Quest Diagnostics 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 8

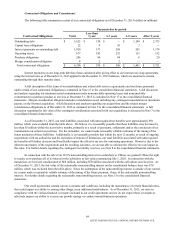

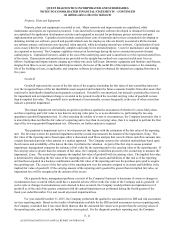

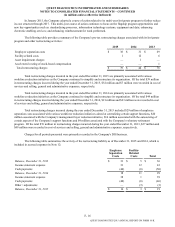

Reclassifications

Prior to the Company's clinical trials central laboratory services joint venture, Q2 Solutions, the earnings of the

Company's equity method investees consisted of earnings that were not directly taxable to the investees, in which case it was

appropriate to present equity in earnings of equity method investees before income tax expense on the consolidated statements

of operations. The earnings of Q2 Solutions, which closed on July 1, 2015, includes earnings that are directly taxable to the

joint venture. As a result of the Q2 Solutions transaction, the current period presentation of equity in earnings of equity method

investees is required to be presented below income tax expense on the consolidated statements of operations. The Company's

equity in earnings of equity method investees on the consolidated statements of operations for the years ended December 31,

2014 and 2013 have been reclassified to conform with the current period presentation. In addition as a result of the current

period presentation of investment in equity method investees on the consolidated balance sheet, the Company's investment in

equity method investees as of December 31, 2014 has been reclassified to conform with the current period presentation. For

further details regarding the Company's investment in Q2 Solutions, see Note 6.

As a result of the classification of certain non-core assets as held for sale on the consolidated balance sheet in the

current period, current assets held for sale on the consolidated balance sheet at December 31, 2014 were reclassified to conform

with the current period presentation. For further details regarding assets held for sale, see Note 6.

As a result of the early adoption of the accounting standard update (“ASU”) associated with classification of debt

issuance costs, certain reclassifications have been made to the prior period financial statements to conform with the current

period presentation. For further details regarding the impact of the ASU, see New Accounting Standards.

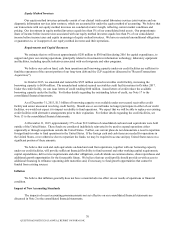

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Actual results could differ from those estimates.

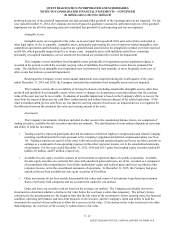

Revenue Recognition

The Company primarily recognizes revenue for services rendered upon completion of the testing process. Billings for

services reimbursed by third-party payers, including Medicare and Medicaid, are recorded as revenues net of allowances for

differences between amounts billed and the estimated receipts from such payers. Adjustments to the allowances, based on

actual receipts from the third-party payers, are recorded upon settlement. Billings to the Medicare and Medicaid programs were

approximately 17%, 17% and 18% of the Company's consolidated net revenues for the years ended December 31, 2015, 2014

and 2013, respectively. Under capitated arrangements with healthcare insurers, the Company recognizes revenue based on a

predetermined monthly reimbursement rate for each member of an insurer's health plan regardless of the number or cost of

services provided by the Company.

Revenues from the Company's risk assessment services, clinical trials testing (see Note 6 regarding the contribution of

the clinical trials testing business to a newly formed joint venture effective July 1, 2015), healthcare information technology

and diagnostics products businesses are recognized when persuasive evidence of a final agreement exists; delivery has occurred

or services have been rendered; the price of the product or service is fixed or determinable; and collectibility from the customer

is reasonably assured.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K