Quest Diagnostics 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

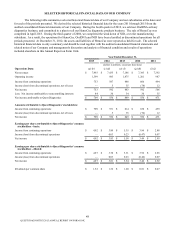

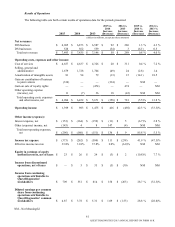

Net cash provided by operating activities includes receipts of $72 million from the termination of certain interest rate swap

agreements and the deferral of approximately $70 million of income tax payments into the first quarter of 2013, which was

offered to companies whose principal place of business was in states most affected by Hurricane Sandy.

(i) On April 4, 2011, we completed the acquisition of Athena Diagnostics (“Athena”). On May 17, 2011, we completed the

acquisition of Celera Corporation (“Celera”). Consolidated operating results for 2011 include the results of operations of

Athena and Celera subsequent to the closing of the applicable acquisition.

(j) Operating income includes a pre-tax charge to earnings in the first quarter of 2011 of $236 million which represented the

cost to resolve a previously disclosed civil lawsuit brought by a California competitor in which the State of California

intervened (the “California Lawsuit”). Results for 2011 also include $52 million of pre-tax charges incurred in conjunction

with further restructuring and integrating our business, consisting of $42 million of pre-tax charges principally associated

with workforce reductions, with the remainder principally professional fees. Results for 2011 also include $17 million of

pre-tax transaction costs, primarily related to professional fees, associated with the acquisitions of Athena and Celera. In

addition, operating income includes pre-tax charges of $6 million, principally representing severance and other separation

benefits as well as accelerated vesting of certain equity awards in connection with the succession of our prior CEO. In

addition, we estimate that the impact of severe weather during the first quarter of 2011 adversely affected operating income

for 2011 by $19 million.

Income from continuing operations includes $3 million of pre-tax financing related transaction costs associated with the

acquisition of Celera, a $3 million pre-tax gain associated with the sale of an investment, and $18 million of discrete

income tax benefits, primarily associated with certain state tax planning initiatives and the favorable resolution of certain

tax contingencies.

Net cash provided by operating activities includes payments associated with the settlement of the California Lawsuit,

restructuring and integration costs, and transaction costs associated with the acquisitions of Athena and Celera totaling

$320 million, or $202 million net of an associated reduction in estimated tax payments.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K