Redbox 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

• During the year ended December 31, 2013, we repurchased 3,306,433 shares of our common stock for $195.0 million.

See Note 9: Repurchases of Common Stock in our Notes to Consolidated Financial Statements.

Q3 2013 Events

• On July 23, 2013, we completed the acquisition of ecoATM for total consideration transferred of $264.3 million and

revalued our previously held 23.0% equity interest at $76.4 million resulting in a gain of $68.4 million which is

included in Other income in our Consolidated Statements of Comprehensive Income. See Note 3: Business

Combinations in our Notes to Consolidated Financial Statements.

Q2 2013 Events

• During the second quarter of 2013, we finalized our preliminary purchase price allocation for our NCR Asset

Acquisition. See Note 3: Business Combinations in our Notes to Consolidated Financial Statements.

• During the second quarter of 2013, we entered into an arrangement to sell certain kiosks previously acquired from

NCR through the sale of a previously consolidated entity for $11.8 million. See Note 4: Property and Equipment and

Note 12: Income Taxes From Continuing Operations in our Notes to Consolidated Financial Statements.

• During the second quarter of 2013, we updated our methodology for amortizing our Redbox content library which

resulted in a $21.7 million reduction in Redbox direct operating expenses. See Note 2: Summary of Significant

Accounting Policies in our Notes to Consolidated Financial Statements.

Q1 2013 Events

• On March 12, 2013, we issued $350.0 million principal amount of 6.000% Senior Notes due 2019. See Note 8: Debt

and Other Long-Term Liabilities in our Notes to Consolidated Financial Statements.

• On March 14, 2013, Redbox Instant by Verizon concluded its public beta launch and began commercial launch of its

nationwide “over-the-top” video distribution service delivered via broadband networks combined with physical DVD

and Blu-ray™ discs rentals from our kiosks.

Subsequent Events

• During January 2014, we repurchased 736,000 shares of our common stock with an average price of $67.93 per share

for $50.0 million. The repurchases were made under a pre-arranged stock trading plan in accordance with guidelines

specified under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, and our policies regarding stock

transactions (the “10b5-1 Plan”). The shares repurchased under the 10b5-1 Plan were recorded as treasury shares and

made in accordance with current share repurchase authorizations of the Board. See Note 21: Subsequent Events in our

Notes to Consolidated Financial Statements.

• On January 30, 2014, Outerwall’s Board of Directors authorized additional common stock repurchases of up to $500.0

million plus the cash proceeds received from the exercise of stock options by our officers, directors, and employees,

bringing the total available for repurchases as of February 3, 2014 to approximately $650.0 million, inclusive of the

impact of the 10b5-1 Plan repurchases. In connection with this increased authorization, the Board also authorized a

tender offer for up to $350.0 million with the option to increase the tender by up to 2% of outstanding shares. We

expect to launch with a price range based on a 5% to 20% premium over the last reported sale price on February 6,

2014. Repurchases under the tender offer would come from this existing repurchase authorization. See Note 21:

Subsequent Events in our Notes to Consolidated Financial Statements.

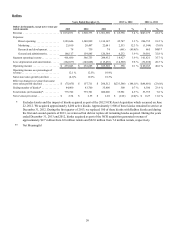

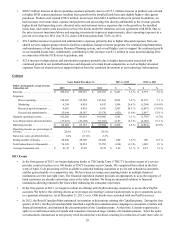

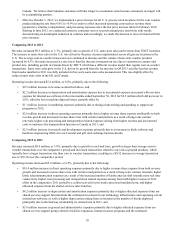

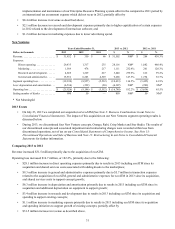

Results of Operations