Redbox 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

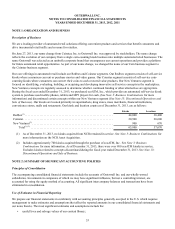

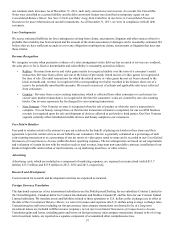

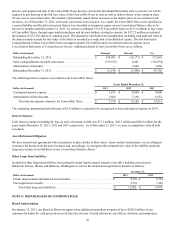

The following table shows our preliminary purchase price allocation, adjustments we made during the six months ended June

30, 2013 and our final purchase price allocation based on the fair value of the assets acquired and liabilities assumed at the

NCR Asset Acquisition date as follows:

June 22, 2012

Dollars in thousands Preliminary Adjustments Final

Assets acquired:

Content library . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,330 $ — $ 4,330

Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 240 — 240

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500 — 1,500

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,130 14,766 23,896

Intangible assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,960 — 46,960

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,110 (14,766) 27,344

Total assets acquired. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104,270 — 104,270

Liabilities assumed:

Accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,270)—

(4,270)

Total consideration paid in cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 100,000 $ — $ 100,000

Goodwill of $27.3 million, attributable primarily to the future expected synergies and operational efficiencies, as well as market

expansion, has been assigned to our Redbox segment. The majority of the goodwill is deductible for tax purposes.

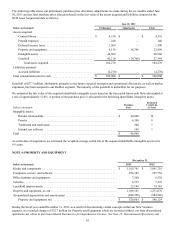

We estimated the fair value of the acquired identifiable intangible assets based on the forecasted future cash flows discounted at

a rate of approximately 11.0%. A portion of the purchase price is allocated to the following identifiable intangible assets:

Dollars in thousands

Purchase

Price

Estimated

Useful Life

in Years

Intangible assets:

Retailer relationships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 40,000 10

Patents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,300 8

Trademark and trade name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 1

Internal use software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160 1

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 46,960

As of the date of acquisition, we estimated the weighted-average useful life of the acquired identifiable intangible assets to be

9.6 years.

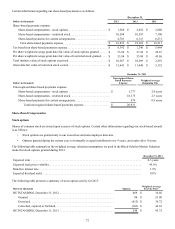

NOTE 4: PROPERTY AND EQUIPMENT

December 31,

Dollars in thousands 2013 2012

Kiosks and components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,105,761 $ 1,041,755

Computers, servers, and software. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 226,389 195,756

Office furniture and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,260 6,538

Vehicles. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,553 7,278

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,198 19,743

Property and equipment, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,369,161 1,271,070

Accumulated depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (848,296)(684,946)

Property and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 520,865 $ 586,124

During the fiscal year ended December 31, 2013, as a result of discontinuing certain concepts within our New Ventures

segment, we recorded charges of $32.7 million for Property and Equipment which are recorded within Loss from discontinued

operations, net of tax in our Consolidated Statements of Comprehensive Income. See Note 13: Discontinued Operations and