Quest Diagnostics 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

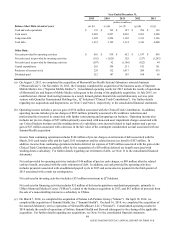

In November 2015, we announced that we entered into a definitive agreement to acquire the outreach laboratory

service business of Clinical Laboratory Partners ("CLP"), a wholly-owned subsidiary of Hartford HealthCare. CLP provides

clinical lab testing to physicians in Connecticut. The acquisition is expected to be completed in the first quarter of 2016,

subject to customary regulatory closing conditions.

Contribution of Clinical Trials Business

On July 1, 2015, we closed on our joint venture with Quintiles to form a global clinical trials central laboratory

services joint venture, Q2 Solutions. In connection with the transaction, we contributed certain assets of our clinical trials

testing business to the newly formed joint venture in exchange for a non-controlling, 40% ownership interest ("Clinical Trials

Contribution"). As a result of the transaction, we recognized a non-cash pre-tax gain of $334 million. The Clinical Trials

Contribution is consistent with our five-point strategy.

Consolidated net revenues and operating costs and expenses include the operating results of our clinical trials testing

business prior to closing. Subsequent to closing, our ownership interest in the operating results of the joint venture is being

accounted for under the equity method of accounting and recorded within a single line item, equity in earnings of equity

method investees, net of taxes, on the consolidated statements of operations.

Assets Held for Sale

During the third quarter of 2015, certain non-core assets of our DS businesses were reclassified to assets held for sale.

For further details regarding our dispositions and assets held for sale, see Note 6 to the consolidated financial

statements.

Senior Notes Offering

In March 2015, we completed a $1.2 billion senior notes offering (the "2015 Senior Notes") that was sold in three

tranches: (a) $300 million aggregate principal amount of 2.50% senior notes due March 2020, issued at a discount of $1

million; (b) $600 million aggregate principal amount of 3.50% senior notes due March 2025; and (c) $300 million aggregate

principal amount of 4.70% senior notes due March 2045. A portion of the proceeds from the 2015 Senior Notes were used to

fund the cash tender offer (the "Tender Offer") in March 2015 in which we purchased $176 million of our 6.95% Senior Notes

due July 2037 and $74 million of our 5.75% Senior Notes due January 2040. The remaining proceeds from the 2015 Senior

Notes, together with borrowing under our existing credit facilities, were used in April 2015 to redeem all of our $500 million

5.45% Senior Notes due November 2015, $150 million, or 50%, of our 3.2% Senior Notes due April 2016 and all of our $375

million 6.4% Senior Notes due July 2017 (the "Redemption"). In connection with the Tender Offer and Redemption, we

recorded a $79 million pre-tax loss on early retirement of debt in the first quarter of 2015 and a $65 million pre-tax loss on

early retirement of debt in the second quarter of 2015, respectively.

For further details regarding our 2015 Senior Notes, Tender Offer and Redemption, see Note 13 to the consolidated

financial statements.

Critical Accounting Policies

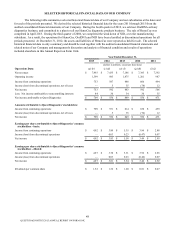

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States requires us to make estimates and assumptions and select accounting policies that affect our reported financial results

and the disclosure of contingent assets and liabilities.

While many operational aspects of our business are subject to complex federal, state and local regulations, the

accounting for most of our business is generally straightforward, with net revenues primarily recognized upon completion of

the testing process. Our revenues are primarily comprised of a high volume of relatively low-dollar transactions, and about

one-half of our total costs and expenses consist of employee compensation and benefits. Due to the nature of our business,

several of our accounting policies involve significant estimates and judgments:

• revenues and accounts receivable associated with DIS;

• reserves for general and professional liability claims;

• reserves for other legal proceedings;

• accounting for and recoverability of goodwill; and

• accounting for stock-based compensation expense.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K