Redbox 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

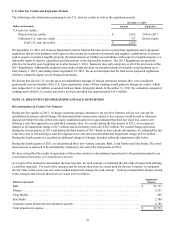

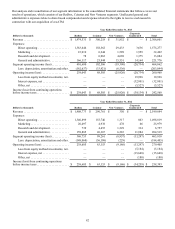

NOTE 12: INCOME TAXES FROM CONTINUING OPERATIONS

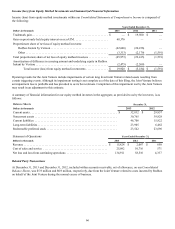

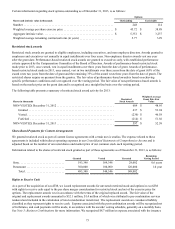

Components of Income Taxes

The components of income(loss) from continuing operations before income taxes were as follows:

Years Ended December 31,

Dollars in thousands 2013 2012 2011

U.S. operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 258,665 $ 262,695 $ 193,213

Foreign operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16,097)(4,302) 4,644

Total income from continuing operations before income taxes . . . $ 242,568 $ 258,393 $ 197,857

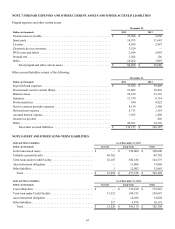

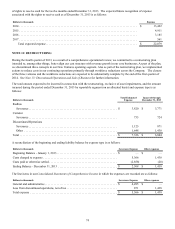

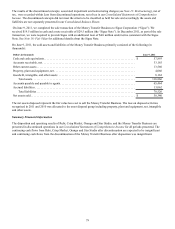

Components of Income Tax Expense

The components of income tax expense from continuing operations were as follows:

Years Ended December 31,

Dollars in thousands 2013 2012 2011

Current:

U.S. Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 39,272 $ — $ —

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,159 4,142 9,845

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (424) 7 375

Total current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49,007 4,149 10,220

Deferred:

U.S. Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,169) 87,375 63,453

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,726) 7,938 612

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,635)(1,521) 638

Total deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,530) 93,792 64,703

Total income tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 34,477 $ 97,941 $ 74,923

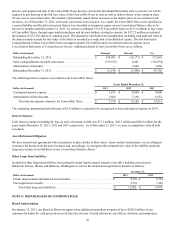

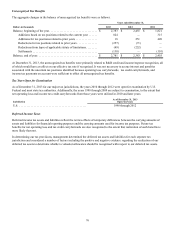

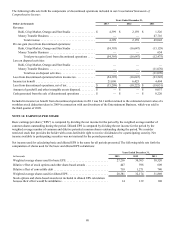

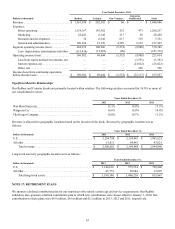

Rate Reconciliation

The income tax expense differs from the amount that would result by applying the U.S. statutory rate to income before income

taxes as follows:

Years Ended December 31,

2013 2012 2011

U.S Federal tax expense at statutory rates . . . . . . . . . . . . . . . . . . . . . . . 35.0 % 35.0 % 35.0 %

State income taxes, net of federal benefit. . . . . . . . . . . . . . . . . . . . 4.2 % 4.0 % 4.3 %

Federal and state credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.9)% (0.8)% (0.6)%

Recognition of Outside Basis Differences . . . . . . . . . . . . . . . . . . . (16.7)% — % — %

Valuation Allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.4 % — % — %

Non-taxable gain related to acquisition of ecoATM. . . . . . . . . . . . (10.0)% — % — %

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.2 % (0.3)% (0.9)%

Effective tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.2 % 37.9 % 37.8 %

During the fourth quarter of 2013, we reported a $16.7 million tax benefit related to the recognition of a worthless stock

deduction from an outside basis difference in a corporate subsidiary. During the third quarter of 2013, we reported a $24.3

million tax benefit related to the non-taxable gain upon the re-measurement of our previously held equity interest in ecoATM.

During the second quarter of 2013, we entered into an arrangement to sell certain NCR kiosks and a series of transactions to

reorganize Redbox related subsidiary structures through the sale of a wholly owned subsidiary. As a result of the series of

transactions we recorded a discrete one-time tax benefit of $17.8 million, net of a valuation allowance, through the realization

of capital and ordinary gains and losses. The combined impact of these three items was a 24.3 percentage point reduction in the

effective tax rate for the year ended December 31, 2013. In addition, our 2013 effective tax rate was increased by state income

taxes.