Quest Diagnostics 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 13

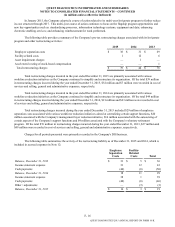

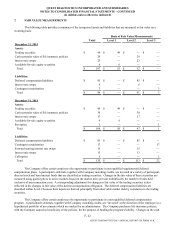

Investments at December 31, 2015 and 2014 consisted of the following:

2015 2014

Available-for-sale equity securities $ 6 $ 9

Trading equity securities 49 49

Other investments 8 8

Total $ 63 $ 66

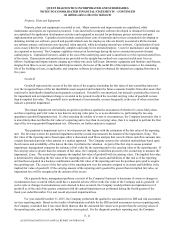

Derivative Financial Instruments

The Company uses derivative financial instruments to manage its exposure to market risks for changes in interest rates

and, from time to time, foreign currencies. This strategy includes the use of interest rate swap agreements, forward starting

interest rate swap agreements, interest rate lock agreements and foreign currency forward contracts to manage its exposure to

movements in interest and currency rates. The Company has established policies and procedures for risk assessment and the

approval, reporting and monitoring of derivative financial instrument activities. These policies prohibit holding or issuing

derivative financial instruments for speculative purposes. The Company does not enter into derivative financial instruments

that contain credit-risk-related contingent features or requirements to post collateral.

Interest Rate Risk

The Company is exposed to interest rate risk on its cash and cash equivalents and its debt obligations. Interest income

earned on cash and cash equivalents may fluctuate as interest rates change; however, due to their relatively short maturities, the

Company does not hedge these assets or their investment cash flows and the impact of interest rate risk is not material. The

Company's debt obligations consist of fixed-rate and variable-rate debt instruments. The Company's primary objective is to

achieve the lowest overall cost of funding while managing the variability in cash outflows within an acceptable range. In order

to achieve this objective, the Company has entered into interest rate swaps. Interest rate swaps involve the periodic exchange

of payments without the exchange of underlying principal or notional amounts. Net settlements between the counterparties are

recognized as an adjustment to interest expense.

The Company accounts for these derivatives as either an asset or liability measured at its fair value. The fair value is

based upon model-derived valuations in which all significant inputs are observable in active markets and includes an

adjustment for the credit risk of the obligor's non-performance. For a derivative instrument that has been formally designated

as a fair value hedge, fair value gains or losses on the derivative instrument are reported in earnings, together with offsetting

fair value gains or losses on the hedged item that are attributable to the risk being hedged. For derivatives that have been

formally designated as a cash flow hedge, the effective portion of changes in the fair value of the derivatives is recorded in

accumulated other comprehensive loss and the ineffective portion is recorded in earnings. Upon maturity or early termination

of an effective interest rate swap designated as a cash flow hedge, unrealized gains or losses are deferred in stockholders' equity,

as a component of accumulated other comprehensive loss, and are amortized as an adjustment to interest expense over the

period during which the hedged forecasted transaction affects earnings, which is when the Company recognizes interest

expense on the hedged cash flows. At inception and quarterly thereafter, the Company formally assesses whether the

derivatives that are used in hedging transactions are highly effective in offsetting changes in the fair value or cash flows of the

hedged item. All components of each derivative financial instrument's gain or loss are included in the assessment of hedge

effectiveness. If it is determined that a derivative ceases to be a highly effective hedge, the Company discontinues hedge

accounting and any deferred gains or losses related to a discontinued cash flow hedge shall continue to be reported in

accumulated other comprehensive loss, unless it is probable that the forecasted transaction will not occur. If it is probable that

the forecasted transaction will not occur by the originally specified time period, the Company discontinues hedge accounting,

and any deferred gains or losses reported in accumulated other comprehensive loss are classified into earnings immediately.

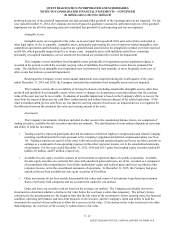

Comprehensive Income (Loss)

Comprehensive income (loss) encompasses all changes in stockholders' equity (except those arising from transactions

with stockholders) and includes net income, net unrealized gains or losses on available-for-sale securities, foreign currency

translation adjustments and deferred gains and losses related to certain derivative financial instruments (see Note 15).

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K