Redbox 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

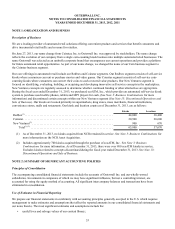

correlation of costs to revenue. The modified approach to amortizing the cost of the content library is based on updated rental

curves, which incorporate thinning estimates, and provides a more systematic method for recognizing the costs of movie and

game titles. The Company anticipates that this new method will better align the recognition of costs with the related revenue.

The Company believes that the change in its content library amortization methodology, made on a prospective basis, is a

change in accounting estimate that is effected by a change in accounting principle. The Company believes that the modified

content library amortization methodology is preferable because it better reflects the pattern of consumption of the expected

benefits of the content library. A copy of our auditor's preferability letter is filed as an exhibit to our 10-Q for the period ended

June 30, 2013.

The effect of this change resulted in a reduction of product costs, as reported in direct operating expenses, of approximately

$21.7 million in the second quarter of 2013, with those costs shifted to primarily the third and fourth quarters and some into

2014. The change resulted in a corresponding increase to the balance of our content library. In addition, the change in

amortization methodology is shifted product costs on titles purchased during the second half of 2013 into 2014 as amortization

is less accelerated than under the prior method. Under the modified amortization methodology, substantially all of the

amortization expense will continue to be recognized within one year of purchase. For year ended December 31, 2013, the

change resulted in a total pretax benefit of $31.8 million or $1.17 per basic share and $1.12 per diluted share.

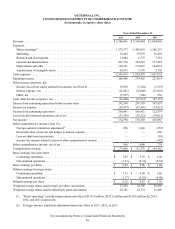

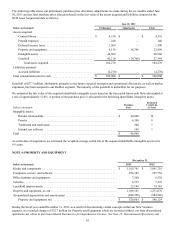

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Expenditures that extend the life, increase the

capacity, or improve the efficiency of property and equipment are capitalized, while expenditures for repairs and maintenance

are expensed as incurred. Depreciation is recognized using the straight-line method over the following approximate useful

lives:

Useful Life

Coin-counting kiosks and components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 to 10 years

Redbox kiosks and components. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-5 years

Computers and software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 - 5 years

Office furniture and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 - 7 years

Leased vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 - 6 years

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 - 11 years

Internal-Use Software

We capitalize costs incurred to develop or obtain internal-use software during the application development stage. Capitalization

of software development costs occurs after the preliminary project stage is complete, management authorizes the project, and it

is probable that the project will be completed and the software will be used for the function intended. We expense costs

incurred for training, data conversion, and maintenance, as well as spending in the post-implementation stage. A subsequent

addition, modification or upgrade to internal-use software is capitalized only to the extent that it enables the software to

perform a task it previously could not perform. The internal-use software is included in computers and software under property

and equipment in our Consolidated Balance Sheets. We amortize the internal-use software based on the estimated useful life on

a straight-line basis.

Intangible Assets Subject to Amortization

Our intangible assets subject to amortization are comprised primarily of developed technology and retailer relationships

acquired in connection with our acquisitions. We used expectations of future cash flows, with appropriate discount rates based

on the stage of the enterprise acquired, to estimate the fair value of our intangible assets. We amortize our intangible assets on a

straight-line basis over their expected useful lives.

Goodwill

Goodwill represents the excess purchase price of an acquired enterprise or assets over the estimated fair value of identifiable

net assets acquired. We assess goodwill for potential impairment at the reporting unit level on an annual basis as of

November 30, or whenever an event occurs or circumstances change that would more likely than not reduce the fair value of a

reporting unit below its carrying amount. We may assess qualitative factors to make this determination, or bypass such a

qualitative assessment and proceed directly to testing goodwill for impairment using a two-step process. Qualitative factors we

may consider include, but are not limited to, macroeconomic conditions, industry conditions, the competitive environment,

changes in the market for our products and services, regulatory and political developments, entity specific factors such as