Redbox 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

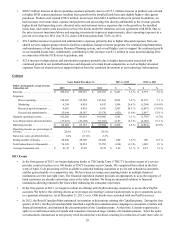

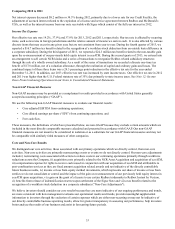

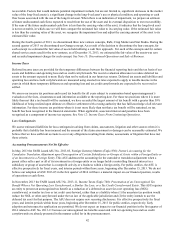

The term loans are subject to mandatory debt repayments of the outstanding borrowings. The schedule of future principal

repayments is as follows:

Dollars in thousands Repayment Amount

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 42,187

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,875

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 255,313

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 344,375

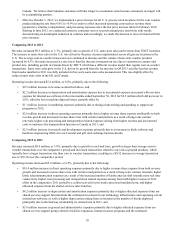

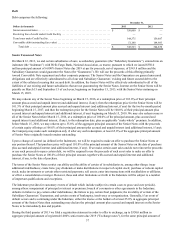

Convertible Debt

The aggregate outstanding principal of our 4.0% Convertible Senior Notes (the “Convertible Notes”) is $51.1 million. The

Convertible Notes bear interest at a fixed rate of 4.0% per annum, payable semi-annually in arrears on each March 1 and

September 1, and mature on September 1, 2014. The effective interest rate at issuance was 8.5%. As of December 31, 2013, we

were in compliance with all covenants.

The Convertible Notes become convertible (the “Conversion Event”) when the closing price of our common stock exceeds

$52.38, 130% of the Convertible Notes’ conversion price, for at least 20 trading days during the 30 consecutive trading days

prior to each quarter-end date. If the Convertible Notes become convertible and should the holders elect to convert, we will be

required to pay them up to the full face value of the Convertible Notes in cash as well as deliver shares of our common stock

for any excess conversion value. The number of potentially issued shares increases as the market price of our common stock

increases. As of December 31, 2013, such early conversion event was met. As a result, the Convertible Notes were classified as

a current liability and the debt conversion feature was classified as temporary equity on our Consolidated Balance Sheets.

During the year ended December 31, 2013 we retired $133.8 million in face value of Convertible Notes, through open market

purchases and the note holders electing to convert, for $172.2 million in cash and the issuance of 272,336 shares of common

stock. The amount by which the total consideration including cash paid and value of the shares issued exceeds the fair value of

the Convertible Notes is recorded as a reduction of stockholders’ equity. The loss from early extinguishment of these

Convertible Notes was approximately $6.0 million and is recorded in interest expense in our Consolidated Statements of

Comprehensive Income.

See Note 8: Debt and Other Long-Term Liabilities in our Notes to Consolidated Financial Statements for more information on

our debt instruments. As of December 31, 2013, we were in compliance with all debt covenants.

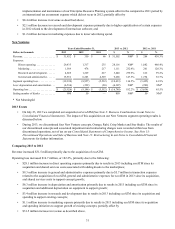

Letters of Credit

As of December 31, 2013, we had six irrevocable standby letters of credit that totaled $8.6 million. These standby letters of

credit, which expire at various times through 2014, are used to collateralize certain obligations to third parties. As of December

31, 2013, no amounts were outstanding under these standby letter of credit agreements.

Other Contingencies

During the year ended December 31, 2013, we resolved a previously disclosed loss contingency related to a supply agreement

and recognized a benefit of $11.4 million included in direct operating in our Consolidated Statements of Comprehensive

Income.