Redbox 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

you that we will be able to refinance any of our indebtedness on commercially reasonable terms or at all. Our failure to fund

indebtedness obligations at any time could constitute an event of default under the instruments governing such indebtedness,

and could trigger a cross default under our other outstanding debt, which could result in an acceleration of such indebtedness.

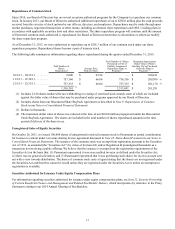

Changes in our effective income tax rate and cash taxes paid could adversely affect our profitability and cash flows.

Our effective income tax rate and cash taxes paid are influenced by a number of factors, including changes in tax law,

interpretation of existing laws, transactions incurred during the period, the utilization or expiration of net operating loss

carryforwards, and our ability to sustain our reporting positions on examination. Changes in any of those factors could change

our effective tax rate and cash taxes paid, which could adversely affect our profitability and cash flows. For example, although

we paid only $9.2 million in cash taxes in fiscal year 2012 due in part to the utilization of net operating loss carryforwards, we

exhausted the majority of our net operating loss carryforwards in fiscal year 2013, and paid $56.0 million in cash taxes in fiscal

year 2013. We expect our effective tax rate to be higher in fiscal year 2014 than in fiscal year 2013. If we continue to be

profitable, we expect our cash tax obligations in fiscal 2014 and future periods to continue to be significant. In addition, the

expansion of our operations outside of the United States may cause greater volatility in our effective tax rate.

We depend upon third-party manufacturers, suppliers and service providers for key components and substantial

support for our kiosks.

We conduct limited manufacturing operations and depend on outside parties to manufacture key components of our kiosks. We

intend to continue to expand our installed base of kiosks. Such expansion may be limited by the manufacturing capacity of our

third-party manufacturers and suppliers. Third-party manufacturers may not be able to meet our manufacturing needs in a

satisfactory and timely manner. If there is an unanticipated increase in demand for our kiosks or our manufacturing needs are

not met in a timely and satisfactory manner, we may be unable to meet demand due to manufacturing limitations.

Some key hardware components used in our kiosks are obtained from a limited number of suppliers. We may be unable to

continue to obtain an adequate supply of these components from our suppliers in a timely manner or, if necessary, from

alternative sources. If we are unable to obtain sufficient quantities of components from our current suppliers or locate

alternative sources of supply on a timely basis, we may experience delays in installing or maintaining our kiosks, either of

which could seriously harm our business, financial condition and results of operations.

In addition, we rely on third-party service providers for substantial support and service efforts that we currently do not provide

directly. In particular, we contract with third-party providers to arrange for pick-up, processing and depositing of coins, as well

as to provide limited servicing of our kiosks. We generally contract with a single transportation provider and coin processor to

service a particular region. We do not currently have, nor do we expect to have in the foreseeable future, the internal capability

to provide back-up coin processing service in the event of a sudden disruption in service from a commercial coin processor.

Any failure by us to maintain our existing coin processing relationships or to establish new relationships on a timely basis or on

acceptable terms could harm our business, financial condition and results of operations.

There are risks associated with conducting our business and sourcing goods internationally.

We currently have Redbox operations in Canada and Coinstar operations in Canada, the United Kingdom and Ireland. We

expect to continue our deployment of kiosks internationally. Accordingly, political uncertainties, economic changes, exchange

rate fluctuations, restrictions on the repatriation of funds, adverse changes in legal requirements, including tax, tariff and trade

regulations, difficulties with foreign distributors and other difficulties in managing an organization outside the United States,

could seriously harm the development of our business and ability to operate profitably. Further, as we do more business in an

increasing number of countries, our business becomes more exposed to the impact of the political and economic uncertainties,

including government oversight, of foreign jurisdictions.

We purchase products from vendors that obtain a significant percentage of such products from foreign manufacturers. As a

result, we are subject to changes in governmental policies, exchange rate fluctuations, various product quality standards, the

imposition of tariffs, import and export controls, transportation delays and interruptions and political and economic disruptions

which could disrupt the supply and timely delivery of products manufactured abroad. In addition, we could be affected by labor

strikes in the sea shipping, trucking and railroad industries. A reduction or interruption in supplies or a significant increase in

the price of one or more supplies could have a material adverse effect on our business.

Events outside of our control, including the current economic environment, have negatively affected, and could continue

to negatively affect, consumers’ use of our products and services.

Our consumers’ use of many of our products and services is dependent on discretionary spending, which is affected by, among