Quest Diagnostics 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 32

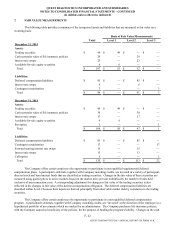

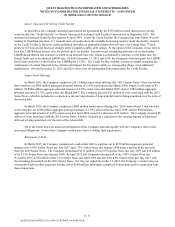

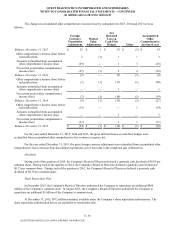

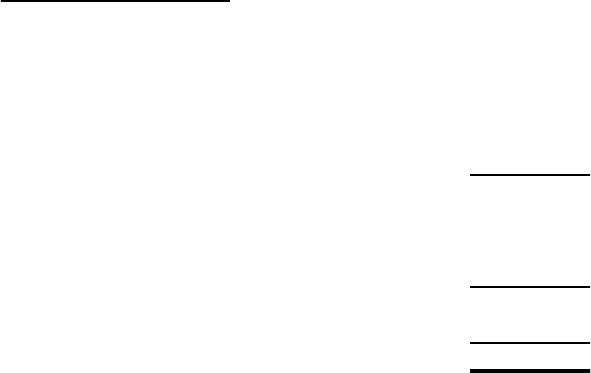

Maturities of Long-Term Debt

As of December 31, 2015, long-term debt matures as follows:

Year Ending December 31,

2016 $ 159

2017 6

2018 4

2019 302

2020 801

Thereafter 2,375

Total maturities of long-term debt 3,647

Unamortized discount (16)

Debt issuance costs (25)

Fair value basis adjustments attributable to hedged debt 45

Total long-term debt 3,651

Less: Current portion of long-term debt 159

Total long-term debt, net of current portion $ 3,492

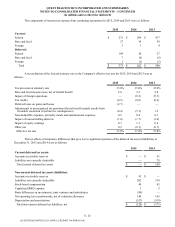

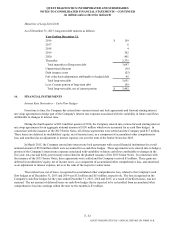

14. FINANCIAL INSTRUMENTS

Interest Rate Derivatives – Cash Flow Hedges

From time to time, the Company has entered into various interest rate lock agreements and forward starting interest

rate swap agreements to hedge part of the Company's interest rate exposure associated with the variability in future cash flows

attributable to changes in interest rates.

During the fourth quarter of 2013 and first quarter of 2014, the Company entered into various forward starting interest

rate swap agreements for an aggregate notional amount of $150 million which were accounted for as cash flow hedges. In

connection with the issuance of the 2015 Senior Notes, all of these agreements were settled and the Company paid $17 million.

These losses are deferred in stockholders’ equity, net of income taxes, as a component of accumulated other comprehensive

loss, and amortized as an adjustment to interest expense, net over the term of the Senior Notes due 2025.

In March 2015, the Company entered into interest rate lock agreements with several financial institutions for a total

notional amount of $350 million which were accounted for as cash flow hedges. These agreements were entered into to hedge a

portion of the Company’s interest rate exposure associated with variability in future cash flows attributable to changes in the

five-year, ten-year and thirty-year treasury rates related to the planned issuance of the 2015 Senior Notes. In connection with

the issuance of the 2015 Senior Notes, these agreements were settled and the Company received $3 million. These gains are

deferred in stockholders’ equity, net of income taxes, as a component of accumulated other comprehensive loss, and amortized

as an adjustment to interest expense, net over the term of the respective senior notes.

The total net loss, net of taxes, recognized in accumulated other comprehensive loss, related to the Company's cash

flow hedges as of December 31, 2015 and 2014 was $12 million and $15 million, respectively. The loss recognized on the

Company's cash flow hedges for the years ended December 31, 2015, 2014 and 2013, as a result of ineffectiveness, was not

material. The net amount of deferred losses on cash flow hedges that is expected to be reclassified from accumulated other

comprehensive loss into earnings within the next twelve months is $3 million.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K