Redbox 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

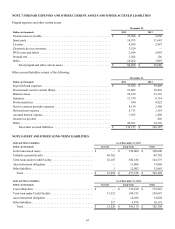

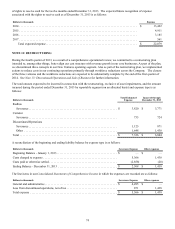

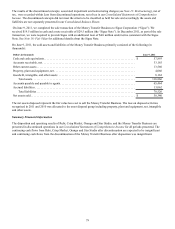

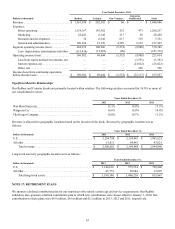

Significant components of our deferred tax assets and liabilities and the net increase (decrease) in the valuation allowance were

as follows:

Dollars in thousands

December 31,

2013 2012

Deferred tax assets:

Income tax loss carryforwards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,347 $ 20,356

Capital loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,917 —

Credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,289 9,226

Accrued liabilities and allowances. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,929 18,455

Stock-based compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,547 12,783

Intangible assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,252 14,004

Investment basis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,968 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,148 6,175

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66,397 80,999

Less: Valuation Allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,898)—

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,499 80,999

Deferred tax liabilities:

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (93,407)(115,381)

Product costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (40,757)(36,837)

Investment basis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (6,906)

Convertible debt interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (552)(5,066)

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (134,716)(164,190)

Net deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ (75,217)$ (83,191)

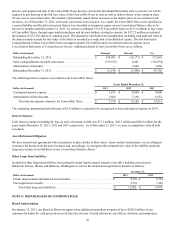

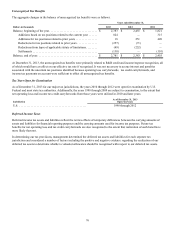

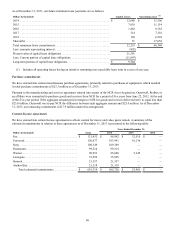

Change in Valuation Allowance

Dollars in thousands

Years Ended December 31,

2013 2012 2011

Increase (decrease) in valuation allowance . . . . . . . . . . . . . . . . . . . . . . $ 6,898 $ — $ (8,947)

The increase in valuation allowance during 2013 was primarily related to capital loss carryforwards generated from the sale of

a subsidiary. The remaining valuation allowances relate to state tax attributes acquired in the acquisition of ecoATM.

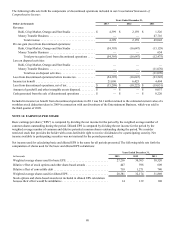

Deferred Tax Assets Relating to Income Tax Loss Carryforwards

Our deferred tax assets relating to income tax loss carryforwards and expiration periods are summarized as below:

Dollars in thousands

December 31, 2013

Federal State Foreign

Net operating loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,109 $ 63,017 $ 10,540

Deferred tax assets related to net operating loss carryforwards . . . . . . . $ 1,438 $ 3,151 $ 2,758

Years that net operating loss carryforwards will expire between. . . . . . 2030 to 2034 2016 and 2030 2033 and 2034

Based upon our projections for future taxable income over the periods in which the deferred tax assets are deductible, we

believe it is more likely than not that we will realize the benefits of these deductible differences.