Redbox 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

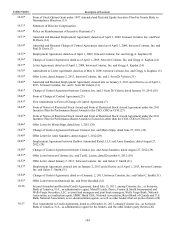

96

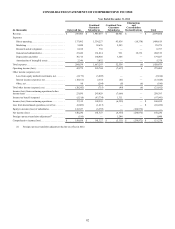

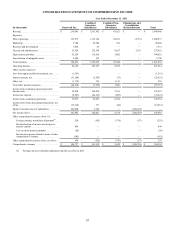

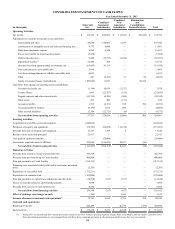

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31, 2011

(in thousands)

Outerwall

Inc.

Combined

Guarantor

Subsidiaries

Combined

Non-

Guarantor

Subsidiaries

Eliminations

and

Consolidation

Reclassifications Total

Operating Activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 103,883 $ 102,021 $ 6,218 $ (108,239) $ 103,883

Adjustments to reconcile net income to net cash flows from operating

activities from continuing operations:

Depreciation and other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26,370 116,106 3,002 — 145,478

Amortization of intangible assets and deferred financing fees . . . 4,990 192 — — 5,182

Share-based payments expense . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,498 7,713 — — 16,211

Excess tax benefits on share-based payments . . . . . . . . . . . . . . . . (2,471) — — — (2,471)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,057 44,362 1,657 — 60,076

Loss from discontinued operations, net of tax(1) . . . . . . . . . . . . . . 11,733 (729) 64 — 11,068

Loss from equity method investments, net . . . . . . . . . . . . . . . . . . 1,591 — — — 1,591

Non-cash interest on convertible debt . . . . . . . . . . . . . . . . . . . . . . 6,551 — — — 6,551

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (684) 589 — — (95)

Equity in (income) losses of subsidiaries. . . . . . . . . . . . . . . . . . . . (103,090) (5,149) — 108,239 —

Cash flows from changes in operating assets and liabilities:

Accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 432 (15,504) (217) — (15,289)

Content library . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (436) (1,626) — — (2,062)

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . (2,718) (2,178) 27 — (4,869)

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 358 1,411 — — 1,769

Accounts payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,977 6,915 (172) (170) 12,550

Accrued payable to retailers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,968 17,993 4,865 — 30,826

Other accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,132 26,002 2,983 — 36,117

Net cash flows from operating activities . . . . . . . . . . . . . . . . . . 90,141 298,118 18,427 (170) 406,516

Investing Activities:

Purchases of property and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . (67,409) (109,492) (2,335) — (179,236)

Proceeds from sale of property and equipment. . . . . . . . . . . . . . . . . . . . 193 445 57 — 695

Proceeds from sale of businesses, net. . . . . . . . . . . . . . . . . . . . . . . . . . . 8,220 — — — 8,220

Cash paid for equity investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,912) — — — (4,912)

Investments in and advances to affiliates . . . . . . . . . . . . . . . . . . . . . . . . 184,264 (173,452) (10,812) — —

Net cash flows from investing activities . . . . . . . . . . . . . . . . . . . . . . . 120,356 (282,499) (13,090) — (175,233)

Financing Activities:

Principal payments on capital lease obligations and other debt . . . . . . . (5,396) (22,480) (326) — (28,202)

Borrowings from term loan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175,000 — — — 175,000

Principal payments on credit facility . . . . . . . . . . . . . . . . . . . . . . . . . . . (154,375) — — — (154,375)

Financing costs associated with Credit Facility and senior unsecured

notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,196) — — — (4,196)

Excess tax benefits related to share-based payments . . . . . . . . . . . . . . . 2,471 — — — 2,471

Repurchases of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (63,349) — — — (63,349)

Proceeds from exercise of stock options. . . . . . . . . . . . . . . . . . . . . . . . . 3,261 — — — 3,261

Net cash flows from financing activities . . . . . . . . . . . . . . . . . . . . . . . (46,584) (22,480) (326) — (69,390)

Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . . . . . 78 (102) (430) — (454)

Increase (decrease) in cash and cash equivalents. . . . . . . . . . . . . . . . 163,991 (6,963) 4,581 (170) 161,439

Cash flows from discontinued operations:(1)

Operating cash flows. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 9,678 — 9,678

Investing cash flows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (12,678) — (12,678)

Net cash flows from discontinued operations . . . . . . . . . . . . . . — — (3,000) — (3,000)

Increase (decrease) in cash and cash equivalents . . . . . . . . . . . . . . . . . . 163,991 (6,963) 1,581 (170) 158,439