Redbox 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

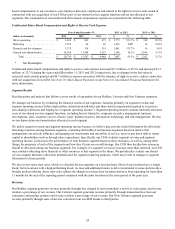

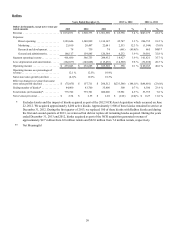

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related

notes thereto included elsewhere in this Annual Report. Except for the consolidated historical information, the following

discussion contains forward-looking statements. Actual results could differ from those projected in the forward-looking

statements. Please refer to “Special Note Regarding Forward-Looking Statements” and “Risk Factors” elsewhere in this

Annual Report.

Overview

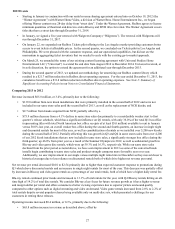

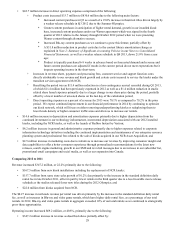

On June 27, 2013, we changed our name to Outerwall Inc. The name change reflects the evolution of our company from a

single coin-counting kiosk business into multiple automated retail businesses. The name Outerwall was selected as an umbrella

corporate brand that encompasses our current operations and provides a platform for future retail opportunities. In connection

with our name change, we now refer to our Coin business segment as the Coinstar business segment.

We are a leading provider of automated retail solutions offering convenient products and services that benefit consumers and

drive incremental retail traffic and revenue for retailers. Collectively our business segments and strategic investments operate

within five consumer sectors: Entertainment, Money, Beauty & Consumer Packaged Goods, Health and Electronics.

Our automated retail business model leverages technology advancements that allow delivery of new and innovative consumer

products in a compact, automated format. We believe this model positions us to address retailers’ increasing need to provide

more in less space driven by increased urbanization and consumers’ increasing expectation of instant gratification. Our

products and services can be found at approximately 65,800 kiosks in leading supermarkets, drug stores, mass merchants,

financial institutions, convenience stores, malls and restaurants.

Core Offerings

We have two core businesses:

• Our Redbox business segment (“Redbox”), where consumers can rent or purchase movies and video games from self-

service kiosks is focused on the entertainment consumer sector.

• Our Coinstar business segment (“Coinstar”) is focused on the money consumer sector and provides self-service kiosks

where consumers can convert their coins to cash, convert coins and paper bills to stored value products and exchange

gift cards for cash.

New Ventures

We identify, evaluate, build or acquire and develop innovative new self-service concepts in the automated retail space in our

New Ventures business segment (“New Ventures”). Self-service kiosk concepts we are currently exploring in the marketplace

represent the Electronics and Beauty & Consumer Packaged Goods consumer sectors. New Ventures concepts are regularly

assessed to determine whether continued funding or other alternatives are appropriate. Subsequent to our acquisition of

ecoATM in the third quarter of 2013, results from ecoATM are now included within our New Ventures segment results. See

Note 3: Business Combinations in our Notes to Consolidated Financial Statements for more information.

Strategic Investments and Joint Venture

We make strategic investments in external companies that provide automated self-service kiosk solutions. Current investments

address the Health sector with our investment in Solo-Health, Inc. and the Entertainment sector through our Redbox Instant by

Verizon joint venture. See Note 6: Equity Method Investments and Related Party Transactions in our Notes to Consolidated

Financial Statements for more information and Note 3: Business Combinations for our acquisition of ecoATM, one of our prior

strategic investments.

Strategy

Our strategy is based upon leveraging our core competencies in the automated retail space to provide the consumer with

convenience and value and to help retailers drive incremental traffic and revenue. Our competencies include success in building

strong consumer and retailer relationships, and in deploying, scaling and managing kiosk businesses. We build strong retailer

relationships by providing retailers with turnkey solutions that complement their businesses without significant outlays of time