Redbox 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

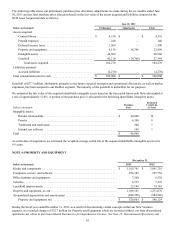

Sale of Business for more information. This included reclassifying total charges related to our Orango concept of $5.6 million

from depreciation and other expense and $0.5 million from direct operating expense for the year ended December 31, 2013 to

Loss from discontinued operations, net of tax. These charges were previously not presented as discontinued operations within

our quarterly reports as they were not material on a stand-alone basis. Upon discontinuing the three additional concepts in the

fourth quarter of 2013, we reclassified the results of all four concepts as Discontinued Operations.

During the second quarter of 2013, we entered into an arrangement to sell certain kiosks previously acquired from NCR (the

“NCR Kiosks”) through the sale of a previously consolidated entity which held certain of the NCR kiosks with a net book value

of $12.4 million. Total proceeds from the sale of the entity were $11.8 million and are recorded within proceeds from sale of

property and equipment within our Consolidated Statements of Cash Flows. As a result of this sale and certain reorganizations

we recorded a one-time tax benefit as described in Note 12: Income Taxes From Continuing Operations.

During the third quarter of 2013, we acquired ecoATM, which included $23.2 million in property and equipment measured at

fair value as of the acquisition date and is included in the table above. See Note 3: Business Combinations for more

information.

NOTE 5: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

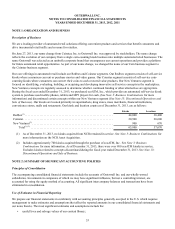

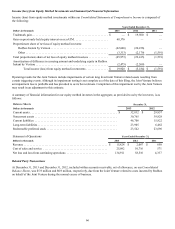

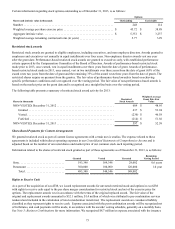

The carrying amount of goodwill was as follows:

Dollars in thousands

Goodwill balance at December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 309,860

Purchase price allocation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,766)

Adjusted balance at December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 295,094

Goodwill from acquisition of ecoATM. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 264,213

Goodwill balance at December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 559,307

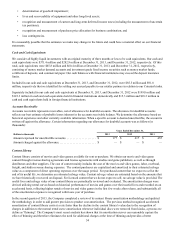

Goodwill by Segment

The carrying amount of goodwill by segment was as follows:

December 31,

2013 2012

Dollars in thousands (As adjusted)

Redbox . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 138,743 $ 138,743

Coinstar . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156,351 156,351

New Ventures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 264,213—

Total goodwill. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 559,307 $ 295,094

During the second quarter of 2013, we finalized the purchase price allocation associated with the NCR Asset Acquisition

resulting in a $14.8 million decrease in Goodwill. During the third quarter of 2013 we acquired ecoATM resulting in a $264.2

million increase in Goodwill. See Note 3: Business Combinations for more information.

We utilized a qualitative assessment for our annual Goodwill impairment analysis, performed as of November 30, 2013, and

determined that it was not more likely than not that the fair value of each of our reporting units was less than its applicable

carrying value. Accordingly, it was not necessary to perform the two-step impairment test and no goodwill impairment was

recognized in 2013.