Quest Diagnostics 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

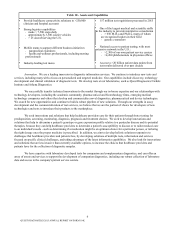

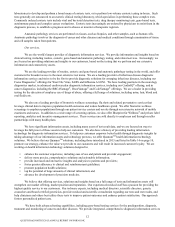

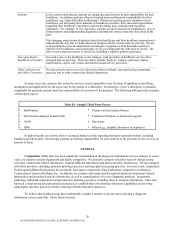

Customers and

payers Our customers and payers, including clinicians, health plans, IDNs, ACOs, employers and

others, have been consolidating, converging and diversifying. For example, an increased

number of hospital systems are considering establishing or have established health insurance

plans, and health insurance plans increasingly are considering providing or are providing

healthcare services.

Consolidation is increasing pricing transparency and bargaining power, and encouraging

internalization of clinical testing.

Physicians increasingly are employed by hospital systems, IDNs, ACOs or large group practices

integrated with healthcare systems, instead of organizing physician-owned practices, which is

changing the dynamics for whether clinical testing is performed in or outside of a hospital.

Physicians and other clinicians also increasingly are being employed by health plans or their

affiliates.

Value-based reimbursement is contributing to changes in the healthcare system. ACOs and

patient-centered medical homes are growing as a means to deliver patient care. Health care

services increasingly are being provided by non-traditional providers (e.g., physician assistants),

in non-traditional venues (e.g., retail medical clinics, urgent care centers) and using new

technologies (e.g., telemedicine).

In addition, federal healthcare reform legislation adopted in 2010 is resulting in changes in the

way that some healthcare services are purchased and delivered in the United States.

Patients are also our customers. Increasingly, patients are engaged in their own healthcare and

are bearing responsibility for payment for the services that we provide to them.

Pricing

transparency There has been a trend toward greater pricing transparency in the healthcare marketplace.

This transparency, combined with increased patient financial responsibility for medical care, is

enhancing purchasing sophistication and changes in behavior in the health care marketplace.

Competition The clinical testing industry remains fragmented, is highly competitive and is subject to new

competition.

Competition is growing from non-traditional competitors. Increased hospital acquisitions of

physician practices enhance clinician ties to hospital-affiliated laboratories and may strengthen

their competitive position.

New industry entrants with extensive resources may make acquisitions or expand into our

traditional areas of operations.

Reimbursement

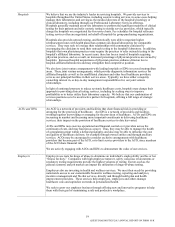

pressure There is a strong focus in the United States on controlling the overall cost of healthcare.

Healthcare market participants, including governments, are focusing on controlling costs,

including potentially by changing reimbursement for healthcare services (including but not

limited to a shift from fee for service to capitation), changing medical coverage policies (e.g.,

healthcare benefits design), pre-authorization of lab testing, requiring co-pays, introducing lab

spend management utilities and payment and patient care innovations such as ACOs and

patient-centered medical homes.

In light of continued pressure to reduce systemic healthcare costs, hospitals may change their

approach to providing clinical testing services.

While pressure to control healthcare costs poses a risk to our Company, it also creates

opportunities, such as an opportunity for increased proper utilization of testing as an efficient

means to manage the total cost of healthcare. We believe that it also creates greater

opportunities for high value, low-cost providers, like our Company, as compared to other

providers.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K