Quest Diagnostics 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 22

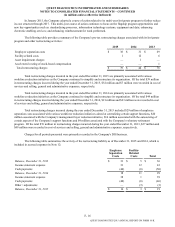

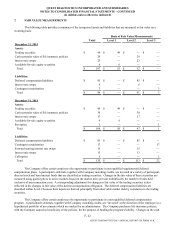

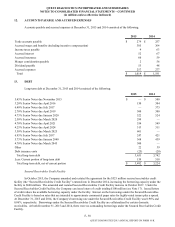

7. FAIR VALUE MEASUREMENTS

The following table provides a summary of the recognized assets and liabilities that are measured at fair value on a

recurring basis:

Basis of Fair Value Measurements

Total Level 1 Level 2 Level 3

December 31, 2015

Assets:

Trading securities $ 49 $ 49 $ — $ —

Cash surrender value of life insurance policies 29 — 29 —

Interest rate swaps 23 — 23 —

Available-for-sale equity securities 6 6 — —

Total $ 107 $ 55 $ 52 $ —

Liabilities:

Deferred compensation liabilities $ 85 $ — $ 85 $ —

Interest rate swaps 6 — 6 —

Contingent consideration 3 — — 3

Total $ 94 $ — $ 91 $ 3

December 31, 2014

Assets:

Trading securities $ 49 $ 49 $ — $ —

Cash surrender value of life insurance policies 30 — 30 —

Interest rate swaps 17 — 17 —

Available-for-sale equity securities 9 9 — —

Put option 1 — — 1

Total $ 106 $ 58 $ 47 $ 1

Liabilities:

Deferred compensation liabilities $ 85 $ — $ 85 $ —

Contingent consideration 17 — — 17

Forward starting interest rate swaps 15 — 15 —

Interest rate swaps 13 — 13 —

Call option 5 — — 5

Total $ 135 $ — $ 113 $ 22

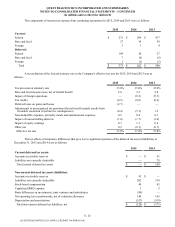

The Company offers certain employees the opportunity to participate in non-qualified supplemental deferred

compensation plans. A participant's deferrals, together with Company matching credits, are invested in a variety of participant-

directed stock and bond mutual funds that are classified as trading securities. Changes in the fair value of these securities are

measured using quoted prices in active markets based on the market price per unit multiplied by the number of units held

exclusive of any transaction costs. A corresponding adjustment for changes in fair value of the trading securities is also

reflected in the changes in fair value of the deferred compensation obligation. The deferred compensation liabilities are

classified within Level 2 because their inputs are derived principally from observable market data by correlation to the trading

securities.

The Company offers certain employees the opportunity to participate in a non-qualified deferred compensation

program. A participant's deferrals, together with Company matching credits, are “invested” at the direction of the employee in a

hypothetical portfolio of investments which are tracked by an administrator. The Company purchases life insurance policies,

with the Company named as beneficiary of the policies, for the purpose of funding the program's liability. Changes in the cash

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K