Redbox 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

based compensation to our executives, non-employee directors, employees and related to the rights to receive cash issued in

connection with our acquisition of ecoATM are part of our shared services support function and are not allocated to our

segments. The components of our unallocated share-based compensation expense are presented in the following table.

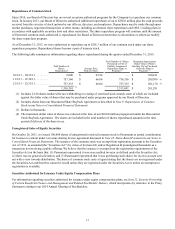

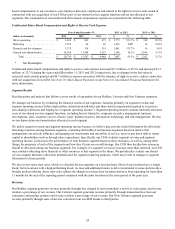

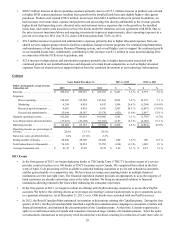

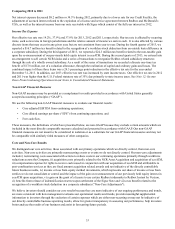

Unallocated Share-Based Compensation and Rights to Receive Cash Expense

Years Ended December 31, 2013 vs. 2012 2012 vs. 2011

Dollars in thousands 2013 2012 2011 $%$%

Direct operating. . . . . . . . . . . . . . . . . . . $ 3,636 $ 863 473 $ 2,773 321.3% $ 390 82.5%

Marketing . . . . . . . . . . . . . . . . . . . . . . . 1,559 66 50 1,493 NM* 16 32.0%

Research and development . . . . . . . . . . 1,375 334 318 1,041 311.7% 16 5.0%

General and administrative . . . . . . . . . . 14,164 11,984 9,139 2,180 18.2% 2,845 31.1%

Total . . . . . . . . . . . . . . . . . . . . . . . $ 20,734 $ 13,247 $ 9,980 $ 7,487 56.5% $ 3,267 32.7%

* Not Meaningful

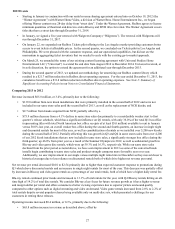

Unallocated share-based compensation and rights to receive cash expense increased $7.5 million, or 56.5% and increased $3.3

million, or 32.7% during the years ended December 31, 2013 and 2012 respectively, due to changes in the fair value of

restricted stock awards granted and $8.7 million in expense associated with the issuance of rights to receive cash in connection

with our acquisition of ecoATM. See Note 10: Share-Based Payments in our Notes to Consolidated Financial Statements for

more information.

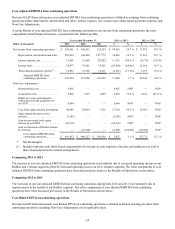

Segment Results

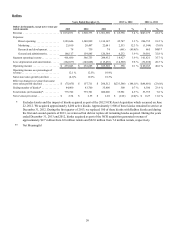

Our discussion and analysis that follows covers results of operations for our Redbox, Coinstar and New Ventures segments.

We manage our business by evaluating the financial results of our segments, focusing primarily on segment revenue and

segment operating income before depreciation, amortization and other and share-based compensation granted to executives,

non-employee directors and employees (“segment operating income”). Segment operating income contains internally allocated

costs of our shared services support functions, including but not limited to, corporate executive management, business

development, sales, customer service, finance, legal, human resources, information technology, and risk management. We also

review depreciation and amortization allocated to each segment.

We utilize segment revenue and segment operating income because we believe they provide useful information for effectively

allocating resources among business segments, evaluating the health of our business segments based on metrics that

management can actively influence, and gauging our investments and our ability to service, incur or pay down debt or return

capital to shareholders such as through share repurchases. Specifically, our CEO evaluates segment revenue and segment

operating income, and assesses the performance of each business segment based on these measures, as well as, among other

things, the prospects of each of the segments and how they fit into our overall strategy. Our CEO then decides how resources

should be allocated among our business segments. For example, if a segment’s revenue increases more than expected, our CEO

may consider allocating more financial or other resources to that segment in the future. We periodically evaluate our shared

services support function’s allocation methods used for segment reporting purposes, which may result in changes to segment

allocations in future periods.

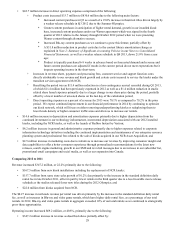

We also review same store sales, which we calculate for our segments on a location basis. Most of our locations have a single

kiosk, but in locations with a high-performing kiosk, we may add additional kiosks to drive incremental revenue and provide a

broader product offering. Same store sales reflects the change in revenue from locations that have been operating for more than

13 months by the end of the reporting period compared with the same locations in the same period of the prior year.

Revenue

Our Redbox segment generates revenue primarily through fees charged to rent or purchase a movie or video game, and we pay

retailers a percentage of our revenue. Our Coinstar segment generates revenue primarily through transaction fees from our

consumers and product partners and we pay retailers a percentage of our revenue. Our New Ventures segment generates

revenue primarily through sales of devices collected at our ecoATM kiosks to third parties.