Redbox 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Pursuant to the Supplement and Amendment, the Accordion was increased by $100.0 million to $350.0 million (the “Increased

Accordion”) and the Company exercised the Increased Accordion with: (i) certain revolving lenders (the “Revolving Lenders”)

agreeing to increase their commitments under the Revolving Line to an aggregate $600.0 million (the “Increased Revolving

Line”); and (ii) the additional term facility lenders (the “Additional Term Facility Lenders”) agreeing to make available an

additional term loan facility in the amount of $200.0 million (the “Additional Term Facility”).

Under the Supplement and Amendment, the terms and conditions applicable to the Increased Revolving Line shall remain

generally the same as those of the Previous Facility. With regard to the Additional Term Facility, the terms shall remain

generally the same as those of the Previous Facility, except that: (i) until the first business day following the date a compliance

certificate is delivered under the Second Amended and Restated Credit Agreement for the fiscal quarter ending March 31, 2014,

the applicable interest rates for loans under the Additional Term Facility shall be no less than those corresponding to Pricing

Level 3 as provided in the Second Amended and Restated Credit Agreement; and (ii) the principal balance of the loans under

the Additional Term Facility shall be payable on the following dates and in the following amounts (expressed as a percentage of

the aggregate amount of the initial loans made under the Additional Term Facility):

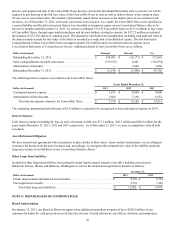

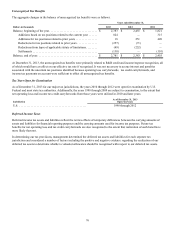

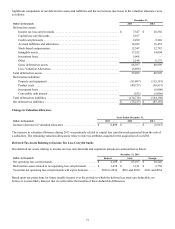

Payment Date Repayment Percentage Amount

Last Business Day of March 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.500%

Last Business Day of June 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.500%

Last Business Day of September 2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of December 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of March 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of June 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of September 2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of December 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of March 2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

Last Business Day of June 2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.125%

July 15, 2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Remaining Principal Balance

The Credit Facility is secured by a first priority security interest in substantially all of our assets and the assets of our domestic

subsidiaries, as well as a pledge of a substantial portion of certain equity interests in our subsidiaries. As of December 31,

2013, we were in compliance with the covenants of the Credit Facility.

On July 15, 2011, we borrowed $175.0 million under the Previous Facility term loan. On December 10, 2013, we borrowed

$200.0 million under the Additional Term Facility. As of December 31, 2013, we had no outstanding borrowing on the

revolving line of credit. The annual interest rate on the Credit Facility is variable, based on an index plus a margin determined

by our consolidated net leverage ratio. The interest rate on amounts outstanding under the Credit Facility at December 31,

2013, was 1.81%.

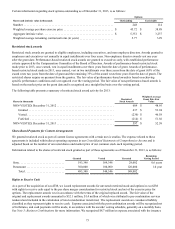

The term loans are subject to mandatory debt repayments of the outstanding borrowings. The schedule of future principal

repayments is as follows:

Dollars in thousands Repayment Amount

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 42,187

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,875

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 255,313

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 344,375

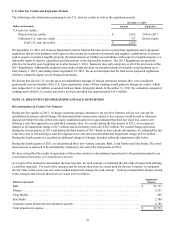

Convertible Debt

The aggregate outstanding principal of our 4.0% Convertible Senior Notes (the “Convertible Notes”) is $51.1 million. The

Convertible Notes bear interest at a fixed rate of 4.0% per annum, payable semi-annually in arrears on each March 1 and

September 1, and mature on September 1, 2014. The effective interest rate at issuance was 8.5%. As of December 31, 2013, we

were in compliance with all covenants.

The Convertible Notes become convertible (the “Conversion Event”) when the closing price of our common stock exceeds

$52.38, 130% of the Convertible Notes’ conversion price, for at least 20 trading days during the 30 consecutive trading days