Redbox 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Reclassifications

We ceased operation of our self-service concept for refurbished electronics called Orango during the second quarter of 2013

and on December 5, 2013, we decided to discontinue three additional new venture concepts, Rubi, Crisp Market and Star

Studio. We have reclassified the results of operations of these four ventures to discontinued operations for all periods presented

in our Consolidated Statements of Comprehensive Income. See Note 13: Discontinued Operations and Sale of Business for

more information.

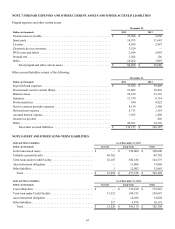

On June 22, 2012, Redbox acquired certain assets of NCR Corporation (“NCR”) related to NCR’s self-service entertainment

DVD kiosk business (the “NCR Asset Acquisition”). The purchased assets included, among others, self-service DVD kiosks,

content library, intellectual property, and certain related contracts, including with certain retailers. In consideration, Redbox

paid NCR $100.0 million in cash and assumed certain liabilities of NCR related to the purchased assets.

We accounted for the NCR Asset Acquisition as a business combination. In accordance with US GAAP, the measurement

period for our purchase price allocation ended as soon as information regarding our assessment of the quality and quantity of

the kiosks acquired as well as certain facts and circumstances became available; such measurement period was not to exceed

twelve months from the acquisition date. In our originally issued FY 2012 10-K, we included a preliminary purchase price

allocation. During the second quarter of 2013, we obtained sufficient evidence regarding the quality and market value of the

kiosks acquired (See Note 3: Business Combination) to finalize our purchase price allocation. As a result, we retroactively

adjusted our purchase price allocation to increase the value assigned to such kiosks acquired by $14.8 million with a

corresponding decrease to goodwill in the period in which the NCR Asset Acquisition occurred resulting in a corresponding

change in our December 31, 2012 ending balances to our originally issued FY 2012 10-K.

NOTE 3: BUSINESS COMBINATIONS

Acquisition of ecoATM, Inc.,

On July 1, 2013, Outerwall Inc., entered into an agreement and plan of merger with ecoATM, Inc., a Delaware corporation

(“ecoATM”) that provides an automated self-service kiosk system to purchase used mobile phones, tablets and MP3 players for

cash. On July 23, 2013 all necessary approvals were obtained and we completed the acquisition of the remaining 77.0% equity

interest which we did not already own. The primary reason for the business combination was to expand Outerwall’s presence

in automated retail and gain exposure to the growing demand for refurbished products and mobile devices.

We accounted for the purchase of ecoATM as a business combination. Costs related to this acquisition of approximately $5.7

million were expensed during the second and third quarters 2013 and are included within general and administrative expenses

in our Consolidated Statements of Comprehensive Income.

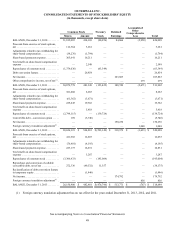

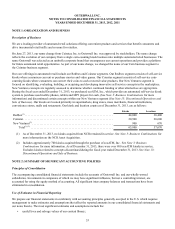

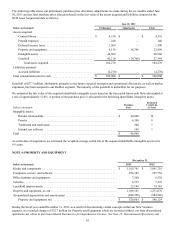

The following table highlights the consideration transferred, the fair value of our previously held equity interest and the fair

value of replacement awards issued attributable to post-combination services.

Dollars in thousands July 23, 2013

Consideration Transferred:

Cash paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 262,882

Replacement awards attributable to pre-combination services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,398

Total consideration transferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 264,280

Previously held equity interest:

Acquisition date fair value of previously held equity interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76,359

Total consideration transferred and fair value of previously held equity interest . . . . . . . . . . . . . . . . . . . . . . . $ 340,639

Fair value of replacement awards attributable to post-combination services . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,671

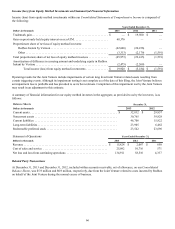

As a part of the merger, we issued replacement awards for unvested restricted stock and options in ecoATM with rights to

receive cash equal to the per share merger consideration for restricted stock and net of the exercise price for options. The

replacement awards vest in accordance with the terms of the original replaced award. The fair value of the original and

replacement awards amounted to $32.1 million, $1.4 million of which was attributed to pre-combination services rendered and

included in the calculation of total consideration transferred. The replacement awards are considered liability classified as they

require settlement in cash. Expense associated with the post-combination awards will be recognized net of forfeitures, and cash

payments will be made, in accordance with the awards' vesting schedule, generally on a monthly basis.