Quest Diagnostics 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

Patients In the current environment, patients are taking increased interest in and responsibility for their

healthcare. In addition, patients often are bearing increased financial responsibility for their

healthcare (e.g., high deductible health plans). Patients are paying greater attention to their

healthcare, are increasing their demands of healthcare providers, have increased expectations

regarding their healthcare experiences and are becoming more sophisticated regarding

healthcare. For example, in our experience, patients are more focused on transparency, ease of

doing business and understanding diagnostics information services than they have been in the

past.

The changing expectations of patients about their healthcare and their healthcare transactions is

influencing the way that we think about our business and the services that we provide. We are

well positioned to provide information and insights to patients to help them take actions to

improve their healthcare, and increasingly we are providing patients with tools to do this. We

strive to give patients reasons to choose us, including a superior patient experience.

Emerging Retail

Healthcare Providers In recent years, as the healthcare sector changes, retail providers of healthcare services have

emerged and are growing. These providers include "big-box" retailers, pharmacy chains,

supermarkets, urgent care centers and Internet-based service providers.

Other Laboratories

and Other Customers We also provide services on a fee-for-service basis to federal, state and local governmental

agencies and to other commercial clinical laboratories

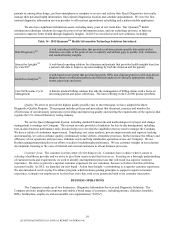

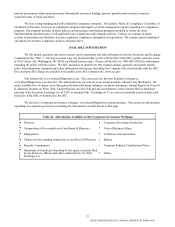

In many cases, the customer that orders the services is not responsible to pay for them. Depending on the billing

arrangement and applicable law, the payer may be the patient or a third party. Increasingly, even if a third party is primarily

responsible for payment, patients may bear responsibility for a portion of the payment. The following table provides examples

of third-party payers.

Table 20 - Sample Third Party Payers

Health plans Patient-centered medical homes

Self-insured employer benefit funds Traditional Medicare or Medicaid program

ACOs Physicians

IDNs Others (e.g., hospital, laboratory or employer)

In light of health care reform, there is increased market activity regarding alternative payment models, including

bundled payment models. Increasingly, patients are bearing responsibility for some portion of the payment for the services we

provide to them.

GENERAL

Competition. While there has been significant consolidation in the diagnostic information services industry in recent

years, our industry remains fragmented and highly competitive. We primarily compete with three types of clinical testing

providers: commercial clinical laboratories, hospital-affiliated laboratories and physician-office laboratories. We also compete

with other providers, including anatomic pathology practices and large physician group practices. In recent years, competition

from hospital-affiliated laboratories has increased. Our largest commercial clinical laboratory competitor is Laboratory

Corporation of America Holdings, Inc. In addition, we compete with many smaller regional and local commercial clinical

laboratories and specialized esoteric laboratories, as well as manufacturers of in vitro diagnostic products. In anatomic

pathology, additional competitors include anatomic pathology practices, including those in academic institutions. There also

has been a trend among specialty physician practices to establish their own histology laboratory capabilities and/or bring

pathologists into their practices, thereby reducing referrals from these practices.

We believe that healthcare providers traditionally consider a number of factors when selecting a diagnostic

information services provider. Those factors include:

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K