.

It is reasonably possible that the estimates we make may change in the future and could have a material effect on our financial

statements.