Quest Diagnostics 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 18

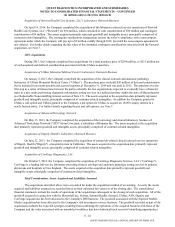

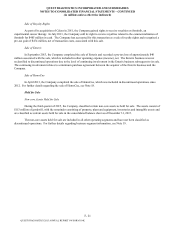

Acquisition of Steward Health Care Systems, LLC's Laboratory Outreach Business

On April 16, 2014, the Company completed the acquisition of the laboratory outreach service operations of Steward

Health Care Systems, LLC ("Steward") for $34 million, which consisted of cash consideration of $30 million and contingent

consideration of $4 million. The assets acquired primarily represent goodwill and intangible assets, principally comprised of

customer-related intangibles. The contingent consideration arrangement secures the seller's compliance with a non-compete

agreement under which the Company will pay up to $5 million, ratably through 2018, provided the non-compete agreement is

not violated. For further details regarding the fair value of the estimated contingent consideration associated with the Steward

acquisition, see Note 7.

2013 Acquisitions

During 2013, the Company completed four acquisitions for a total purchase price of $264 million, or $213 million net

of cash acquired and deferred consideration associated with the UMass acquisition.

Acquisition of UMass Memorial Medical Center's Laboratory Outreach Business

On January 2, 2013, the Company completed the acquisition of the clinical outreach and anatomic pathology

businesses of UMass Memorial Medical Center ("UMass"). The purchase price included $50 million of deferred consideration

that is included in accounts payable and accrued expenses at December 31, 2014 and was paid in 2015. This purchase was the

first step in a series of transactions between the parties whereby the two organizations expected to eventually have a financial

stake in a new entity performing diagnostic information testing services in a defined territory within the state of Massachusetts

(see Redeemable Noncontrolling Interest section of Note 15). The assets acquired at the acquisition date primarily represent

goodwill and intangible assets, principally comprised of customer-related intangibles. In addition the Company granted to

UMass a call option and UMass granted to the Company a put option for UMass to acquire an 18.90% equity interest in a

newly formed entity. For further details regarding the put and call options, see Note 7.

Acquisition of Advanced Toxicology Network

On May 15, 2013, the Company completed the acquisition of the toxicology and clinical laboratory business of

Advanced Toxicology Network ("ATN") from Concentra, a subsidiary of Humana Inc. The assets acquired at the acquisition

date primarily represent goodwill and intangible assets, principally comprised of customer-related intangibles.

Acquisition of Dignity Health's Laboratory Outreach Business

On June 22, 2013, the Company completed the acquisition of certain lab-related clinical outreach service operations

of Dignity Health ("Dignity"), a hospital system in California. The assets acquired at the acquisition date primarily represent

goodwill and intangible assets, principally comprised of customer-related intangibles.

Acquisition of ConVerge Diagnostics, LLC

On October 7, 2013, the Company completed the acquisition of ConVerge Diagnostic Services, LLC ("ConVerge").

ConVerge is a leading full-service laboratory providing clinical, cytology and anatomic pathology testing services to patients,

physicians and hospitals in New England. The assets acquired at the acquisition date primarily represent goodwill and

intangible assets, principally comprised of customer-related intangibles.

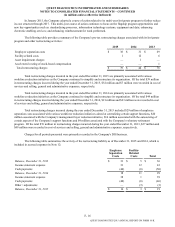

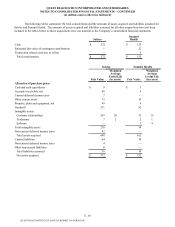

Total Consideration, Assets Acquired and Liabilities Assumed

The acquisitions described above were accounted for under the acquisition method of accounting. As such, the assets

acquired and liabilities assumed are recorded based on their estimated fair values as of the closing date. The consolidated

financial statements include the results of operations of the acquisitions subsequent to the closing of each acquisition. All of the

goodwill acquired in connection with the MemorialCare, Solstas, Summit Health, Steward, UMass, ATN, Dignity and

ConVerge acquisitions has been allocated to the Company's DIS business. The goodwill associated with the Superior Mobile

Medics acquisition has been allocated to the Company's risk assessment services business. The goodwill recorded as part of the

acquisitions includes the expected synergies resulting from combining the operations of the acquired business with those of the

Company and the value associated with an assembled workforce that has a historical track record of identifying opportunities.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K