Redbox 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

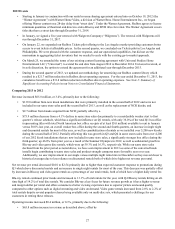

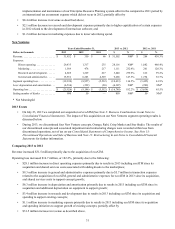

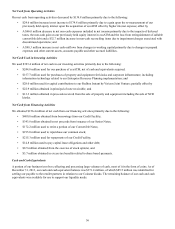

Debt

Debt comprises the following:

December 31,

Dollars in thousands 2013 2012

Senior unsecured notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 350,000 $ —

Revolving line of credit under Credit Facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——

Term loans under Credit Facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 344,375 159,687

Convertible debt (outstanding face value) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51,148 184,983

Total debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 745,523 $ 344,670

Senior Unsecured Notes

On March 12, 2013, we and certain subsidiaries of ours, as subsidiary guarantors (the “Subsidiary Guarantors”), entered into an

indenture (the “Indenture”) with Wells Fargo Bank, National Association, as trustee, pursuant to which we issued $350.0

million principal amount of 6.000% Senior Notes due 2019 at par for proceeds, net of expenses, of $343.8 million and the

Subsidiary Guarantors would guarantee the Notes (the “Guarantees”). We will use the proceeds of this offering primarily

toward Convertible Note repayment and other corporate purposes. The Senior Notes and the Guarantees are general unsecured

obligations and are effectively subordinated to all of our and Subsidiary Guarantors’ existing and future secured debt to the

extent of the collateral securing that secured debt. In addition, the Senior Notes will be effectively subordinated to all of the

liabilities of our existing and future subsidiaries that are not guaranteeing the Senior Notes. Interest on the Senior Notes will be

payable on March 15 and September 15 of each year, beginning on September 15, 2013, with the Senior Notes maturing on

March 15, 2019.

We may redeem any of the Senior Notes beginning on March 15, 2016, at a redemption price of 103.0% of their principal

amount plus accrued and unpaid interest (and additional interest, if any); then the redemption price for the Senior Notes will be

101.5% of their principal amount plus accrued and unpaid interest (and additional interest, if any) for the twelve-month period

beginning March 15, 2017; and then the redemption price for the Senior Notes will be 100.0% of their principal amount plus

accrued interest and unpaid interest (and additional interest, if any) beginning on March 15, 2018. We may also redeem some or

all of the Senior Notes before March 15, 2016, at a redemption price of 100.0% of the principal amount, plus accrued and

unpaid interest (and additional interest, if any), to the redemption date, plus an applicable “make-whole” premium. In addition,

before March 15, 2016, we may redeem up to 35.0% of the aggregate principal amount of the Senior Notes with the proceeds

of certain equity offerings at 106.0% of their principal amount plus accrued and unpaid interest (and additional interest, if any);

the Company may make such redemption only if, after any such redemption, at least 65.0% of the aggregate principal amount

of Senior Notes originally issued remains outstanding.

Upon a change of control (as defined in the Indenture), we will be required to make an offer to purchase the Senior Notes or

any portion thereof. That purchase price will equal 101.0% of the principal amount of the Senior Notes on the date of purchase

plus accrued and unpaid interest (and additional interest, if any). If we make certain asset sales and do not reinvest the proceeds

or use such proceeds to repay certain debt, we will be required to use the proceeds of such asset sales to make an offer to

purchase the Senior Notes at 100.0% of their principal amount, together with accrued and unpaid interest and additional

interest, if any, to the date of purchase.

The terms of the Senior Notes restrict our ability and the ability of certain of its subsidiaries to, among other things: incur

additional indebtedness; create liens; pay dividends or make distributions in respect of capital stock; purchase or redeem capital

stock; make investments or certain other restricted payments; sell assets; enter into transactions with stockholders or affiliates;

or effect a consolidation or merger. However, these and other limitations set forth in the Indenture will be subject to a number

of important qualifications and exceptions.

The Indenture provides for customary events of default which include (subject in certain cases to grace and cure periods),

among others: nonpayment of principal or interest or premium; breach of covenants or other agreements in the Indenture;

defaults in failure to pay certain other indebtedness; the failure to pay certain final judgments; the invalidity of certain of the

Subsidiary Guarantors’ Guarantees; and certain events of bankruptcy, insolvency or reorganization. Generally, if an event of

default occurs and is continuing under the Indenture, either the trustee or the holders of at least 25.0% in aggregate principal

amount of the Senior Notes then outstanding may declare the principal amount plus accrued and unpaid interest on the Senior

Notes to be immediately due and payable.

During the third quarter of 2013 we filed a registration statement in order to offer to exchange, up to $350.0 million in

aggregate principal amount of registered 6.000% senior notes due 2019 ("Exchange notes"), for the same principal amount of