Quest Diagnostics 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

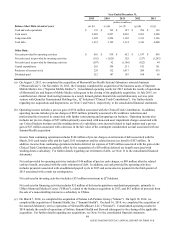

(d) Operating income includes pre-tax charges of $121 million, primarily associated with workforce reductions and

professional fees incurred in connection with further restructuring and integrating our business. In addition, operating

income includes pre-tax charges of $24 million principally associated with costs related to legal matters, partially offset by

a pre-tax gain of $9 million associated with a decrease in the fair value of the contingent consideration accrual associated

with our Summit Health acquisition.

Income from continuing operations includes discrete income tax benefits of $44 million associated with the favorable

resolution of certain tax contingencies.

(e) On January 2, 2013, we completed the acquisition of the clinical outreach and anatomic pathology businesses of UMass.

On May 15, 2013, we completed the acquisition of the toxicology and clinical laboratory business of Advanced Toxicology

Network ("ATN") from Concentra, a subsidiary of Humana Inc. On June 22, 2013, we completed the acquisition of certain

lab-related clinical outreach service operations of Dignity Health ("Dignity"), a hospital system in California. On October

7, 2013, we completed the acquisition of ConVerge Diagnostic Services, LLC ("ConVerge"), a leading full-service

laboratory providing clinical, cytology and anatomic pathology testing services to patients, physicians and hospitals in

New England. Consolidated operating results for 2013 include the results of operations of UMass, ATN, Dignity and

ConVerge subsequent to the closing of the applicable acquisition. For further details regarding our acquisitions, see Note 5

to the consolidated financial statements.

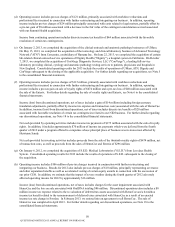

(f) Operating income includes pre-tax charges of $115 million, primarily associated with workforce reductions and

professional fees incurred in connection with further restructuring and integrating our business. In addition, operating

income includes a pre-tax gain on sale of royalty rights of $474 million and a pre-tax loss of $40 million associated with

the sale of the Enterix. For further details regarding the sale of royalty rights and Enterix, see Note 6 to the consolidated

financial statements.

Income (loss) from discontinued operations, net of taxes includes a gain of $14 million (including foreign currency

translation adjustments, partially offset by income tax expense and transaction costs) associated with the sale of HemoCue.

In addition, income (loss) from discontinued operations, net of taxes includes discrete tax benefits of $20 million

associated with favorable resolution of certain tax contingencies related to our NID business. For further details regarding

our discontinued operations, see Note 18 to the consolidated financial statements.

Net cash provided by operating activities includes income tax payments of $175 million associated with the sale of royalty

rights. In addition, it includes approximately $70 million of income tax payments which were deferred from the fourth

quarter of 2012 under a program offered to companies whose principal place of business was in states most affected by

Hurricane Sandy.

Net cash provided by investing activities includes proceeds from the sale of the ibrutinib royalty rights of $474 million, net

of transaction costs, as well as proceeds from the sales of HemoCue and Enterix of $296 million.

(g) On January 6, 2012, we completed the acquisition of S.E.D. Medical Laboratories ("S.E.D.") from Lovelace Health

System. Consolidated operating results for 2012 include the results of operations of S.E.D. subsequent to the closing of

the acquisition.

(h) Operating income includes $106 million of pre-tax charges incurred in conjunction with further restructuring and

integrating our business. Results for 2012 also include pre-tax charges of $10 million, principally representing severance

and other separation benefits as well as accelerated vesting of certain equity awards in connection with the succession of

our prior CEO. In addition, we estimate that the impact of severe weather during the fourth quarter of 2012 adversely

affected operating income for 2012 by approximately $16 million.

Income (loss) from discontinued operations, net of taxes includes charges for the asset impairment associated with

HemoCue and the loss on sale associated with OralDNA totaling $86 million. Discontinued operations also includes a $8

million income tax expense related to the re-valuation of deferred tax assets associated with HemoCue and a $4 million

income tax benefit related to the remeasurement of deferred taxes associated with HemoCue as a result of an enacted

income tax rate change in Sweden. In February 2013, we entered into an agreement to sell HemoCue. The sale of

HemoCue was completed in April 2013. For further details regarding our discontinued operations, see Note 18 to the

consolidated financial statements.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K