Quest Diagnostics 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 26

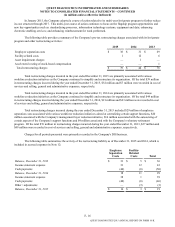

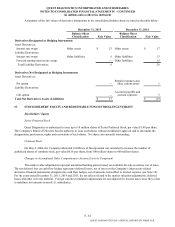

During the fourth quarter of 2015, the Company early adopted a new accounting standard which requires that all

deferred income tax assets and liabilities be classified as non-current in the balance sheet (see Note 2). As the Company elected

to apply the standard prospectively, prior periods were not retrospectively adjusted. Adoption of this standard resulted in $168

million of deferred taxes associated with current assets and liabilities being classified as non-current deferred tax assets of $26

million and as a reduction of non-current deferred tax liabilities of $142 million on the consolidated balance sheet as of

December 31, 2015.

At December 31, 2015 and 2014, non-current deferred tax assets of $37 million and $33 million, respectively, are

recorded in other long-term assets in the consolidated balance sheets. At December 31, 2015 and 2014, non-current deferred

tax liabilities of $157 million and $204 million, respectively, are included in other long-term liabilities in the consolidated

balance sheets.

As of December 31, 2015, the Company had estimated net operating loss carryforwards for federal and state income

tax purposes of $268 million and $1.4 billion, respectively, which expire at various dates through 2035. Estimated net

operating loss carryforwards for foreign income tax purposes are $48 million at December 31, 2015, some of which can be

carried forward indefinitely while others expire at various dates through 2025. As of December 31, 2015, 2014 and 2013,

deferred tax assets associated with net operating loss carryforwards of $222 million, $242 million and $140 million,

respectively, have each been reduced by valuation allowances of $54 million, $60 million and $34 million, respectively. The

increase in the valuation allowance as of December 31, 2014 was a result of a $14 million valuation allowance recorded on net

operating loss carryforwards acquired in a business combination, with the remainder primarily associated with additional net

operating losses generated during 2014.

The Company has not provided U.S. federal income and foreign tax withholdings on undistributed earnings from

certain non-U.S. subsidiaries for which the Company intends to reinvest such earnings indefinitely outside the U.S.

Determination of the amount of unrecognized deferred tax liability related to these earnings is not practicable.

Income taxes payable, including those classified in other long-term liabilities in the consolidated balance sheets at

December 31, 2015 and 2014, were $50 million and $110 million, respectively. Prepaid income taxes were $41 million and $44

million at December 31, 2015 and 2014, respectively, and were included in prepaid expenses and other current assets in the

consolidated balance sheets.

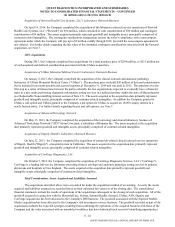

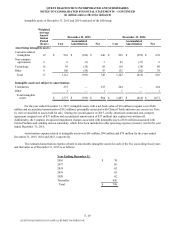

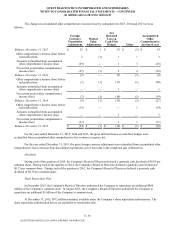

The total amount of unrecognized tax benefits as of and for the years ended December 31, 2015, 2014 and 2013

consisted of the following:

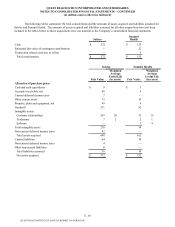

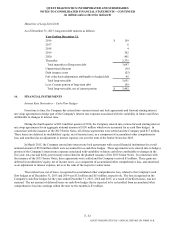

2015 2014 2013

Balance, beginning of year $ 122 $ 168 $ 199

Additions:

For tax positions of current year 5 17 11

For tax positions of prior years 5 1 12

Reductions:

Changes in judgment (11)(56)(23)

Expirations of statutes of limitations (3)(6)(2)

Settlements (27)(2)(29)

Balance, end of year $ 91 $ 122 $ 168

The contingent liabilities for tax positions primarily relate to uncertainties associated with the realization of tax

benefits derived from the allocation of income and expense among state jurisdictions, the characterization and timing of certain

tax deductions associated with business combinations, income and expenses associated with certain intercompany licensing

arrangements, certain tax credits and the deductibility of certain settlement payments.

The total amount of unrecognized tax benefits as of December 31, 2015, that, if recognized, would affect the effective

income tax rate from continuing operations is $38 million. Based upon the expiration of statutes of limitations, settlements and/

or the conclusion of tax examinations, the Company believes it is reasonably possible that the total amount of unrecognized tax

benefits may decrease by up to $4 million within the next twelve months.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K