Quest Diagnostics 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 36

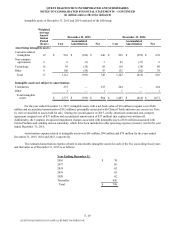

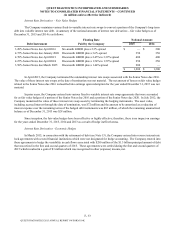

Share Repurchases

For the year ended December 31, 2015, the Company repurchased 3.2 million shares of its common stock for $224

million.

For the year ended December 31, 2014, the Company repurchased 2.2 million shares of its common stock for $132

million.

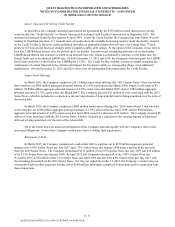

On April 19, 2013 and September 4, 2013, the Company entered in accelerated share repurchase agreements ("ASR")

with financial institutions to repurchase $450 million and $350 million, respectively, of the Company’s common stock as part of

the Company’s Common Stock repurchase program. Each ASR was structured as a combination of two transactions: (1) a

treasury stock repurchase and (2) a forward contract which permitted the Company to purchase shares immediately with the

final purchase price of those shares determined by the volume weighted average price of the Company's common stock during

the purchase period, less a fixed discount. Pursuant to these ASRs, the Company received 7.6 million shares of common stock

at a final price of $59.46 per share and 5.8 million shares of common stock at a final price of $60.73 per share, respectively. In

addition to the ASRs, the Company repurchased shares of its common stock on the open market in 2013. For the year ended

December 31, 2013, the Company also repurchased 4.1 million shares of its common stock for $237 million on the open

market.

For the years ended December 31, 2015, 2014 and 2013 the Company reissued 1 million shares, 2 million shares and 3

million shares, respectively, for employee benefit plans.

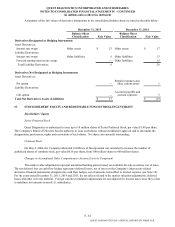

Redeemable Noncontrolling Interest

On July 1, 2015, UMass exercised its call option, acquiring an 18.9% noncontrolling interest in a subsidiary of the

Company that performs diagnostic information services in a defined territory within the state of Massachusetts. In connection

with the transaction, the Company received consideration of $68 million, including $50 million associated with the call option

exercise price. Under the terms of the transaction, UMass has the right to require the Company to purchase all of its interest in

the subsidiary at fair value commencing July 1, 2020. Since the redemption of the noncontrolling interest is outside of the

Company's control, it has been presented outside of stockholders' equity at the greater of its carrying amount or its fair value.

The Company will record changes in the fair value of the noncontrolling interest immediately as they occur. At December 31,

2015, the redeemable noncontrolling interest was $70 million and was presented at its fair value.

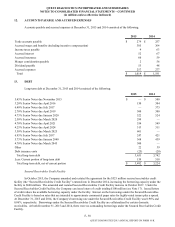

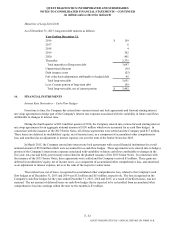

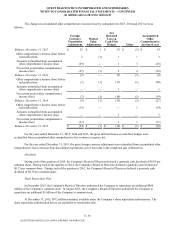

16. STOCK OWNERSHIP AND COMPENSATION PLANS

Employee and Non-employee Directors Stock Ownership Programs

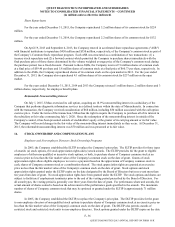

In 2005, the Company established the ELTIP to replace the Company's prior plan. The ELTIP provides for three types

of awards: (a) stock options, (b) stock appreciation rights and (c) stock awards. The ELTIP provides for the grant to eligible

employees of either non-qualified or incentive stock options, or both, to purchase shares of Company common stock at an

exercise price no less than the fair market value of the Company's common stock on the date of grant. Grants of stock

appreciation rights allow eligible employees to receive a payment based on the appreciation of Company common stock in

cash, shares of Company common stock or a combination thereof. The stock appreciation rights are granted at an exercise

price no less than the fair market value of the Company's common stock on the date of grant. Stock options and stock

appreciation rights granted under the ELTIP expire on the date designated by the Board of Directors but in no event more than

ten years from date of grant. No stock appreciation rights have been granted under the ELTIP. The stock options and shares are

subject to forfeiture if employment terminates prior to the end of the vesting period prescribed by the Board of Directors. For

all award types, the vesting period is generally over three years from the date of grant. For performance share unit awards, the

actual amount of shares earned is based on the achievement of the performance goals specified in the awards. The maximum

number of shares of Company common stock that may be optioned or granted under the ELTIP is approximately 71 million

shares.

In 2005, the Company established the DLTIP, to replace the Company's prior plan. The DLTIP provides for the grant

to non-employee directors of non-qualified stock options to purchase shares of Company common stock at an exercise price no

less than the fair market value of the Company's common stock on the date of grant. The DLTIP also permits awards of

restricted stock and restricted stock units to non-employee directors. Stock options granted under the DLTIP expire on the date

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K